United Kingdom Value Added Tax Form

What is the United Kingdom Value Added Tax

The United Kingdom Value Added Tax (VAT) is a consumption tax levied on goods and services at each stage of production or distribution. It is designed to be paid by the end consumer, with businesses acting as intermediaries in the collection process. The VAT system is structured to ensure that tax is charged on the value added at each stage, rather than on the total sale price. This means that businesses can reclaim the VAT they pay on their purchases, effectively making the tax a final burden only for the consumer.

Key elements of the United Kingdom Value Added Tax

Understanding the key elements of the United Kingdom VAT is essential for compliance and effective management. Important components include:

- VAT rates: The standard rate is currently set at twenty percent, with reduced rates for certain goods and services.

- VAT registration: Businesses with a taxable turnover exceeding a specified threshold must register for VAT.

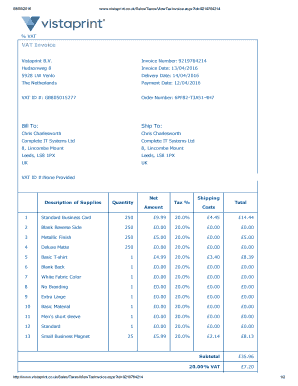

- VAT invoices: Proper documentation is required, including details such as the invoice number, date of issue, and VAT amount charged.

- Exemptions and zero-rating: Certain goods and services are exempt from VAT or charged at a zero rate, affecting how businesses account for VAT.

Steps to complete the United Kingdom Value Added Tax

Completing the VAT process involves several steps to ensure compliance:

- Determine registration requirement: Assess whether your business meets the threshold for VAT registration.

- Collect necessary documentation: Gather all relevant invoices, receipts, and records of sales and purchases.

- Complete VAT returns: Fill out the VAT return form accurately, reflecting sales, purchases, and the VAT owed or reclaimable.

- Submit your return: File the completed VAT return by the deadline, either online or through the appropriate channels.

Legal use of the United Kingdom Value Added Tax

To ensure the legal use of VAT, businesses must adhere to regulations set forth by HM Revenue and Customs (HMRC). This includes maintaining accurate records, issuing valid VAT invoices, and submitting returns on time. Non-compliance can lead to penalties, including fines and interest on unpaid VAT. It is crucial for businesses to stay informed about changes in legislation and ensure that their practices align with legal requirements.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting VAT forms. The most common methods include:

- Online submission: This is the preferred method, allowing for quicker processing and confirmation of receipt.

- Mail submission: Businesses can send paper forms to HMRC, though this method may result in longer processing times.

- In-person submission: While less common, some businesses may choose to deliver forms directly to HMRC offices.

Penalties for Non-Compliance

Failure to comply with VAT regulations can result in significant penalties. Common consequences include:

- Late filing penalties: Businesses may incur fines for submitting VAT returns after the deadline.

- Incorrect VAT returns: Errors in reporting can lead to additional charges and the requirement to pay back any underpaid VAT.

- Interest on unpaid VAT: HMRC may charge interest on any outstanding amounts, increasing the total liability.

Quick guide on how to complete united kingdom value added tax

Easily Prepare United Kingdom Value Added Tax on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct format and securely store it in the cloud. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle United Kingdom Value Added Tax on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and eSign United Kingdom Value Added Tax Effortlessly

- Locate United Kingdom Value Added Tax and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the files or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send the form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow satisfies your document management requirements in just a few clicks from any device you choose. Edit and eSign United Kingdom Value Added Tax and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the united kingdom value added tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the impact of the united kingdom value added tax on my business?

The united kingdom value added tax (VAT) can signNowly affect your business operations and pricing strategies. It's essential to understand how VAT impacts both your sales and purchases, ensuring compliance to avoid penalties. Utilizing platforms like airSlate SignNow can help streamline your invoicing process to include VAT calculations, making it easier to manage your accounts.

-

How can airSlate SignNow assist with managing united kingdom value added tax?

airSlate SignNow offers tools that simplify the invoicing process, including the ability to include united kingdom value added tax in your documents. Our platform allows you to create, send, and track invoices that automatically calculate VAT, ensuring your business remains compliant. This feature helps reduce time spent on accounting tasks related to VAT management.

-

Are there any costs associated with VAT compliance on airSlate SignNow?

While there is no specific fee for VAT compliance with airSlate SignNow, subscription pricing varies based on features needed. Ensuring compliance with united kingdom value added tax regulations is included in the service, offering peace of mind without hidden fees. The cost-effectiveness of our solution enables businesses to manage VAT more efficiently.

-

Is airSlate SignNow suitable for small businesses dealing with united kingdom value added tax?

Yes, airSlate SignNow is designed to be scalable and suitable for businesses of all sizes, including small businesses managing the united kingdom value added tax. Our intuitive interface allows small business owners to easily create documents and manage VAT-related invoicing without requiring extensive accounting knowledge. This helps you focus more on growing your business rather than on compliance issues.

-

What features help automate tasks concerning united kingdom value added tax?

airSlate SignNow includes features that automate VAT-related tasks, such as automated invoicing and eSignature integrations. These tools allow for seamless tracking and management of transactions subject to united kingdom value added tax. Automation not only saves time but also minimizes the risk of errors in VAT calculations, further ensuring compliance.

-

Can airSlate SignNow integrate with my existing accounting software for VAT purposes?

Yes, airSlate SignNow offers integrations with various popular accounting software that can assist with managing united kingdom value added tax. This interoperability allows you to synchronize your financial data effortlessly, ensuring that all aspects of VAT management are up to date. Such integration means less manual data entry and improved accuracy in VAT reporting.

-

How does airSlate SignNow ensure compliance with united kingdom value added tax regulations?

airSlate SignNow is continually updated to reflect current united kingdom value added tax regulations. Our platform helps businesses generate compliant invoices by providing up-to-date tax calculations and necessary documentation templates. This commitment to compliance helps protect your business from potential legal issues related to VAT.

Get more for United Kingdom Value Added Tax

Find out other United Kingdom Value Added Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors