Consumer Loan Application Sample Form

What is the Consumer Loan Application Sample

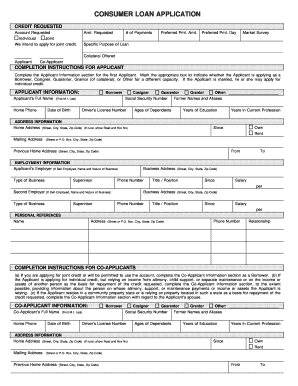

The consumer loan application sample is a standardized form used by individuals seeking to obtain a loan from a financial institution. This form collects essential information about the applicant, including personal details, employment history, income, and the purpose of the loan. By providing this information, lenders can assess the applicant's creditworthiness and ability to repay the loan. The consumer loan application sample serves as a crucial first step in the loan approval process, ensuring that both the lender and borrower have a clear understanding of the terms and conditions involved.

How to use the Consumer Loan Application Sample

Using the consumer loan application sample involves several straightforward steps. First, gather all necessary documents, such as identification, proof of income, and any other financial information required by the lender. Next, carefully fill out the application form, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions before submitting it to the lender. Many lenders now offer digital submission options, allowing for a more efficient process. Utilizing a reliable eSignature solution can also streamline the signing process, making it easier to finalize the application.

Key elements of the Consumer Loan Application Sample

The consumer loan application sample includes several key elements that are critical for the loan approval process. These elements typically consist of:

- Personal Information: Full name, address, date of birth, and Social Security number.

- Employment Details: Current employer, job title, length of employment, and income.

- Financial Information: Current debts, monthly expenses, and assets.

- Loan Details: Amount requested, loan purpose, and desired repayment terms.

Providing accurate and complete information in these sections is vital for a smooth application process.

Steps to complete the Consumer Loan Application Sample

Completing the consumer loan application sample involves a series of organized steps:

- Gather Documentation: Collect necessary documents, including proof of identity and income.

- Fill Out the Form: Enter your personal and financial information accurately.

- Review the Application: Check for errors or missing information before submission.

- Submit the Application: Send the completed form to the lender, either digitally or via traditional mail.

- Follow Up: Contact the lender to confirm receipt and inquire about the next steps.

Legal use of the Consumer Loan Application Sample

The legal use of the consumer loan application sample is governed by various regulations that ensure the protection of both the lender and the borrower. It is essential to comply with federal and state laws regarding lending practices, including the Truth in Lending Act (TILA) and the Equal Credit Opportunity Act (ECOA). These laws require lenders to provide clear and transparent information about loan terms and conditions. Additionally, using a secure platform for submitting the application can help maintain compliance with eSignature laws, making the process legally binding and secure.

Eligibility Criteria

Eligibility criteria for the consumer loan application sample vary by lender but generally include:

- Minimum age requirement, typically eighteen years.

- Proof of steady income or employment.

- A satisfactory credit history or credit score.

- U.S. citizenship or legal residency status.

Meeting these criteria is essential for a successful loan application, as lenders use them to evaluate the risk associated with lending money.

Quick guide on how to complete consumer loan application sample

Effortlessly Prepare Consumer Loan Application Sample on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents quickly and without delays. Handle Consumer Loan Application Sample effortlessly on any device using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

Easy Steps to Modify and eSign Consumer Loan Application Sample with Ease

- Locate Consumer Loan Application Sample and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or hide sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to share your form via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Consumer Loan Application Sample while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consumer loan application sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a consumer loan application sample?

A consumer loan application sample is a template that outlines the necessary information required from borrowers to process a loan. It typically includes personal details, financial information, and employment history. Utilizing a consumer loan application sample can streamline the application process and ensure all critical data is collected efficiently.

-

How does airSlate SignNow facilitate the consumer loan application process?

airSlate SignNow provides a user-friendly platform for businesses to create, send, and manage consumer loan application samples. With easy eSigning capabilities, it simplifies the document handling process and reduces turnaround time for approvals. The platform is designed to enhance efficiency and customer satisfaction.

-

Is there a cost associated with using the consumer loan application sample in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans depending on the features needed, including access to consumer loan application samples. It's best to review our pricing page to choose a plan that fits your business needs. The investment is often offset by the time and resources saved in document management.

-

Can I customize the consumer loan application sample in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize consumer loan application samples according to specific requirements. You can add or edit fields to capture all necessary information, ensuring that the application meets your lenders' standards and organizational needs.

-

What are the benefits of using airSlate SignNow for consumer loan applications?

Using airSlate SignNow for consumer loan applications offers numerous advantages including faster processing times, reduced paper usage, and enhanced security. The platform’s eSigning feature enables quick approvals, which can signNowly improve user experience for both lenders and borrowers. Additionally, compliance tracking supports adherence to legal requirements.

-

Does airSlate SignNow integrate with other software for processing consumer loan applications?

Yes, airSlate SignNow integrates seamlessly with various third-party applications such as CRM systems and accounting software. This integration allows for a more streamlined workflow, enabling you to manage consumer loan application samples alongside other business processes. Check our integrations page for a full list of compatible applications.

-

How can I ensure the security of my consumer loan application sample data?

airSlate SignNow prioritizes the security of all documents, including consumer loan application samples. We use top-tier encryption and security protocols to protect sensitive data during transmission and storage. Regular audits and compliance with industry standards further ensure that your information remains secure.

Get more for Consumer Loan Application Sample

- Form of charge over account created by surplus international

- Daily menu production record form

- 5197566505 form

- Cbp form 4647 pdf

- Woodmans employment application jobapplicationform

- Need info please address for mvc mail in license renewal form

- Lease for property agreement template form

- Lease for renting a house agreement template form

Find out other Consumer Loan Application Sample

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document