Ms Form 70 698

What is the Ms Form 70 698

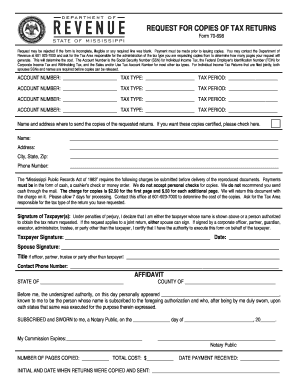

The Ms Form 70 698 is a specific document used for various administrative purposes within the United States. It may serve as a request for information or a declaration of certain facts, depending on the context in which it is used. Understanding the purpose of this form is essential for ensuring proper completion and submission.

How to use the Ms Form 70 698

Using the Ms Form 70 698 involves several straightforward steps. First, ensure you have the most current version of the form, which can typically be obtained from official sources. Next, fill out the required fields accurately, providing any necessary supporting documentation. Finally, submit the form according to the specified guidelines, which may include online submission or mailing it to a designated address.

Steps to complete the Ms Form 70 698

Completing the Ms Form 70 698 requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form.

- Read the instructions carefully to understand the requirements.

- Fill in all required fields, ensuring accuracy.

- Attach any necessary supporting documents.

- Review the form for completeness before submission.

- Submit the form as directed, either online or by mail.

Legal use of the Ms Form 70 698

The legal use of the Ms Form 70 698 hinges on its proper execution and adherence to relevant regulations. When filled out correctly, it can serve as a legally binding document. It is crucial to ensure that all signatures are obtained and that the form complies with applicable laws governing electronic signatures and document submissions.

Key elements of the Ms Form 70 698

Key elements of the Ms Form 70 698 include the following:

- Identification information: This typically includes the name and contact details of the individual or entity submitting the form.

- Purpose of the form: A clear statement outlining the reason for submission.

- Signature section: Where signers must provide their signatures or electronic signatures, validating the information provided.

- Date of submission: Important for tracking deadlines and compliance.

Form Submission Methods (Online / Mail / In-Person)

The Ms Form 70 698 can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via a designated portal, which may offer immediate confirmation.

- Mailing the completed form to the appropriate address, ensuring it is sent well before any deadlines.

- In-person submission at specified locations, which may allow for direct interaction with officials.

Quick guide on how to complete ms form 70 698

Prepare Ms Form 70 698 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle Ms Form 70 698 seamlessly on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to edit and electronically sign Ms Form 70 698 with ease

- Locate Ms Form 70 698 and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to apply your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow accommodates your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Ms Form 70 698 to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ms form 70 698

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does the 70 698 feature work?

AirSlate SignNow is a document management and eSignature solution that simplifies the signing process. The '70 698' feature allows users to streamline document workflows, making it easy to send and eSign documents efficiently.

-

What pricing plans does airSlate SignNow offer related to the 70 698 feature?

AirSlate SignNow offers various pricing plans that include access to the '70 698' feature at different tiers. These plans are designed to accommodate businesses of all sizes, ensuring you can find an option that meets your specific needs and budget.

-

Can I integrate airSlate SignNow with other tools to leverage the 70 698 capability?

Yes, airSlate SignNow seamlessly integrates with a variety of popular business tools to enhance the functionality of the '70 698' feature. This integration allows for a more streamlined process, combining document management with your existing workflow.

-

What are the benefits of using the 70 698 feature in airSlate SignNow?

The '70 698' feature in airSlate SignNow provides several benefits, including increased efficiency and reduced turnaround time for document signing. By using this feature, businesses can improve their workflow management and focus more on core tasks.

-

Is the 70 698 feature user-friendly for new users of airSlate SignNow?

Absolutely! The '70 698' feature is designed with user experience in mind, making it accessible even for those new to airSlate SignNow. The intuitive interface ensures that users can quickly adapt and make the most of the eSigning process.

-

How secure is airSlate SignNow, especially with the 70 698 functionality?

Security is a top priority for airSlate SignNow, and the '70 698' feature is no exception. It employs advanced encryption and security protocols to protect your documents and data throughout the signing process, giving you peace of mind.

-

What types of documents can I send using airSlate SignNow's 70 698 feature?

You can send a wide range of documents with airSlate SignNow's '70 698' feature, including contracts, agreements, and forms. This versatility allows businesses to manage various document types in one place, streamlining operations.

Get more for Ms Form 70 698

- Motion to continue reschedule hearing i am forms

- Graphing linear and quadratic functions independent practice worksheet form

- Ohp client agreement to pay form

- Course registration form form y nols nols

- Sub processor agreement template form

- Subaward agreement template 787747956 form

- Subconsultant professional service agreement template form

- Subconsultant agreement template form

Find out other Ms Form 70 698

- How To Install eSign in Police

- How Do I Implement eSignature in Plumbing

- How To Use Electronic signature in Banking

- How To Integrate Electronic signature in Banking

- How To Install Electronic signature in Banking

- How To Add Electronic signature in Banking

- How To Set Up Electronic signature in Banking

- How To Save Electronic signature in Banking

- How To Implement Electronic signature in Banking

- Can I Implement Electronic signature in Car Dealer

- How To Install Electronic signature in Charity

- How To Add Electronic signature in Charity

- How To Set Up Electronic signature in Charity

- How To Save Electronic signature in Charity

- How To Use Electronic signature in Construction

- How To Implement Electronic signature in Charity

- How To Set Up Electronic signature in Construction

- How To Integrate Electronic signature in Doctors

- How To Use Electronic signature in Doctors

- How To Install Electronic signature in Doctors