W7 Coa Form

What is the W7 Coa

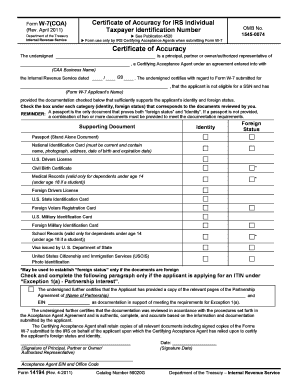

The W7 Coa, or Certificate of Accuracy, is a form utilized primarily for tax purposes in the United States. It is designed for individuals who need to provide proof of their identity and foreign status when applying for an Individual Taxpayer Identification Number (ITIN). The W7 Coa is essential for those who do not qualify for a Social Security Number but require a means to file taxes. This form helps ensure that the IRS can accurately process tax returns and maintain compliance with U.S. tax laws.

How to obtain the W7 Coa

To obtain the W7 Coa, individuals must first complete the W-7 form, which is the application for an ITIN. After filling out this form, applicants can submit it to the IRS along with the necessary documentation that verifies their identity and foreign status. This documentation may include passports, national identification cards, or other government-issued documents. It is crucial to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the W7 Coa

Completing the W7 Coa involves several key steps:

- Gather required documents, including proof of identity and foreign status.

- Fill out the W-7 form accurately, ensuring all sections are completed.

- Attach the necessary documentation to the W-7 form.

- Submit the completed form and documents to the IRS by mail or through an authorized acceptance agent.

It is important to double-check all entries for accuracy, as any errors may result in processing delays.

Legal use of the W7 Coa

The W7 Coa is legally recognized as a valid document for establishing an individual's identity and foreign status for tax purposes. When completed correctly and submitted with the appropriate documentation, it fulfills the requirements set forth by the IRS. This ensures that individuals can comply with U.S. tax laws while protecting their rights and identities. The legal standing of the W7 Coa is reinforced by adherence to regulations governing tax documentation and identity verification.

Key elements of the W7 Coa

Several key elements must be included in the W7 Coa for it to be valid:

- Personal Information: Full name, address, and date of birth of the applicant.

- Proof of Identity: Documentation such as a passport or government-issued ID.

- Foreign Status: Evidence that the individual is a non-resident alien or foreign national.

- Signature: The applicant must sign the form, affirming that the information provided is accurate.

Each of these elements plays a critical role in ensuring the W7 Coa is accepted by the IRS and serves its intended purpose.

Filing Deadlines / Important Dates

Filing deadlines for the W7 Coa are crucial for individuals seeking to obtain an ITIN. Generally, the W-7 form should be submitted along with a tax return by the tax filing deadline, which is typically April 15 for most taxpayers. However, if an extension is filed, the deadline may be extended to October 15. It is essential to be aware of these dates to avoid penalties and ensure timely processing of tax documents.

Quick guide on how to complete w7 coa

Effortlessly Prepare W7 Coa on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed materials, allowing you to obtain the right format and securely save it online. airSlate SignNow provides you with all the necessary tools to quickly generate, alter, and electronically sign your documents without hurdles. Handle W7 Coa on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign W7 Coa with Ease

- Locate W7 Coa and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically designed by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you'd like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign W7 Coa to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w7 coa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w7 coa and how does it work?

The w7 coa is a specific class of documents that facilitates the verification of identity for individuals when eSigning. With airSlate SignNow, users can easily create, send, and eSign their w7 coa documents securely in just a few clicks. This streamlined process ensures that your documents are both legally binding and compliant.

-

What are the pricing options for using w7 coa within airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business needs for managing w7 coa documents. You can choose from individual, team, or enterprise plans, ensuring you only pay for the features necessary for your organization. Each plan includes access to eSigning capabilities, document tracking, and secure storage.

-

What features does airSlate SignNow provide for managing w7 coa documents?

AirSlate SignNow provides a range of features specifically designed for the management of your w7 coa documents. These features include customizable templates, automatic reminders for signers, and comprehensive auditing tools. This ensures that the entire workflow is efficient and compliant.

-

How can airSlate SignNow help businesses streamline their w7 coa signing process?

airSlate SignNow streamlines the w7 coa signing process through its user-friendly interface and automated workflows. By allowing users to pre-fill fields and set signing orders, the platform reduces the time and effort needed to get documents signed. Additionally, reminders help ensure that important documents are signed promptly.

-

Is airSlate SignNow compliant with legal standards for w7 coa eSigning?

Yes, airSlate SignNow complies with all legal standards regarding the electronic signing of w7 coa documents. The platform follows stringent security protocols and adheres to regulations such as ESIGN and UETA. This compliance guarantees that your eSigned documents hold legal weight in various jurisdictions.

-

Can airSlate SignNow integrate with other software for w7 coa management?

AirSlate SignNow offers integration capabilities with numerous platforms, allowing seamless management of w7 coa documents. You can easily connect it with CRM systems, email clients, and cloud storage services to centralize your document workflow. This flexibility enhances productivity and ensures that your processes remain efficient.

-

What benefits does using airSlate SignNow for w7 coa provide to businesses?

Using airSlate SignNow for your w7 coa offers several key benefits, including cost savings, improved efficiency, and enhanced security. Businesses can signNowly reduce the time and resources spent on managing paper documents while also minimizing risks associated with lost or misplaced paperwork. This makes the eSigning process not only faster but also more reliable.

Get more for W7 Coa

- Debenture format

- State of ct emergency room waiver form

- Louisiana title application 27282667 form

- San francisco ca form

- Swachh bharat mission format i for data on toilet form no no download needed needed

- Charlotte county setback requirements form

- Wellstar plan b letter quality improvement form

- Self declaration for income fill and sign printable form

Find out other W7 Coa

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile