01115 Rev 91624 TEXAS SALES and USE TAX RETURN 2019-2026

Understanding the Texas Sales and Use Tax Return

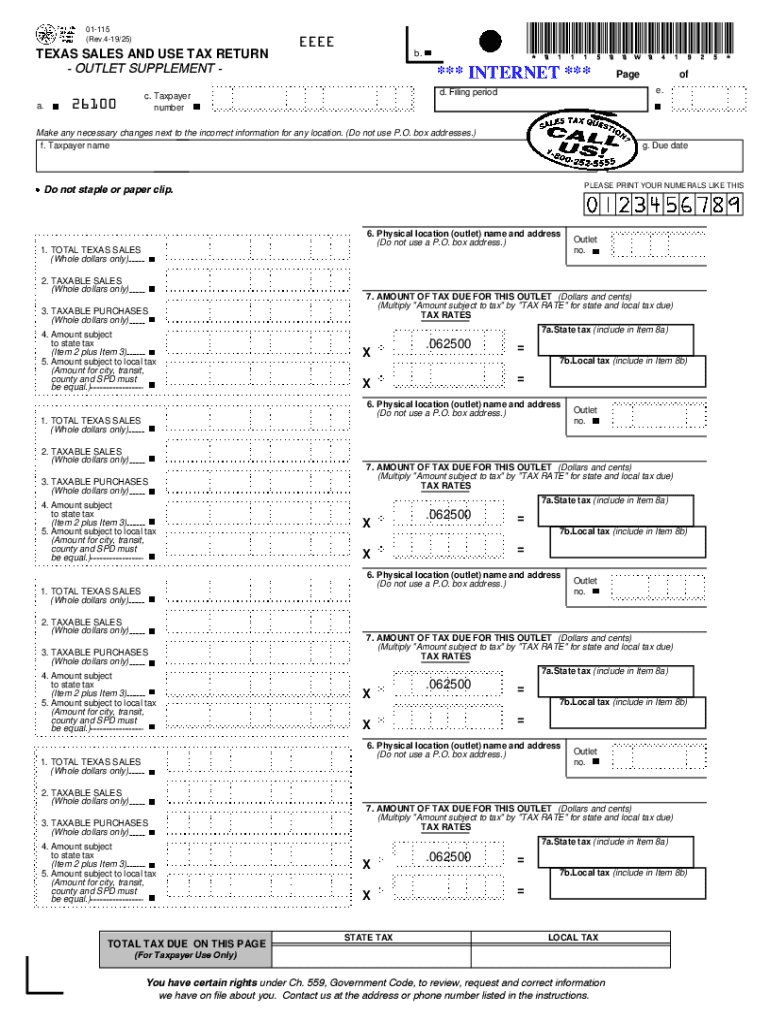

The Texas Sales and Use Tax Return, officially designated as form 01115 Rev 91624, is a crucial document for businesses operating in Texas. This form is used to report and remit sales and use taxes collected from customers. The Texas Comptroller of Public Accounts oversees the administration of this tax, ensuring compliance with state tax laws. Businesses must accurately complete this form to avoid penalties and maintain good standing with the state.

Steps to Complete the Texas Sales and Use Tax Return

Completing the Texas Sales and Use Tax Return involves several key steps:

- Gather necessary financial records, including sales invoices and receipts.

- Determine the total sales and taxable sales for the reporting period.

- Calculate the total amount of sales tax collected.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the completed form for any errors before submission.

Filing Deadlines and Important Dates

Timely filing of the Texas Sales and Use Tax Return is essential to avoid penalties. The due date for submitting this form typically falls on the 20th day of the month following the end of the reporting period. For businesses on a quarterly filing schedule, the deadlines are the 20th of the month following each quarter. Annual filers must submit their return by January 20 of the following year.

Required Documents for Filing

To successfully file the Texas Sales and Use Tax Return, businesses need to prepare specific documents:

- Sales records detailing all transactions during the reporting period.

- Receipts for any purchases subject to use tax.

- Previous tax returns for reference and consistency.

- Any correspondence from the Texas Comptroller regarding tax obligations.

Form Submission Methods

The Texas Sales and Use Tax Return can be submitted through various methods:

- Online: Businesses can file electronically through the Texas Comptroller's website.

- Mail: Completed forms can be sent via postal service to the designated address provided by the Comptroller.

- In-Person: Filers may also submit their returns at local Comptroller offices.

Penalties for Non-Compliance

Failure to file the Texas Sales and Use Tax Return on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is vital for businesses to adhere to filing deadlines and ensure the accuracy of their submissions to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct 01115 rev 91624 texas sales and use tax return

Create this form in 5 minutes!

How to create an eSignature for the 01115 rev 91624 texas sales and use tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas use tax return supplement?

A Texas use tax return supplement is a document that helps businesses report and pay use tax on items purchased for use in Texas. It is essential for compliance with state tax laws and ensures that businesses fulfill their tax obligations accurately.

-

How can airSlate SignNow assist with Texas use tax return supplements?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign Texas use tax return supplements. Our user-friendly interface simplifies the process, making it easier to manage tax documents and ensure timely submissions.

-

What are the pricing options for using airSlate SignNow for Texas use tax return supplements?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solution ensures that you can manage your Texas use tax return supplements without breaking the bank, with options for monthly or annual subscriptions.

-

Are there any features specifically designed for Texas use tax return supplements?

Yes, airSlate SignNow includes features that streamline the creation and management of Texas use tax return supplements. These features include customizable templates, automated reminders, and secure eSigning capabilities to enhance your workflow.

-

What benefits does airSlate SignNow provide for managing Texas use tax return supplements?

Using airSlate SignNow for your Texas use tax return supplements offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our platform helps you stay organized and ensures that your tax documents are always up to date.

-

Can airSlate SignNow integrate with other accounting software for Texas use tax return supplements?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to manage your Texas use tax return supplements alongside your financial records. This integration helps streamline your tax processes and enhances overall efficiency.

-

Is airSlate SignNow secure for handling Texas use tax return supplements?

Yes, airSlate SignNow prioritizes security and compliance. Our platform uses advanced encryption and security protocols to protect your Texas use tax return supplements and sensitive information, ensuring that your documents are safe and secure.

Get more for 01115 Rev 91624 TEXAS SALES AND USE TAX RETURN

- 05 163 texas franchise tax annual no tax due information report window state tx

- Advanced pain management general referral form

- Masjid farooq form

- Which king was purple and had many wives form

- Site candidate information package

- Form 2441

- Rider agreement template form

- Right of first offer agreement template form

Find out other 01115 Rev 91624 TEXAS SALES AND USE TAX RETURN

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form