Fairborn Ohio Tax Form 1986-2026

What is the Fairborn Ohio Tax Form

The Fairborn Ohio Tax Form is a local tax document used by residents and businesses in Fairborn to report income and calculate local taxes owed. This form is essential for ensuring compliance with local tax regulations. It typically includes sections for personal information, income details, and deductions applicable to the local tax structure. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding penalties.

Steps to complete the Fairborn Ohio Tax Form

Completing the Fairborn Ohio Tax Form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and other income statements. Next, fill out the personal information section, ensuring that names and addresses are correct. Then, report all sources of income in the designated areas, including wages, self-employment income, and any other taxable earnings. After that, apply any eligible deductions or credits. Finally, review the form for accuracy before submitting it to the appropriate local tax authority.

Legal use of the Fairborn Ohio Tax Form

The Fairborn Ohio Tax Form must be used in accordance with local tax laws and regulations. It is legally binding and must be completed truthfully to avoid potential penalties. Misrepresentation of income or failure to file can result in fines or legal action. It is important to stay informed about local tax laws and ensure that the form is submitted by the designated deadlines to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Fairborn Ohio Tax Form are crucial for taxpayers to observe. Typically, the form must be filed by April fifteenth of each year, coinciding with federal tax deadlines. Additionally, any extensions granted must be submitted by the extended deadline to avoid penalties. It is advisable to check for any changes in deadlines each tax year to remain compliant with local regulations.

Form Submission Methods (Online / Mail / In-Person)

The Fairborn Ohio Tax Form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the local tax authority's website, ensuring a faster processing time. Alternatively, the form can be mailed to the designated tax office, allowing for physical documentation. In-person submissions may also be available, providing an opportunity for direct assistance if needed. Each method has its own processing times and requirements, so it is important to choose the one that best suits individual needs.

Required Documents

To successfully complete the Fairborn Ohio Tax Form, several documents are required. These typically include W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation of any other income sources. Additionally, records of deductions, such as receipts for business expenses or charitable contributions, may be necessary. Having all required documents organized and accessible can streamline the filing process and help ensure accuracy.

IRS Guidelines

While the Fairborn Ohio Tax Form is a local document, it must still adhere to IRS guidelines for income reporting and tax compliance. Taxpayers should ensure that all income reported on the form aligns with federal tax returns. The IRS provides specific instructions on how to report various types of income and deductions, which can aid in completing the local form accurately. Familiarity with IRS guidelines can help prevent discrepancies and potential audits.

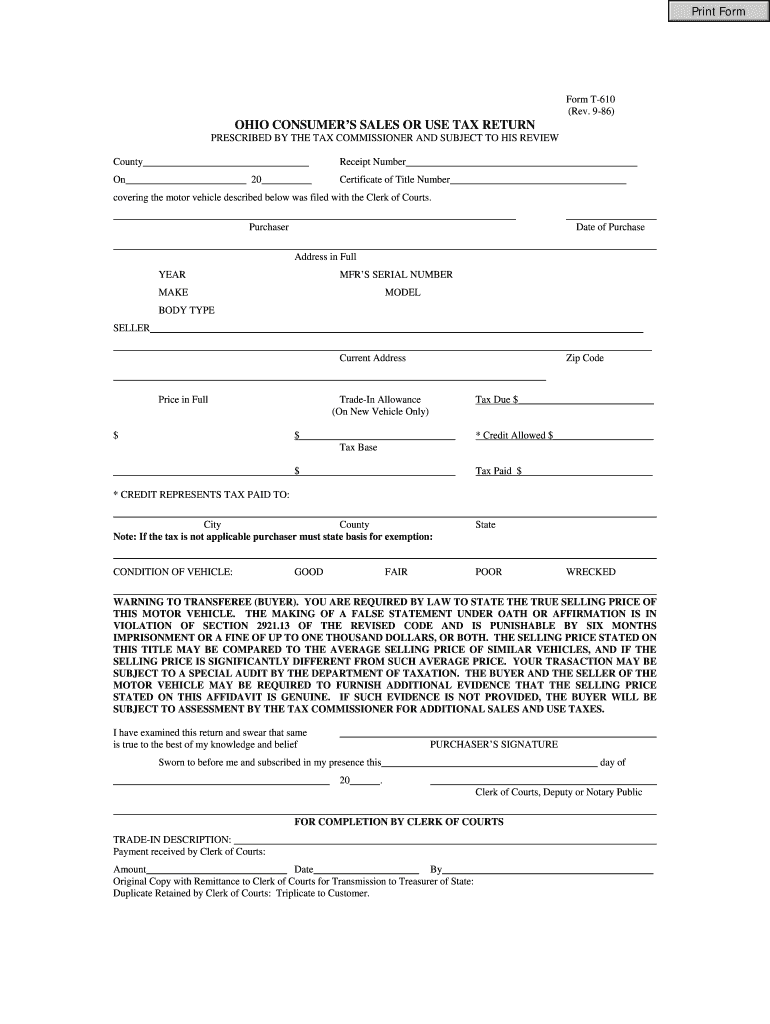

Quick guide on how to complete ohio consumers sales or use tax return print form

Your assistance manual on how to prepare your Fairborn Ohio Tax Form

If you’re eager to learn how to generate and dispatch your Fairborn Ohio Tax Form, here are some straightforward guidelines on how to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that allows you to modify, draft, and finalize your tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to modify details when necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing features.

Follow the steps below to finalize your Fairborn Ohio Tax Form in just a few minutes:

- Create your account and start processing PDFs shortly.

- Utilize our catalog to locate any IRS tax form; browse through various versions and schedules.

- Click Get form to access your Fairborn Ohio Tax Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and correct any errors.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to mistakes and delays in refunds. Moreover, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How do I find out who is using my social security number in name to file taxes?

It is probably not possible to find out if someone is using your SSN currently, but you can obtain an income transcript from the IRS that will show any W-2 that was issued in past years to your SSN. Also the IRS probably would have sent you a letter if you did not report some income that was on a W-2 in your SSN, but the letters regarding the 2017 returns have not come out yet.You can call IRS fraud hotline. Go to the IRS website to find a section on this. There is a form 14039 that you can file with IRS if you suspect that someone may file a tax return using your identity. If someone has filed a return for 2018 using your identity, your return will be rejected if you file electronically and the rejection message will show that a return has already been filed using your SSN. If that occurs you will need to file a paper return with form 14039. The filing information is on the IRS website.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

I’m on a H1B visa, single and have been in the U.S. for less than 5 years. Are the forms 1040A and 1040EZ the only ones that I need to fill for my tax return? Should I just use a software like TurboTax or hire an accountant?

It’s tax time.Taxation of immigrants by the United States is signNowly affected by the immigration status of such immigrants. Although the immigration laws of the United States refer to aliens as immigrants, nonimmigrants, and undocumented (illegal) aliens, the tax laws of the United States refer only to “resident aliens” and “nonresident aliens”.In general, the controlling principle is that resident aliens are taxed in the same manner as U.S. citizens on their worldwide income, and nonresident aliens are taxed according to special rules contained in certain parts of the Internal Revenue Code.Holders of nonimmigrant visas or temporary visas may or may not have to report income and pay taxes to the United States Government. Holders of nonimmigrant visas only become tax residents if they spend at least 183 days of the current year within the United States. If you have spent more than 183 days of the current year in the U.S., you are considered a “resident alien.”A nonresident alien/nonimmigrant visa holder (with certain narrowly defined exceptions) is subject to federal income tax only on income which is derived from sources within the United States and or income that is effectively connected with a U.S. trade or business.Nonresident aliens who are required to file an income tax return must use:Form 1040NR, U.S. Nonresident Alien Income Tax Return or,Form 1040NR-EZ, U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents, if qualified.Resident aliens who are required to file an income tax return must use:Form 1040, U.S. Individual Income Tax Return,Form 1040A, U.S. Individual Income Tax Return, orForm 1040EZ, Income Tax Return for Single and Joint Filers With No Dependents.According to TurboTax, its software does not support the filing of Form 1040NR. However, it has a partnership with Sprintax that does support such filings. I would recommend that you also consult with a certified public accountant because depending on your circumstances, s/he may be able to identify other IRS forms and or deductions that may be applicable to you.For more information on the intersection of US taxation and immigration, go here.For more information on immigration, please visit here.

-

How do I write a C code to firstly store two fractions using structure, then calculate their sum using function, and return the results back to structures or print the result using structures (everything in a/b form)?

You could try it this way (assuming numerator and denominators are integers and not float types)#include

Create this form in 5 minutes!

How to create an eSignature for the ohio consumers sales or use tax return print form

How to make an electronic signature for the Ohio Consumers Sales Or Use Tax Return Print Form online

How to create an eSignature for your Ohio Consumers Sales Or Use Tax Return Print Form in Google Chrome

How to generate an eSignature for putting it on the Ohio Consumers Sales Or Use Tax Return Print Form in Gmail

How to create an electronic signature for the Ohio Consumers Sales Or Use Tax Return Print Form straight from your smart phone

How to make an electronic signature for the Ohio Consumers Sales Or Use Tax Return Print Form on iOS

How to make an electronic signature for the Ohio Consumers Sales Or Use Tax Return Print Form on Android OS

People also ask

-

What is a 1099 form and why is it important in Ohio?

A 1099 form is used to report various types of income other than wages to the IRS. In Ohio, it is essential for freelancers and independent contractors to accurately report their earnings using the 1099 form. This ensures compliance with tax regulations and avoids potential penalties.

-

Where can I find a 1099 form Ohio printable version?

You can find a 1099 form Ohio printable version on the airSlate SignNow website, where we provide easy access to all necessary tax forms. Simply navigate to our forms section, and you will be able to download the 1099 form in a printable format, ready for your use.

-

How much does it cost to use airSlate SignNow for signing a 1099 form?

airSlate SignNow offers a cost-effective solution for eSigning documents, including the 1099 form. Our pricing plans are designed to accommodate different needs, starting from a basic package to more comprehensive solutions. Check our pricing page for detailed information on the options available.

-

What features does airSlate SignNow offer for managing 1099 forms?

With airSlate SignNow, you can easily upload, fill out, and eSign your 1099 form online. Our platform offers features such as document tracking, templates for speed, and secure storage. This streamlines your tax filing process, making it simpler and more efficient.

-

Are there integrations available for using 1099 forms with airSlate SignNow?

Yes, airSlate SignNow supports various integrations that allow you to use 1099 forms seamlessly with other applications. We work with popular software solutions for accounting and workforce management, enhancing your workflow and providing an all-in-one solution for your documentation needs.

-

Is it easy to use airSlate SignNow for creating and sending 1099 forms?

Absolutely! airSlate SignNow is designed for ease of use, allowing you to create, fill out, and send your 1099 form with just a few clicks. Our user-friendly interface ensures that even those unfamiliar with digital forms can navigate the system effortlessly.

-

Can I securely store my completed 1099 forms with airSlate SignNow?

Yes, airSlate SignNow provides secure storage for all your completed documents, including the 1099 form. Your files are encrypted and securely stored, giving you peace of mind that your sensitive information is protected at all times.

Get more for Fairborn Ohio Tax Form

- Resale certificate mexico form

- Polimaster 1208 guide form

- Bajaj fd form pdf

- Ccusa health history form

- Instrucciones para el anexo 8812 formulario 1040sp de rev enero de instrucciones para el anexo 8812 formulario 1040sp de rev

- 244201110 tax illinois form

- Xxv xxv xiii xiv form

- Rental room contract template form

Find out other Fairborn Ohio Tax Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document