Mortgage Assistance Application 2016-2026

What is the Mortgage Assistance Application

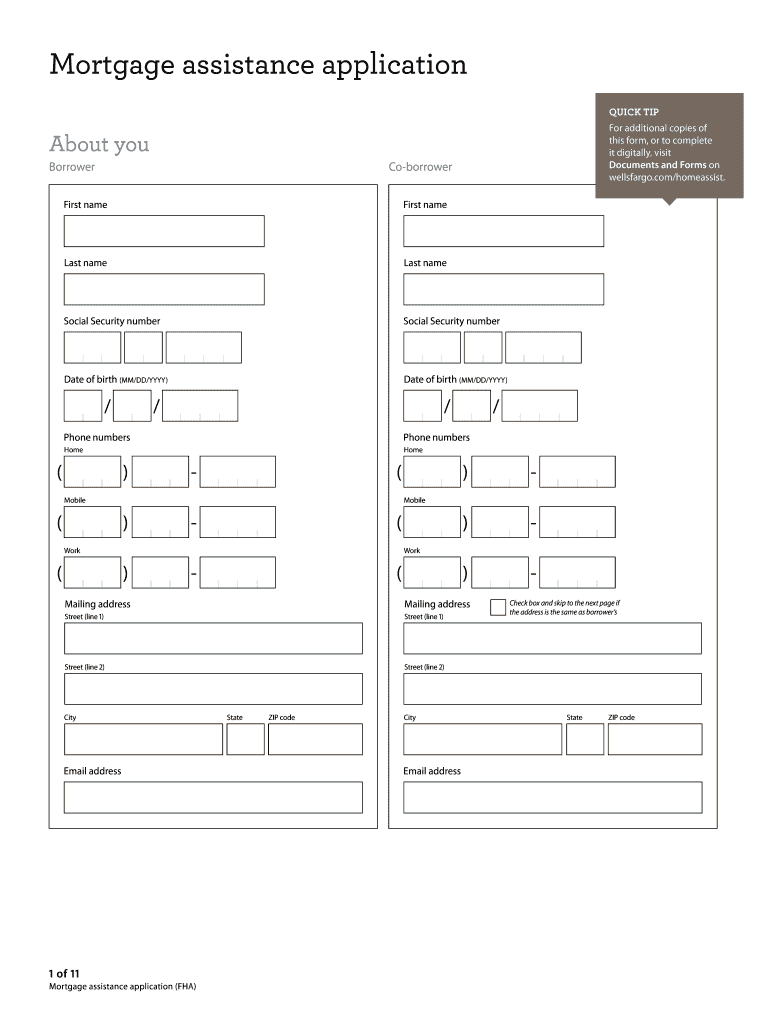

The mortgage assistance application is a formal document that homeowners can submit to seek help with their mortgage payments. This application is often used by individuals facing financial difficulties, such as job loss or medical emergencies, which may hinder their ability to meet mortgage obligations. The application typically requests detailed information about the homeowner's financial situation, including income, expenses, and any other relevant circumstances that may affect their ability to pay their mortgage.

Steps to Complete the Mortgage Assistance Application

Completing the mortgage assistance application involves several key steps to ensure that all necessary information is accurately provided. First, gather all required documentation, such as proof of income, bank statements, and any relevant financial records. Next, fill out the application form carefully, ensuring that all sections are completed. Pay particular attention to details regarding your financial status and any hardships you may be experiencing. After filling out the form, review it for accuracy before submitting it to ensure that it meets all requirements for consideration.

Required Documents

When applying for mortgage assistance, certain documents are typically required to support your application. These may include:

- Proof of income, such as pay stubs or tax returns

- Bank statements for the past few months

- Documentation of any financial hardships, such as medical bills or unemployment notices

- Identification documents, such as a driver's license or Social Security card

Having these documents ready can streamline the application process and improve the chances of approval.

Eligibility Criteria

Eligibility for mortgage assistance can vary based on the lender and specific programs available. Generally, homeowners must demonstrate financial hardship, which can include loss of income, increased expenses, or other significant financial burdens. Additionally, applicants may need to meet certain income thresholds and provide proof of their current mortgage status. Understanding these criteria is essential to determine whether you qualify for assistance.

Form Submission Methods

The mortgage assistance application can typically be submitted through various methods, depending on the lender's policies. Common submission methods include:

- Online submission through the lender's website

- Mailing a physical copy of the application to the lender's designated address

- In-person submission at a local branch or office

Choosing the right submission method can help ensure that your application is processed efficiently.

Legal Use of the Mortgage Assistance Application

The mortgage assistance application is a legally binding document, and it is important to provide accurate and truthful information. Misrepresentation or submission of false information can lead to penalties, including denial of assistance or legal repercussions. Homeowners should ensure that they understand the legal implications of their application and comply with all relevant regulations.

Quick guide on how to complete wells fargo mortgage assistance application fha wells fargo mortgage assistance application fha

The simplest method to locate and sign Mortgage Assistance Application

On the scale of your whole organization, ineffective workflows surrounding document approval can consume a signNow amount of productive time. Signing documents such as Mortgage Assistance Application is a regular aspect of operations in any enterprise, which is why the efficacy of each agreement’s lifecycle profoundly impacts the organization’s overall performance. With airSlate SignNow, signing your Mortgage Assistance Application is as straightforward and quick as it can be. This platform provides you with the most up-to-date version of virtually any document. Even better, you can sign it right away without the need to install external software on your computer or produce physical paper copies.

Steps to acquire and sign your Mortgage Assistance Application

- Explore our library by category or use the search feature to locate the document you require.

- Examine the document preview by clicking on Learn more to ensure it is the correct one.

- Press Get form to begin editing immediately.

- Fill out your document and add any necessary details using the toolbar.

- Upon completion, click the Sign tool to sign your Mortgage Assistance Application.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing choices as required.

With airSlate SignNow, you have everything you need to handle your paperwork efficiently. You can search for, complete, modify, and even send your Mortgage Assistance Application all in one tab without difficulty. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wells fargo mortgage assistance application fha wells fargo mortgage assistance application fha

How to make an electronic signature for the Wells Fargo Mortgage Assistance Application Fha Wells Fargo Mortgage Assistance Application Fha online

How to create an eSignature for the Wells Fargo Mortgage Assistance Application Fha Wells Fargo Mortgage Assistance Application Fha in Chrome

How to make an eSignature for putting it on the Wells Fargo Mortgage Assistance Application Fha Wells Fargo Mortgage Assistance Application Fha in Gmail

How to create an eSignature for the Wells Fargo Mortgage Assistance Application Fha Wells Fargo Mortgage Assistance Application Fha from your mobile device

How to generate an electronic signature for the Wells Fargo Mortgage Assistance Application Fha Wells Fargo Mortgage Assistance Application Fha on iOS devices

How to create an eSignature for the Wells Fargo Mortgage Assistance Application Fha Wells Fargo Mortgage Assistance Application Fha on Android

People also ask

-

What is a mortgage assistance application?

A mortgage assistance application is a formal request for help with your mortgage payments or loan modifications. It allows homeowners facing financial difficulties to seek support from lenders or assistance programs. Completing a mortgage assistance application can help you find potential solutions to manage your mortgage more effectively.

-

How can airSlate SignNow help with my mortgage assistance application?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning your mortgage assistance application. With user-friendly features, you can streamline the process and ensure all necessary documents are completed and submitted correctly. This ease of use minimizes delays and helps you manage your mortgage assistance application more effectively.

-

Is there a cost associated with using airSlate SignNow for my mortgage assistance application?

Yes, airSlate SignNow offers various pricing plans to cater to different needs. The costs are affordable and provide excellent value for users looking to simplify the mortgage assistance application process. You can choose a plan that fits your business requirements while enjoying intuitive features and support.

-

Can I track the status of my mortgage assistance application with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your mortgage assistance application in real-time. You will receive notifications and updates as your application progresses, ensuring you stay informed every step of the way. This feature enhances communication and transparency during the application process.

-

What features does airSlate SignNow offer for mortgage assistance applications?

airSlate SignNow offers features like document templates, eSignature capabilities, and real-time collaboration for mortgage assistance applications. These tools make it easier to prepare, send, and sign documents electronically, saving you time and simplifying the overall process. With these features, managing your mortgage assistance application becomes straightforward.

-

How secure is my information when using airSlate SignNow for mortgage assistance applications?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption and security protocols to protect your personal information during the mortgage assistance application process. You can trust that your data is safe, allowing you to focus on getting the assistance you need.

-

Does airSlate SignNow integrate with other platforms for mortgage assistance applications?

Yes, airSlate SignNow offers seamless integrations with various platforms and tools, enhancing your experience with mortgage assistance applications. This connectivity allows for improved workflow and easy access to your files and information across different systems. Integration can help streamline your processes further, making handling your mortgage assistance application hassle-free.

Get more for Mortgage Assistance Application

- City of phoenix police department phoenix form

- Punjab university undertaking form

- Bbusinessb form

- Cptpp certificate of origin pdf form

- The effect of a consent order on your constitutionally and statutorily protected rights including form

- Draft california trial court facilities standards form

- Chef employment contract template form

- Chinese employment contract template form

Find out other Mortgage Assistance Application

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy