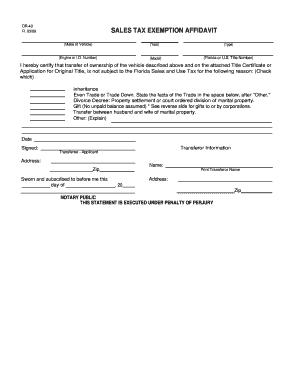

Certificate of Tax Exemption Affidavit Form

What is the certificate of tax exemption affidavit form

The certificate of tax exemption affidavit form is a legal document used by individuals or businesses to claim exemption from certain taxes. This form is essential for those who qualify for tax exemptions, such as non-profit organizations, educational institutions, or specific types of purchases. By submitting this affidavit, the filer asserts their eligibility for tax exemption under applicable laws, thereby avoiding unnecessary tax liabilities.

Steps to complete the certificate of tax exemption affidavit form

Completing the certificate of tax exemption affidavit form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all relevant details, including your name, address, and the specific tax exemption you are claiming.

- Fill out the form: Carefully enter the required information in the designated fields, ensuring that all entries are accurate and complete.

- Review the affidavit: Double-check all information for accuracy, as errors may lead to delays or denials of your exemption claim.

- Sign the affidavit: Ensure that you sign and date the form, as a signature is often required to validate the document.

Legal use of the certificate of tax exemption affidavit form

The legal use of the certificate of tax exemption affidavit form is critical for ensuring that the claims made are valid and enforceable. This form must be completed in compliance with state and federal laws governing tax exemptions. It serves as a formal declaration, which can be presented to tax authorities to substantiate the exemption claim. Proper use of this affidavit can protect individuals and businesses from tax liabilities that they are not legally obligated to pay.

Required documents

When filing the certificate of tax exemption affidavit form, certain documents may be required to support your claim. Commonly required documents include:

- Proof of eligibility for tax exemption, such as IRS determination letters for non-profits.

- Identification documents, like a driver's license or tax identification number.

- Any relevant financial statements or records that demonstrate your status.

Filing deadlines / important dates

Filing deadlines for the certificate of tax exemption affidavit form can vary based on state regulations and the type of exemption being claimed. It is important to be aware of these deadlines to ensure timely submission. Missing a deadline may result in the loss of the exemption for the current tax year. Generally, it is advisable to file the affidavit well in advance of tax deadlines to avoid complications.

Eligibility criteria

Eligibility criteria for the certificate of tax exemption affidavit form typically include specific conditions that must be met to qualify for tax exemption. These criteria may vary by state but often include:

- Being a recognized non-profit or charitable organization.

- Meeting specific income thresholds or operational requirements.

- Using the funds or resources for exempt purposes as defined by tax laws.

How to obtain the certificate of tax exemption affidavit form

The certificate of tax exemption affidavit form can usually be obtained through state tax authority websites or offices. Many states provide downloadable versions of the form, while others may require you to request a physical copy. It is important to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Quick guide on how to complete certificate of tax exemption affidavit form

Complete Certificate Of Tax Exemption Affidavit Form effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without holdups. Manage Certificate Of Tax Exemption Affidavit Form on any platform through the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The easiest way to modify and eSign Certificate Of Tax Exemption Affidavit Form with ease

- Locate Certificate Of Tax Exemption Affidavit Form and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred method of distribution for your form—by email, SMS, or invitation link—or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from your selected device. Modify and eSign Certificate Of Tax Exemption Affidavit Form while ensuring seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of tax exemption affidavit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an affidavit for tax exemption?

An affidavit for tax exemption is a legal document that certifies an individual's eligibility for tax relief or exemption. This document is often used by nonprofits or individuals to claim exemptions on property taxes or income taxes. Using airSlate SignNow, you can easily create and eSign affidavits for tax exemption seamlessly.

-

How can airSlate SignNow help with my affidavit for tax exemption?

airSlate SignNow provides an intuitive platform for creating, signing, and managing your affidavit for tax exemption. With our easy-to-use interface, you can quickly input your necessary information and eSign your document securely. The platform also allows for convenient sharing and storage of your affidavit.

-

What are the costs associated with using airSlate SignNow for an affidavit for tax exemption?

airSlate SignNow offers various pricing plans to fit different needs, starting with a free trial. After the trial, you can choose a plan that provides essential features for managing your affidavit for tax exemption effectively. Each plan comes with a range of services that ensure efficiency without breaking the bank.

-

Are there any templates available for affidavits for tax exemption?

Yes, airSlate SignNow provides a variety of templates specifically designed for affidavits for tax exemption. These templates are customizable, allowing you to tailor them to your specific requirements. This feature saves time and ensures that you meet your legal obligations efficiently.

-

Can I send my affidavit for tax exemption to multiple recipients?

Absolutely! airSlate SignNow allows you to send your affidavit for tax exemption to multiple recipients at once. This feature is especially beneficial for organizations needing approvals from various parties. You can track the status of each recipient's response in real-time for better document management.

-

Is airSlate SignNow compliant with legal standards for affidavits?

Yes, airSlate SignNow is fully compliant with all legal standards necessary for documents like affidavits for tax exemption. Our platform ensures that all eSignatures and processes meet industry regulations, which helps ensure the validity and legal acceptance of your affidavit.

-

What integrations does airSlate SignNow offer for managing affidavits for tax exemption?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Dropbox. These integrations facilitate easy document storage and retrieval for your affidavit for tax exemption. You can streamline your workflow by accessing all your documents from a single platform.

Get more for Certificate Of Tax Exemption Affidavit Form

- Contact lens care and handling form

- Stertil koni sk 2030 manual form

- Ps form 3621 a

- Medical treatment authorization request form

- Consent for treatment of minors amp others form

- The philosophy of the working mens residential program form

- Sole agent agreement template form

- Sole child custody agreement template form

Find out other Certificate Of Tax Exemption Affidavit Form

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online