Self Declaration for Income Fill and Sign Printable 2020-2026

Understanding the Self Declaration of Income Form

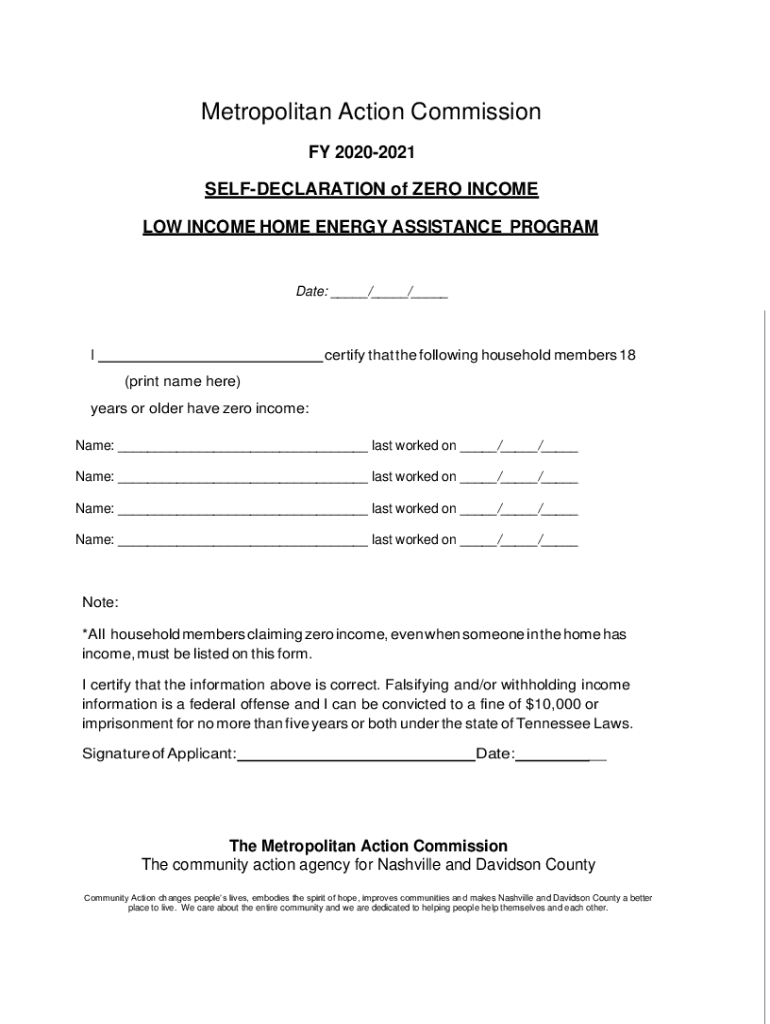

The self declaration of income form is a crucial document that individuals use to declare their income status for various purposes, such as applying for government assistance, loans, or tax-related matters. This form allows individuals to provide a clear account of their income levels, whether they are employed, self-employed, or have no income at all. It is particularly important for those who may not have traditional income documentation, such as pay stubs or tax returns. By submitting this form, individuals can ensure that their financial situation is accurately represented, which can affect eligibility for various programs and services.

Steps to Complete the Self Declaration of Income Form

Filling out the self declaration of income form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary information: Collect all relevant financial information, including any income sources, expenses, and supporting documents.

- Fill out personal details: Include your full name, address, and contact information at the top of the form.

- Declare your income: Clearly state your income sources, including wages, freelance earnings, or any government assistance. If you have no income, indicate this in the designated section.

- Provide supporting documentation: Attach any necessary documents that support your claims, such as bank statements or letters from employers.

- Review the form: Double-check all entries for accuracy and completeness before signing.

- Sign and date: Ensure you sign and date the form to validate your declaration.

Legal Use of the Self Declaration of Income Form

The self declaration of income form serves multiple legal purposes. It can be used in various contexts, including:

- Government assistance programs: Many state and federal programs require this form to assess eligibility for benefits.

- Loan applications: Financial institutions may request this form to evaluate your income status when applying for loans.

- Tax filings: It may be necessary for individuals who do not have traditional income documentation to declare their income during tax season.

Using this form legally requires that all information provided is truthful and accurate, as providing false information can lead to penalties or legal repercussions.

Examples of Using the Self Declaration of Income Form

There are various scenarios in which the self declaration of income form is applicable. Here are some common examples:

- Unemployed individuals: Those who are currently unemployed can use the form to declare their income status when applying for unemployment benefits.

- Freelancers: Freelancers or gig workers may need to submit this form to demonstrate their income levels when applying for loans or credit.

- Students: Students who may not have a steady income can use the form to apply for financial aid or scholarships.

Required Documents for the Self Declaration of Income Form

When completing the self declaration of income form, certain documents may be required to support your claims. Commonly needed documents include:

- Bank statements: Recent statements can help verify income sources and amounts.

- Tax returns: Previous tax returns may be requested to provide a comprehensive view of your financial history.

- Employment letters: Letters from employers or clients confirming your income can serve as additional proof.

- Affidavits: In some cases, a sworn affidavit may be necessary to validate your income declaration.

Form Submission Methods

The self declaration of income form can typically be submitted through various methods, depending on the requirements of the entity requesting it. Common submission methods include:

- Online submissions: Many organizations allow for digital submission through their websites or secure portals.

- Mail: You may also send a physical copy of the form to the relevant agency or institution.

- In-person delivery: Some situations may require you to submit the form in person, especially for government assistance programs.

Quick guide on how to complete self declaration for income fill and sign printable

Effortlessly Prepare Self Declaration For Income Fill And Sign Printable on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, edit, and electronically sign your documents promptly without delays. Manage Self Declaration For Income Fill And Sign Printable on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Self Declaration For Income Fill And Sign Printable with Ease

- Find Self Declaration For Income Fill And Sign Printable and hit Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential parts of the documents or redact sensitive information with the tools specifically available through airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Choose how you wish to send your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Self Declaration For Income Fill And Sign Printable ensuring seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct self declaration for income fill and sign printable

Create this form in 5 minutes!

How to create an eSignature for the self declaration for income fill and sign printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self declaration of income form?

A self declaration of income form is a document that allows individuals to report their income without the need for extensive documentation. This form is essential for various financial processes, including loan applications and tax filings. Using airSlate SignNow, you can easily create and eSign your self declaration of income form, streamlining the process.

-

How can airSlate SignNow help with the self declaration of income form?

airSlate SignNow simplifies the creation and signing of your self declaration of income form. With our user-friendly interface, you can quickly fill out the form and send it for eSignature. This not only saves time but also ensures that your document is legally binding and secure.

-

Is there a cost associated with using airSlate SignNow for the self declaration of income form?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our plans are designed to be cost-effective, allowing you to manage your self declaration of income form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the self declaration of income form?

airSlate SignNow provides a range of features for your self declaration of income form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your document is completed efficiently and securely. Additionally, you can integrate with other tools to enhance your workflow.

-

Can I integrate airSlate SignNow with other applications for my self declaration of income form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage your self declaration of income form alongside other business tools. This integration capability enhances your productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for my self declaration of income form?

Using airSlate SignNow for your self declaration of income form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and sign documents from anywhere, making it convenient for busy professionals. Plus, you can rest assured that your information is protected.

-

Is it easy to use airSlate SignNow for creating a self declaration of income form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to create a self declaration of income form. With our intuitive interface, you can quickly navigate through the process, ensuring that you can complete your form without any hassle. Our support team is also available to assist you if needed.

Get more for Self Declaration For Income Fill And Sign Printable

- Tompkins county health department septic form

- Tompkins county proof of residence form

- Building permit application form village of south barrington southbarrington

- Ny ambulance call form

- Data intake form pdf hauser clinic amp associates

- Hope fund application for assistance hca hope fund form

- Umr fillable forms

- New equipment request form herberger institute for design and herbergerinstitute asu

Find out other Self Declaration For Income Fill And Sign Printable

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free