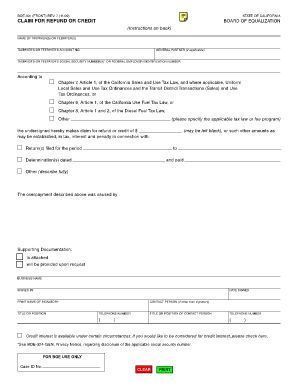

Boe 101 Form

What is the Boe 101

The Boe 101 form is a crucial document used primarily for tax purposes in the United States. It serves as a declaration for businesses and individuals to report specific information to the relevant tax authorities. This form is essential for ensuring compliance with federal and state tax regulations. Understanding the purpose and requirements of the Boe 101 is vital for anyone involved in business activities that may require tax reporting.

How to use the Boe 101

Using the Boe 101 form involves a series of straightforward steps. First, you need to gather all necessary information, including your business details and financial data relevant to the reporting period. Next, accurately fill out the form, ensuring that all entries are complete and correct. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements of your state or local tax authority.

Steps to complete the Boe 101

Completing the Boe 101 form requires careful attention to detail. Here are the steps to follow:

- Gather required documentation, such as financial records and identification numbers.

- Download the Boe 101 form from the appropriate tax authority's website.

- Fill in the form with accurate information, ensuring all fields are addressed.

- Review the completed form for any errors or omissions.

- Submit the form according to the guidelines provided by your local tax authority.

Legal use of the Boe 101

The legal use of the Boe 101 form is governed by specific tax laws and regulations. To ensure that the form is legally binding, it must be filled out correctly and submitted on time. Failure to comply with these regulations can lead to penalties or legal issues. It is essential to familiarize yourself with the legal requirements associated with the Boe 101 to avoid complications.

Key elements of the Boe 101

Several key elements must be included when filling out the Boe 101 form. These elements typically consist of:

- Taxpayer identification information, including name and address.

- Details about the business entity, such as type and registration number.

- Financial information relevant to the reporting period.

- Signature and date to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Boe 101 form can vary based on the type of business and the jurisdiction. Generally, it is important to submit the form by the designated deadline to avoid penalties. Keeping track of these dates ensures compliance and helps maintain good standing with tax authorities. It is advisable to consult the specific guidelines provided by your local tax authority for the most accurate deadlines.

Quick guide on how to complete boe 101

Complete Boe 101 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Boe 101 on any device with airSlate SignNow Android or iOS applications and streamline any document-focused process today.

The easiest way to modify and eSign Boe 101 with ease

- Locate Boe 101 and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to store your changes.

- Choose how you want to send your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Boe 101 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the boe 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is boe 101 in the context of airSlate SignNow?

Boe 101 refers to the basic understanding of document signing and management using airSlate SignNow. It encompasses how the platform simplifies sending, signing, and managing documents electronically. By mastering boe 101, users can enhance their workflow and efficiency.

-

How much does it cost to use airSlate SignNow for boe 101 features?

airSlate SignNow offers various pricing plans to fit different business needs, with competitive pricing that includes the essential boe 101 features. Users can choose from monthly or annual subscriptions, allowing for flexibility and scalability as your business grows. Contact our sales team for custom pricing options based on your requirements.

-

What features does airSlate SignNow provide for understanding boe 101?

The boe 101 features in airSlate SignNow include easy document creation, secure eSigning, and a user-friendly interface. Users can access real-time tracking, templates, and collaboration tools to streamline their document workflows. These features are designed to simplify the signing process for everyone involved.

-

How can boe 101 benefits enhance business efficiency?

Understanding boe 101 can signNowly enhance business efficiency by reducing the time spent on manual document handling. With airSlate SignNow, businesses can quickly send, sign, and store documents securely online. This leads to faster decision-making and improved productivity across teams.

-

Are there integrations available with airSlate SignNow for boe 101?

Yes, airSlate SignNow offers various integrations that support boe 101, including popular tools like Google Drive, Salesforce, and Dropbox. These integrations streamline your document workflows by connecting airSlate SignNow with the applications you already use. This helps in managing documents more effectively and reduces friction in your processes.

-

What industries benefit from boe 101 with airSlate SignNow?

Many industries benefit from the boe 101 approach in airSlate SignNow, including real estate, finance, healthcare, and legal sectors. Essentially, any organization that requires document signing and management can leverage these easy-to-use tools to enhance their operations. Adopting boe 101 can lead to industry-specific benefits by enabling seamless transactions.

-

Is training available for users new to boe 101 with airSlate SignNow?

Yes, airSlate SignNow provides a variety of training resources for users new to boe 101. These include tutorials, webinars, and a comprehensive knowledge base to help users become proficient quickly. Support is also available to ensure a smooth transition to using the platform.

Get more for Boe 101

- Alberta 4 h public speaking certificate alberta 4 h public speaking certificate www1 agric gov ab form

- Washington state vendor registration form

- Combined fire safety emergency action plan staffing chart nyc form

- Ohio use form

- Application for economic assistance benefits nebraska benefitscheckup form

- Conditional power application holly springs nc form

- Title transfer application seaside heights seaside heightsnj form

- Motor vehicle lease agreement template form

Find out other Boe 101

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe