Indiana Department of Revenue Form St 105 49065 R2 1 05 Fillable

What is the Indiana Department of Revenue Form ST5 R2 1 05 Fillable

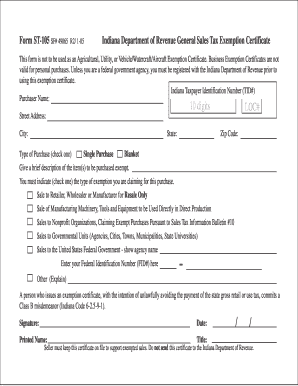

The Indiana Department of Revenue Form ST5 R2 1 05 is a sales tax exemption certificate used by businesses and individuals to claim exemption from sales tax on qualifying purchases. This form is essential for those who are eligible to make tax-exempt purchases, such as non-profit organizations, government entities, or businesses purchasing goods for resale. The fillable version of the form allows users to complete it digitally, streamlining the process and ensuring that all necessary information is accurately provided.

How to Use the Indiana Department of Revenue Form ST5 R2 1 05 Fillable

Using the Indiana Department of Revenue Form ST5 R2 1 05 fillable is straightforward. Begin by downloading the form from the Indiana Department of Revenue website or accessing it through a digital document management platform. Once you have the form open, fill in the required fields, including your name, address, and the reason for the exemption. After completing the form, ensure that all information is accurate before saving and submitting it to the vendor or retailer from whom you are purchasing goods. This electronic format allows for easy edits and ensures clarity in your submissions.

Steps to Complete the Indiana Department of Revenue Form ST5 R2 1 05 Fillable

Completing the Indiana Department of Revenue Form ST5 R2 1 05 fillable involves several key steps:

- Download and open the fillable form.

- Enter your personal or business information in the designated fields.

- Provide the reason for the tax exemption, ensuring it aligns with the criteria set by the Indiana Department of Revenue.

- Review all entered information for accuracy.

- Save the completed form securely.

- Submit the form to the vendor or retailer for processing.

Legal Use of the Indiana Department of Revenue Form ST5 R2 1 05 Fillable

The Indiana Department of Revenue Form ST5 R2 1 05 fillable is legally recognized as a valid document for claiming sales tax exemptions when completed correctly. To ensure its legal validity, the form must be filled out with accurate information and submitted to the appropriate parties. It is important to keep a copy of the completed form for your records, as this may be required for future reference or audits. Compliance with state regulations regarding the use of this form is essential to avoid potential penalties.

Key Elements of the Indiana Department of Revenue Form ST5 R2 1 05 Fillable

Several key elements must be included in the Indiana Department of Revenue Form ST5 R2 1 05 fillable to ensure its effectiveness:

- Purchaser Information: Name, address, and contact details of the individual or business claiming the exemption.

- Reason for Exemption: A clear statement indicating the basis for claiming tax exemption.

- Vendor Information: Name and address of the vendor from whom goods are being purchased.

- Signature: The form must be signed by the purchaser or an authorized representative to validate the claim.

Form Submission Methods for the Indiana Department of Revenue Form ST5 R2 1 05 Fillable

The Indiana Department of Revenue Form ST5 R2 1 05 fillable can be submitted through various methods, depending on the preferences of the purchaser and the vendor. The most common submission methods include:

- In-Person: Presenting the completed form directly to the vendor at the time of purchase.

- Via Email: Sending the completed form electronically to the vendor if they accept digital submissions.

- By Mail: Mailing a printed copy of the completed form to the vendor if required.

Quick guide on how to complete indiana department of revenue form st 105 49065 r2 1 05 fillable

Effortlessly Prepare Indiana Department Of Revenue Form St 105 49065 R2 1 05 Fillable on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the correct format and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Indiana Department Of Revenue Form St 105 49065 R2 1 05 Fillable on any device with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

How to Edit and eSign Indiana Department Of Revenue Form St 105 49065 R2 1 05 Fillable with Ease

- Locate Indiana Department Of Revenue Form St 105 49065 R2 1 05 Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Indiana Department Of Revenue Form St 105 49065 R2 1 05 Fillable and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana department of revenue form st 105 49065 r2 1 05 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable?

The Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable is a sales tax exemption certificate that allows eligible businesses to make tax-exempt purchases in Indiana. This form is essential for those looking to purchase items without incurring sales tax, facilitating compliance with state tax laws.

-

How can I obtain the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable?

You can easily obtain the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable by visiting the official Indiana Department of Revenue website or using platforms like airSlate SignNow to access and complete the form digitally. With airSlate SignNow, you can fill out and eSign the form quickly and efficiently.

-

Can I fill out the Indiana Department of Revenue Form ST-105 49065 R2 1 05 online?

Yes, you can fill out the Indiana Department of Revenue Form ST-105 49065 R2 1 05 online using airSlate SignNow. Our platform offers a user-friendly interface that lets you complete the form electronically, streamlining the process and saving you time.

-

Are there any fees associated with using airSlate SignNow for the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable?

While the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable itself is free to download, airSlate SignNow operates on a subscription basis with various pricing plans. These plans provide additional features such as unlimited eSigning and document storage, ensuring you receive a value-packed solution.

-

What features does airSlate SignNow offer for filling out the Indiana Department of Revenue Form ST-105 49065 R2 1 05?

airSlate SignNow offers several features for filling out the Indiana Department of Revenue Form ST-105 49065 R2 1 05, such as electronic signatures, document templates, and seamless collaboration tools. These features enhance the efficiency and security of document handling, making it easier to manage your forms.

-

Can I integrate airSlate SignNow with other software for the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable?

Yes, airSlate SignNow supports integrations with various business applications, allowing you to streamline your workflow when handling the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable. Popular integrations include CRM systems, cloud storage solutions, and project management tools.

-

What benefits does airSlate SignNow provide for using the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable?

Using the Indiana Department of Revenue Form ST-105 49065 R2 1 05 fillable with airSlate SignNow provides numerous benefits, including improved efficiency, reduced paper waste, and enhanced document security. This digital approach allows businesses to process forms quicker and maintain compliance with ease.

Get more for Indiana Department Of Revenue Form St 105 49065 R2 1 05 Fillable

- Burn permit city of ammon form

- Ignou migration certificate form

- Direct deposit form lamar state college orange lsco

- Off campus school activity form edline

- Printable wedding checklist little wedding guide our 12 month wedding checklist in pdf format simply print and start crossing

- Pregnancy and postpartum massage therapy release katy tx form

- Direct deposit for existing vendors form texas tech university depts ttu

- Computer lease agreement template form

Find out other Indiana Department Of Revenue Form St 105 49065 R2 1 05 Fillable

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe