Third Party Authorization Form RoundPoint Mortgage Servicing

What is the Third Party Authorization Form RoundPoint Mortgage Servicing

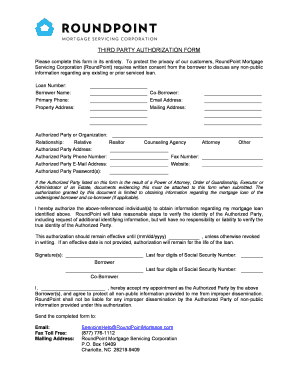

The Third Party Authorization Form for RoundPoint Mortgage Servicing is a legal document that allows a borrower to designate another individual or entity to act on their behalf concerning their mortgage account. This form is essential for situations where the borrower may need assistance in managing their mortgage, such as when they are unavailable or require help understanding their obligations. By completing this form, the borrower grants permission for the designated third party to access specific information and communicate with RoundPoint regarding the mortgage account.

How to use the Third Party Authorization Form RoundPoint Mortgage Servicing

Using the Third Party Authorization Form is straightforward. First, the borrower must download the form from the RoundPoint Mortgage Servicing website or request it directly from customer service. After obtaining the form, the borrower fills in their personal details, including their mortgage account number and the information of the third party they wish to authorize. It is crucial to ensure that all information is accurate to avoid processing delays. Once completed, the form should be submitted according to the instructions provided, which may include online submission, mailing, or faxing to the appropriate department.

Steps to complete the Third Party Authorization Form RoundPoint Mortgage Servicing

Completing the Third Party Authorization Form involves several key steps:

- Obtain the form from the RoundPoint Mortgage Servicing website or customer service.

- Fill in your personal information, including your name, address, and mortgage account number.

- Provide the details of the third party you wish to authorize, including their name, contact information, and relationship to you.

- Sign and date the form to validate your request.

- Submit the form via the specified method, ensuring it reaches the correct department for processing.

Legal use of the Third Party Authorization Form RoundPoint Mortgage Servicing

The Third Party Authorization Form is legally binding, provided it is completed correctly and submitted according to legal standards. It is essential for the borrower to understand that by signing this form, they are granting specific rights to the third party, which may include access to sensitive financial information. Compliance with federal and state regulations is crucial to ensure the authorization is recognized and enforceable. This form must also adhere to privacy laws to protect the borrower's information.

Key elements of the Third Party Authorization Form RoundPoint Mortgage Servicing

Several key elements must be included in the Third Party Authorization Form to ensure its effectiveness:

- Borrower's Information: Full name, address, and mortgage account number.

- Authorized Party's Information: Name, relationship to the borrower, and contact details.

- Scope of Authorization: Clearly defined permissions granted to the third party, such as access to account details and communication with RoundPoint.

- Signature and Date: The borrower's signature and the date of signing to validate the authorization.

Examples of using the Third Party Authorization Form RoundPoint Mortgage Servicing

The Third Party Authorization Form is commonly used in various scenarios. For instance, a borrower may authorize a family member to manage their mortgage account while they are away on vacation or in a hospital. Similarly, a borrower may designate a financial advisor to discuss mortgage options and payment plans. This form is particularly useful for elderly borrowers who may require assistance in managing their finances or for those who are navigating complex financial situations.

Quick guide on how to complete third party authorization form roundpoint mortgage servicing

Complete Third Party Authorization Form RoundPoint Mortgage Servicing effortlessly on any device

Digital document management has become widely embraced by businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Third Party Authorization Form RoundPoint Mortgage Servicing on any device with the airSlate SignNow apps for Android or iOS and enhance any document-oriented task today.

The simplest method to edit and electronically sign Third Party Authorization Form RoundPoint Mortgage Servicing effortlessly

- Locate Third Party Authorization Form RoundPoint Mortgage Servicing and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Third Party Authorization Form RoundPoint Mortgage Servicing and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the third party authorization form roundpoint mortgage servicing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow?

airSlate SignNow offers a suite of features including electronic signatures, document templates, and real-time tracking. With our solution, you can easily send and eSign documents from anywhere, ensuring a streamlined process. For more details, contact us at 877 426 8805.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, ensuring that you only pay for what you need. We offer flexible pricing options suitable for businesses of all sizes. For a detailed quote, please signNow out to us at 877 426 8805.

-

Is airSlate SignNow easy to integrate with other software?

Yes, airSlate SignNow can be easily integrated with various software platforms, including CRMs and productivity tools. This interoperability helps streamline your workflow and optimize productivity. For specific integration inquiries, call us at 877 426 8805.

-

What benefits does airSlate SignNow provide to businesses?

airSlate SignNow helps businesses save time and reduce unnecessary paperwork by providing a fast and effective electronic signing process. This increases efficiency and enhances the customer experience. For more information on how it can benefit your business, call us at 877 426 8805.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly and allows you to send and eSign documents on the go. This flexibility ensures you can manage your documents anytime, anywhere. For more details, feel free to contact us at 877 426 8805.

-

What types of documents can I sign with airSlate SignNow?

You can sign a variety of documents with airSlate SignNow, including contracts, agreements, and forms. Our platform supports multiple file formats, making it user-friendly for diverse needs. For any queries, please signNow out to us at 877 426 8805.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for new users to explore our features and solutions without commitment. This is a great way to test the platform and see how it fits your business needs. For details on our trial offers, call us at 877 426 8805.

Get more for Third Party Authorization Form RoundPoint Mortgage Servicing

- Police clearancevisa request salt lake city police form

- Ambulance patient care report form

- Student classwork schedule form our lady of the lake university ollusa

- Sample of a registered company or business document form

- Level b application for renewal fulford certification form

- Chow residential cover letter draft form

- Undertaking agreement template form

- Underwriting agreement template form

Find out other Third Party Authorization Form RoundPoint Mortgage Servicing

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online