BORROWERS PERSONAL INFORMATION Auto Loan Philippines

What is the BORROWERS PERSONAL INFORMATION Auto Loan Philippines

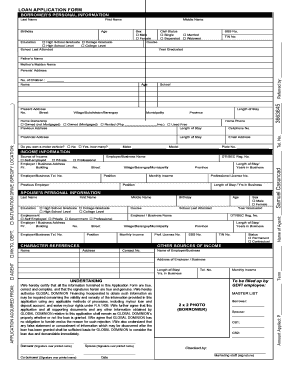

The BORROWERS PERSONAL INFORMATION Auto Loan Philippines form is a crucial document used by lenders to gather essential details about individuals applying for auto loans. This form typically includes personal data such as the borrower's full name, address, contact information, Social Security number, and employment details. The information collected is vital for assessing the borrower's creditworthiness and determining loan eligibility. Properly completing this form is essential for a smooth loan application process.

Key elements of the BORROWERS PERSONAL INFORMATION Auto Loan Philippines

Understanding the key elements of the BORROWERS PERSONAL INFORMATION Auto Loan Philippines form is vital for applicants. The main components include:

- Personal Identification: Full name, date of birth, and Social Security number.

- Contact Information: Current address, phone number, and email address.

- Employment Details: Employer's name, position, and income information.

- Financial Information: Existing debts, monthly expenses, and credit history.

These elements help lenders evaluate the borrower's financial situation and make informed lending decisions.

Steps to complete the BORROWERS PERSONAL INFORMATION Auto Loan Philippines

Completing the BORROWERS PERSONAL INFORMATION Auto Loan Philippines form involves several straightforward steps:

- Gather Required Information: Collect all necessary personal and financial details before starting the form.

- Fill Out Personal Information: Enter your name, address, and contact details accurately.

- Provide Employment Information: Include your current employer's details and your income.

- Review Financial Information: List any existing debts and monthly expenses to give a complete picture of your financial status.

- Double-Check for Accuracy: Review all entries to ensure there are no errors before submission.

Following these steps can help streamline the application process and reduce the likelihood of delays.

Legal use of the BORROWERS PERSONAL INFORMATION Auto Loan Philippines

The legal use of the BORROWERS PERSONAL INFORMATION Auto Loan Philippines form is governed by various regulations that protect consumer information. Lenders must comply with the Fair Credit Reporting Act (FCRA) and other relevant privacy laws to ensure that the borrower's data is handled securely and confidentially. This includes obtaining the borrower's consent before accessing their credit report and ensuring that the information is used solely for the purpose of assessing loan eligibility.

How to use the BORROWERS PERSONAL INFORMATION Auto Loan Philippines

Using the BORROWERS PERSONAL INFORMATION Auto Loan Philippines form effectively involves understanding its purpose and ensuring accuracy. Applicants should fill out the form with their personal and financial information as requested. It is essential to provide truthful and complete information, as inaccuracies can lead to loan denial or legal issues. Once completed, the form can be submitted electronically or in person, depending on the lender's requirements.

Required Documents

When completing the BORROWERS PERSONAL INFORMATION Auto Loan Philippines form, several supporting documents may be required. These typically include:

- Proof of Identity: A government-issued ID such as a driver's license or passport.

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Credit History: Authorization for the lender to access your credit report.

Having these documents ready can expedite the loan application process and enhance the chances of approval.

Quick guide on how to complete borrowers personal information auto loan philippines

Complete BORROWERS PERSONAL INFORMATION Auto Loan Philippines effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely archive it online. airSlate SignNow provides you with all the resources you need to create, adjust, and eSign your documents quickly without delays. Handle BORROWERS PERSONAL INFORMATION Auto Loan Philippines on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign BORROWERS PERSONAL INFORMATION Auto Loan Philippines effortlessly

- Obtain BORROWERS PERSONAL INFORMATION Auto Loan Philippines and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management demands in just a few clicks from your chosen device. Modify and eSign BORROWERS PERSONAL INFORMATION Auto Loan Philippines and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the borrowers personal information auto loan philippines

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of providing BORROWERS PERSONAL INFORMATION for an Auto Loan in the Philippines?

Providing BORROWERS PERSONAL INFORMATION is essential when applying for an auto loan in the Philippines. This information helps lenders assess your creditworthiness and ability to repay the loan. It also streamlines the application process and ensures a quicker loan approval.

-

How secure is my BORROWERS PERSONAL INFORMATION when using airSlate SignNow for an Auto Loan?

airSlate SignNow prioritizes the security of your BORROWERS PERSONAL INFORMATION during the auto loan process. The platform uses advanced encryption protocols and secure servers to protect sensitive data. You can confidently send and eSign documents knowing your information is safe and compliant with regulations.

-

What features does airSlate SignNow offer for managing BORROWERS PERSONAL INFORMATION in auto loans?

airSlate SignNow offers various features tailored for managing BORROWERS PERSONAL INFORMATION in auto loans. You can easily create, send, and track documents, ensuring all required information is collected efficiently. Additionally, templates and automated workflows minimize manual errors and streamline the loan process.

-

Are there any costs associated with using airSlate SignNow for Auto Loan Philippines?

Using airSlate SignNow to manage BORROWERS PERSONAL INFORMATION for an auto loan in the Philippines is cost-effective. The pricing plans are designed to accommodate various business sizes and needs, ensuring you pay only for the features you use. Consider contacting us for a customized quote for your requirements.

-

How does airSlate SignNow integrate with other platforms for Auto Loan processing?

airSlate SignNow seamlessly integrates with various platforms to enhance the management of BORROWERS PERSONAL INFORMATION in auto loans. Whether you're using CRM systems or financial software, our integrations allow for a smooth flow of data, making the loan application process more efficient and cohesive.

-

Can I access my BORROWERS PERSONAL INFORMATION remotely with airSlate SignNow?

Yes, with airSlate SignNow, you can access your BORROWERS PERSONAL INFORMATION remotely. The platform is cloud-based, allowing you to manage your documents anytime, anywhere. This flexibility helps you respond quickly to loan inquiries and approvals without being tied to a specific location.

-

What benefits does airSlate SignNow offer related to BORROWERS PERSONAL INFORMATION for Auto Loans?

airSlate SignNow provides numerous benefits for managing BORROWERS PERSONAL INFORMATION associated with auto loans. These include improved accuracy in document handling, faster processing times, and strengthened compliance measures. Overall, the platform enhances the customer experience by making the loan journey smoother and more efficient.

Get more for BORROWERS PERSONAL INFORMATION Auto Loan Philippines

- Report for internationa transportatin form

- Nannies contract form

- Credit app ozinga materials form

- Nys fillable online tax form

- Monetize and market your mind workbook by regina form

- Roofing installation information and certification

- Article of association sample a by lai ying ng form

- Purchase and sale for real estate agreement template form

Find out other BORROWERS PERSONAL INFORMATION Auto Loan Philippines

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter