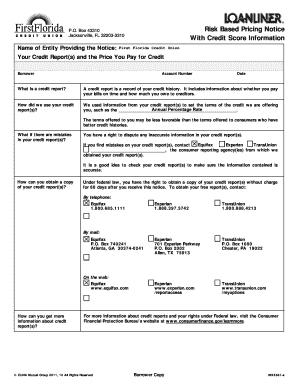

Risk Based Pricing Notice Form

What is the Risk Based Pricing Notice

The Risk Based Pricing Notice is a crucial document that lenders must provide to consumers when they use a credit report to make decisions about creditworthiness. This notice informs individuals if they received less favorable terms due to information in their credit report. The goal is to promote transparency and help consumers understand how their credit history affects their borrowing options.

This notice must include specific details, such as the identity of the credit reporting agency that provided the report, the consumer's credit score, and a summary of the factors that negatively impacted their score. By receiving this notice, consumers can take proactive steps to improve their credit standing.

How to use the Risk Based Pricing Notice

Using the Risk Based Pricing Notice effectively involves understanding its contents and implications. Upon receiving the notice, consumers should carefully review the information provided. This includes identifying the credit reporting agency mentioned and obtaining a copy of their credit report to verify the details.

Consumers can use the insights gained from the notice to address any inaccuracies in their credit report, seek advice on improving their credit score, and explore better lending options. It is also advisable to keep the notice for personal records in case of future credit applications.

Key elements of the Risk Based Pricing Notice

Several key elements must be included in the Risk Based Pricing Notice to ensure it meets legal requirements. These elements include:

- The name and contact information of the credit reporting agency that provided the report.

- The consumer's credit score and the date it was obtained.

- A summary of the factors that negatively impacted the credit score.

- Information on how to obtain a free copy of the consumer's credit report.

- Details regarding the consumer's rights under the Fair Credit Reporting Act.

These components are essential for helping consumers understand their credit situation and the rationale behind the credit decisions made by lenders.

Steps to complete the Risk Based Pricing Notice

Completing the Risk Based Pricing Notice involves several steps to ensure compliance and accuracy. Lenders should follow these guidelines:

- Gather the necessary information about the consumer's credit report and score.

- Draft the notice, ensuring all key elements are included as per regulatory requirements.

- Review the notice for clarity and accuracy before sending it to the consumer.

- Deliver the notice to the consumer in a timely manner, ideally at the same time as the credit offer.

By following these steps, lenders can ensure that they provide the Risk Based Pricing Notice correctly and fulfill their legal obligations.

Legal use of the Risk Based Pricing Notice

The legal use of the Risk Based Pricing Notice is governed by the Fair Credit Reporting Act (FCRA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act. Lenders must issue this notice when they use a credit report to make a credit decision that results in less favorable terms for the consumer.

Failure to provide this notice can lead to penalties and legal repercussions for lenders. Therefore, it is essential for financial institutions to understand their obligations under these laws and ensure that they comply with all requirements related to the Risk Based Pricing Notice.

Examples of using the Risk Based Pricing Notice

Examples of using the Risk Based Pricing Notice can help clarify its practical application. For instance, if a consumer applies for a loan and is offered a higher interest rate due to a low credit score, the lender must provide a Risk Based Pricing Notice. This notice would explain that the higher rate is a result of the consumer's credit history.

Another example is when a credit card issuer decides to deny an application based on the consumer's credit report. In this case, the issuer must also send a Risk Based Pricing Notice, detailing the reasons for the denial and providing the necessary information about the credit reporting agency.

Quick guide on how to complete risk based pricing notice

Effortlessly Prepare Risk Based Pricing Notice on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without any delays. Manage Risk Based Pricing Notice on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Risk Based Pricing Notice with ease

- Locate Risk Based Pricing Notice and select Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you wish to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Wave goodbye to lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Risk Based Pricing Notice to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the risk based pricing notice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a risk based pricing notice?

A risk based pricing notice is a document that informs borrowers about their credit risk and the prices associated with it. This notice outlines any differences in credit terms due to an individual's credit score and helps ensure transparency in the lending process. With airSlate SignNow, you can easily create and send these notices to maintain compliance and enhance customer trust.

-

How can airSlate SignNow help with creating a risk based pricing notice?

airSlate SignNow provides an intuitive platform to draft and manage risk based pricing notices efficiently. Our customizable templates enable you to tailor your notices based on your specific requirements. This not only saves time but also ensures that your notices are consistent and professionally presented.

-

What are the benefits of using airSlate SignNow for risk based pricing notices?

Using airSlate SignNow for risk based pricing notices offers several benefits, including ease of use, cost-effectiveness, and compliance assurance. Our eSigning capabilities allow for quick approvals, reducing turnaround times signNowly. Additionally, the platform's security features protect sensitive information, giving you peace of mind.

-

Are there integrations available for airSlate SignNow related to risk based pricing notices?

Yes, airSlate SignNow integrates seamlessly with various CRM and document management systems to facilitate risk based pricing notices. This allows you to streamline your workflow, ensuring that the generation and distribution of notices are in sync with your existing processes. You can also connect with tools like Salesforce and Zapier for enhanced functionality.

-

Is it easy to track sent risk based pricing notices with airSlate SignNow?

Absolutely! airSlate SignNow includes features that allow you to track the status of sent risk based pricing notices in real time. You will be notified when a notice is viewed, signed, or needs follow-up, ensuring you stay informed and can act promptly to any responses. This tracking capability enhances customer service and responsiveness.

-

Can I customize my risk based pricing notice templates in airSlate SignNow?

Yes, airSlate SignNow offers extensive customization options for your risk based pricing notice templates. You can modify text, branding elements, and terms as needed to suit your business requirements. This flexibility ensures that your notices are aligned with your company’s identity and messaging.

-

What security features does airSlate SignNow offer for risk based pricing notices?

Security is paramount when handling risk based pricing notices. airSlate SignNow protects your documents with bank-level encryption, ensuring that your data remains confidential and secure. Additionally, the platform complies with industry standards and regulations, allowing you to send sensitive information with confidence.

Get more for Risk Based Pricing Notice

- Private music lessons registration form 15

- Form 19 release of student information our lady of victory school

- Ha 0780 0510p form

- Signature verification form nyc gov nyc

- Minnesota department of public safety alcohol and form

- Software nda agreement template form

- Software master service agreement template form

- Software non disclosure agreement template form

Find out other Risk Based Pricing Notice

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors