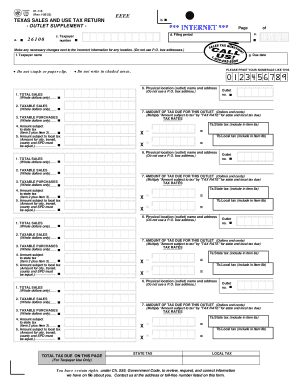

Tx Sales and Use Tax Return 01 115 Form 2005

What is the Tx Sales And Use Tax Return 01 115 Form

The Tx Sales And Use Tax Return 01 115 Form is a document used by businesses in Texas to report sales and use tax collected during a specific period. This form is essential for compliance with state tax regulations, ensuring that businesses accurately report their taxable sales and remit the appropriate amount of tax to the state. It is typically required for both retail and wholesale businesses operating within Texas.

How to use the Tx Sales And Use Tax Return 01 115 Form

Using the Tx Sales And Use Tax Return 01 115 Form involves several steps. First, businesses must gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and any taxable purchases. Next, the form must be filled out accurately, ensuring that all calculations are correct. After completing the form, businesses can submit it electronically or via mail, depending on their preference and the specific guidelines provided by the Texas Comptroller's office.

Steps to complete the Tx Sales And Use Tax Return 01 115 Form

Completing the Tx Sales And Use Tax Return 01 115 Form requires careful attention to detail. Here are the steps to follow:

- Gather sales records, including receipts and invoices.

- Calculate total sales and any exempt sales.

- Fill out the form, ensuring to report all taxable sales accurately.

- Double-check calculations for accuracy.

- Submit the form electronically or by mail, following the specified submission guidelines.

Legal use of the Tx Sales And Use Tax Return 01 115 Form

The Tx Sales And Use Tax Return 01 115 Form is legally binding when completed and submitted according to Texas state laws. Businesses must ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. Using electronic signatures through a compliant platform adds an additional layer of legal validity to the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Tx Sales And Use Tax Return 01 115 Form vary based on the reporting period. Typically, businesses must file monthly, quarterly, or annually, depending on their sales volume. It is crucial to adhere to these deadlines to avoid penalties. The Texas Comptroller's office provides a schedule of important dates, which businesses should reference to ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Tx Sales And Use Tax Return 01 115 Form can be submitted through various methods. Businesses may choose to file online through the Texas Comptroller's website, which is often the most efficient option. Alternatively, forms can be mailed to the appropriate address or submitted in person at designated locations. Each method has its own requirements and processing times, so businesses should select the one that best suits their needs.

Quick guide on how to complete tx sales and use tax return 01 115 form

Complete Tx Sales And Use Tax Return 01 115 Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without delays. Handle Tx Sales And Use Tax Return 01 115 Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

How to modify and eSign Tx Sales And Use Tax Return 01 115 Form with ease

- Obtain Tx Sales And Use Tax Return 01 115 Form and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiring form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Tx Sales And Use Tax Return 01 115 Form to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tx sales and use tax return 01 115 form

Create this form in 5 minutes!

How to create an eSignature for the tx sales and use tax return 01 115 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tx Sales And Use Tax Return 01 115 Form?

The Tx Sales And Use Tax Return 01 115 Form is a document required by the Texas Comptroller of Public Accounts for businesses to report their sales and use tax liabilities. This form helps ensure compliance with Texas sales tax laws and simplifies the process of tax filing for businesses operating within the state.

-

How can airSlate SignNow help with the Tx Sales And Use Tax Return 01 115 Form?

airSlate SignNow provides an efficient platform for businesses to complete, eSign, and send the Tx Sales And Use Tax Return 01 115 Form quickly. With its user-friendly interface, you can easily manage your tax documents while ensuring compliance and accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the Tx Sales And Use Tax Return 01 115 Form?

Yes, airSlate SignNow offers various pricing plans based on your business needs, which include features for preparing and eSigning the Tx Sales And Use Tax Return 01 115 Form. Our plans are cost-effective, designed to provide value while simplifying your document workflow.

-

What are the key features of airSlate SignNow for handling the Tx Sales And Use Tax Return 01 115 Form?

Key features of airSlate SignNow include easy document signing, templates for the Tx Sales And Use Tax Return 01 115 Form, and secure cloud storage. These functionalities help streamline the tax filing process, making it quicker and more efficient for your business.

-

Can I track my Tx Sales And Use Tax Return 01 115 Form submissions with airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your Tx Sales And Use Tax Return 01 115 Form submissions in real-time. This feature ensures you stay informed about your document's progress and enhances your workflow efficiency.

-

Does airSlate SignNow integrate with other accounting software for the Tx Sales And Use Tax Return 01 115 Form?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easier to manage your Tx Sales And Use Tax Return 01 115 Form alongside your financial records. This integration helps ensure all your documents and data are synchronized for seamless tax management.

-

What are the benefits of using airSlate SignNow for the Tx Sales And Use Tax Return 01 115 Form?

Using airSlate SignNow for the Tx Sales And Use Tax Return 01 115 Form provides numerous benefits, including time savings, improved accuracy, and enhanced security. You'll simplify your tax filing process while ensuring that your documents are protected and compliant with state regulations.

Get more for Tx Sales And Use Tax Return 01 115 Form

Find out other Tx Sales And Use Tax Return 01 115 Form

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy