PUSD Tax Credit Form Prescott Unified School District

What is the PUSD Tax Credit Form?

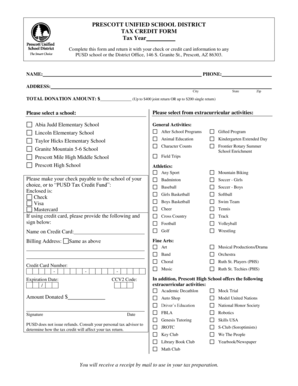

The PUSD tax credit form is a document provided by the Prescott Unified School District that allows taxpayers to claim a tax credit for contributions made to public schools. This form is designed to encourage donations to support educational programs, extracurricular activities, and other initiatives that enhance student learning. By filling out this form, individuals can receive a dollar-for-dollar reduction in their state income tax liability, making it a beneficial option for those looking to support local education while also receiving tax benefits.

How to Obtain the PUSD Tax Credit Form

To obtain the PUSD tax credit form, individuals can visit the Prescott Unified School District's official website or contact the district's administrative office directly. The form is typically available for download in PDF format, allowing for easy access and printing. Additionally, the form may be distributed at local schools or community events, ensuring that residents have multiple avenues to acquire it.

Steps to Complete the PUSD Tax Credit Form

Completing the PUSD tax credit form involves several straightforward steps:

- Download or obtain a physical copy of the form.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail the amount of your contribution to the school or educational program.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form as instructed, either online or by mail, along with any required documentation.

Legal Use of the PUSD Tax Credit Form

The PUSD tax credit form is legally binding when completed and submitted according to the guidelines set forth by the Prescott Unified School District and state tax regulations. It is essential to ensure that all information is accurate and truthful, as providing false information can result in penalties or disqualification from receiving the tax credit. Compliance with relevant tax laws is crucial to ensure that the benefits of the tax credit are fully realized.

Eligibility Criteria for the PUSD Tax Credit

To be eligible for the PUSD tax credit, taxpayers must meet specific criteria set by the state. Generally, individuals must be Arizona residents who contribute to a qualified public school in the Prescott Unified School District. The contributions must be made directly to the school or a specific program that qualifies for the tax credit. There may also be limits on the amount that can be claimed, depending on filing status and income levels.

Form Submission Methods

The PUSD tax credit form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to submit the form online through the Prescott Unified School District's website, ensuring a quick and efficient process. Alternatively, individuals can mail the completed form to the designated office or deliver it in person during business hours. Each submission method is designed to ensure that taxpayers can easily comply with the requirements.

Quick guide on how to complete pusd tax credit form prescott unified school district

Effortlessly configure PUSD Tax Credit Form Prescott Unified School District on any gadget

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents quickly and without delays. Manage PUSD Tax Credit Form Prescott Unified School District on any gadget using airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to modify and electronically sign PUSD Tax Credit Form Prescott Unified School District with ease

- Locate PUSD Tax Credit Form Prescott Unified School District and then click Obtain Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all details and then click on the Finish button to save your modifications.

- Select your desired delivery method for your form, be it email, SMS, invitation link, or download it to your computer.

Eliminate the woes of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign PUSD Tax Credit Form Prescott Unified School District and guarantee excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pusd tax credit form prescott unified school district

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pusd tax credit?

The pusd tax credit is a financial incentive designed to support eligible taxpayers in the PUSD district. It helps reduce tax liability, making it an important consideration for individuals and businesses seeking to maximize their savings. Understanding how the pusd tax credit works can help you make informed financial decisions.

-

How can I qualify for the pusd tax credit?

To qualify for the pusd tax credit, you must meet specific eligibility criteria set by the PUSD district. This often includes residency requirements and income thresholds. It’s important to stay updated on changes to qualifying standards to ensure you can take full advantage of this credit.

-

What documents do I need to apply for the pusd tax credit?

Applying for the pusd tax credit typically requires documentation such as proof of residency and income statements. You may also need to submit additional forms provided by local tax authorities. Ensure you gather all necessary documents to streamline the application process.

-

Can businesses benefit from the pusd tax credit?

Yes, businesses can benefit from the pusd tax credit, depending on their eligibility. This credit can help reduce operational costs and improve your bottom line. It’s advisable for business owners to review their eligibility with a tax professional.

-

Does the pusd tax credit impact my overall tax return?

The pusd tax credit can signNowly impact your overall tax return by lowering your taxable income. As a result, this can lead to a larger refund or reduced tax liability. Understanding this impact can motivate you to explore all available credits to maximize your tax benefits.

-

How often can I claim the pusd tax credit?

You can typically claim the pusd tax credit each tax year you meet the eligibility requirements. This allows for continuous financial benefits if you consistently qualify. It’s crucial to keep abreast of any changes in tax regulations that may affect your ability to claim the credit.

-

Are there any restrictions on using the pusd tax credit?

There may be specific restrictions on using the pusd tax credit, such as income limits or property usage stipulations. Understanding these limitations can help prevent issues during your tax filing. Make sure to consult available resources or tax professionals to clarify any restrictions.

Get more for PUSD Tax Credit Form Prescott Unified School District

- Nyslrs form

- Ucsf declaration of missing receipt form

- Model adverse action notice form

- Relias learning course crosswalk to the carf behavioral health tn form

- Ga secretary board of barbers fax number form

- Cheer coach introduction letter to parents form

- Mv10 form montana

- Floodplain development permit application form

Find out other PUSD Tax Credit Form Prescott Unified School District

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online