Itp 92 1 Arizona Form

What is the ITP 92 1 Arizona

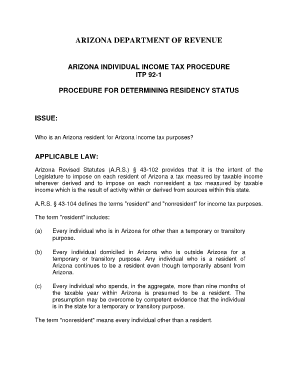

The ITP 92 1 Arizona is a specific form used to determine residency status for individuals in Arizona. It is essential for taxpayers who need to establish their residency for tax purposes. This form is particularly relevant for those who may have moved to or from Arizona and need to clarify their tax obligations. Understanding the nuances of this form is crucial for compliance with state tax laws.

Steps to Complete the ITP 92 1 Arizona

Completing the ITP 92 1 Arizona involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your current address, previous addresses, and any relevant documentation that supports your residency claim. Next, carefully fill out the form, ensuring that all sections are completed with accurate information. After completing the form, review it for any errors before submission. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, as specified by the Arizona Department of Revenue.

Legal Use of the ITP 92 1 Arizona

The legal use of the ITP 92 1 Arizona is governed by state tax laws, which require accurate representation of residency status. This form serves as a declaration that can impact your tax liabilities, making it vital to complete it correctly. It is legally binding once submitted, and any inaccuracies or omissions can lead to penalties or complications with the Arizona Department of Revenue. Therefore, understanding the legal implications of this form is essential for all taxpayers.

Required Documents for the ITP 92 1 Arizona

To complete the ITP 92 1 Arizona, certain documents may be required to substantiate your residency claim. These documents can include proof of address, such as utility bills or lease agreements, identification documents like a driver's license, and any other relevant paperwork that supports your residency status. Having these documents ready can streamline the completion process and enhance the credibility of your submission.

Filing Deadlines for the ITP 92 1 Arizona

Filing deadlines for the ITP 92 1 Arizona are crucial to ensure compliance with state regulations. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individual income tax returns. However, if you are filing for an extension, it is important to verify the specific deadlines that apply to your situation. Missing these deadlines can result in penalties and interest on any taxes owed.

Examples of Using the ITP 92 1 Arizona

Examples of using the ITP 92 1 Arizona include scenarios where individuals have recently moved to Arizona and need to establish their residency for tax purposes. For instance, a person relocating from another state may need to submit this form to clarify their tax obligations in Arizona. Additionally, those who have lived in Arizona but are temporarily out of state for work or education may also need to use the form to maintain their residency status for tax purposes.

Quick guide on how to complete itp 92 1 arizona

Effortlessly Prepare itp 92 1 arizona on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly and without delays. Handle itp 92 1 arizona on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Alter and Electronically Sign arizona individual income tax procedure itp 92 1 with Ease

- Locate arizona itp 92 1 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or obscure confidential information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to preserve your updates.

- Choose how you would like to send your form, whether via email, text message (SMS), an invitation link, or by downloading it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign itp 92 1 procedure for determining residency status to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to itp 92 1 arizona

Create this form in 5 minutes!

How to create an eSignature for the arizona individual income tax procedure itp 92 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask itp 92 1 procedure for determining residency status

-

What is ITP 92 1 Arizona?

ITP 92 1 Arizona refers to a specific document used in Arizona for tax purposes. Understanding its details is essential for businesses operating in the area. Using airSlate SignNow can simplify the signing and management of ITP 92 1 Arizona documents effectively.

-

How does airSlate SignNow support ITP 92 1 Arizona signing?

AirSlate SignNow enables users to electronically sign and send ITP 92 1 Arizona documents with ease. Its intuitive interface allows for a seamless signing process, ensuring that businesses can remain compliant without any hassle. Plus, you'll appreciate the timely notifications for document signing.

-

What are the pricing options for using airSlate SignNow for ITP 92 1 Arizona?

AirSlate SignNow offers a variety of pricing plans suitable for businesses of all sizes. The cost-effective solution includes features for managing legal documents like ITP 92 1 Arizona. Be sure to check our website for the latest pricing and promotional offers that could fit your needs.

-

What features does airSlate SignNow provide for managing ITP 92 1 Arizona documents?

With airSlate SignNow, you can utilize features like customizable templates, reminders, and real-time tracking for ITP 92 1 Arizona documents. These tools enhance your document management experience, making it easy to keep all parties informed and engaged. The platform also ensures security and compliance throughout the process.

-

Are there any benefits of using airSlate SignNow for ITP 92 1 Arizona?

Absolutely! Using airSlate SignNow for ITP 92 1 Arizona streamlines your document workflow, saving time and reducing administrative overhead. The eSignature feature not only speeds up approvals but also helps ensure that all documents are legally binding and easily accessible from any device.

-

Can airSlate SignNow integrate with other software for ITP 92 1 Arizona processing?

Yes, airSlate SignNow integrates with a wide range of applications, making it easier to manage ITP 92 1 Arizona documents alongside your business tools. This integration capability ensures a seamless workflow, allowing you to enhance productivity and eliminate data silos. Popular integrations include CRM systems, cloud storage services, and more.

-

What security measures are in place for ITP 92 1 Arizona documents on airSlate SignNow?

AirSlate SignNow employs advanced security measures, such as encryption, to protect ITP 92 1 Arizona documents. Your data is safeguarded while ensuring compliance with regulatory standards. We prioritize your security, so you can focus on your business without worrying about document safety.

Get more for itp 92 1 arizona

Find out other arizona individual income tax procedure itp 92 1

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT