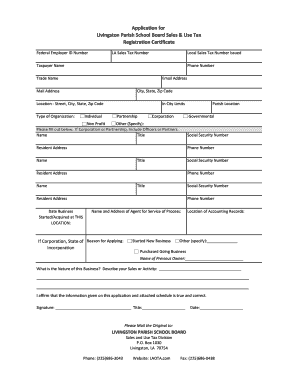

Application for Livingston Parish School Board Sales & Use Form

What is the Application for Livingston Parish Sales Tax Online?

The Application for Livingston Parish Sales Tax Online is a digital form that enables businesses and individuals to report and pay sales tax obligations to the Livingston Parish authorities. This application streamlines the tax reporting process, allowing users to complete their filings efficiently and securely through an online platform. The form is essential for compliance with local tax regulations and helps ensure that all sales tax collected is accurately reported and remitted.

How to Use the Application for Livingston Parish Sales Tax Online

Using the Application for Livingston Parish Sales Tax Online involves several straightforward steps. First, users must access the online platform designated for tax submissions. After logging in or creating an account, individuals can fill out the required fields, including sales figures and relevant business information. Once the form is completed, users can review their entries for accuracy before submitting. The platform typically provides options for payment processing, ensuring that the tax due is paid promptly.

Steps to Complete the Application for Livingston Parish Sales Tax Online

Completing the Application for Livingston Parish Sales Tax Online requires attention to detail. Here are the primary steps:

- Access the online tax application portal.

- Create or log into your user account.

- Fill in the necessary information, including sales amounts and business details.

- Review the completed application for accuracy.

- Submit the application electronically.

- Make the required payment through the available online methods.

Legal Use of the Application for Livingston Parish Sales Tax Online

The Application for Livingston Parish Sales Tax Online is legally binding when completed in accordance with local regulations. To ensure compliance, users must provide accurate information and adhere to submission deadlines. The application must be signed electronically, which is permissible under U.S. law, provided it meets the criteria set forth by the ESIGN Act and UETA. This legal framework validates electronic signatures and ensures the legitimacy of online submissions.

Required Documents for the Application for Livingston Parish Sales Tax Online

To successfully complete the Application for Livingston Parish Sales Tax Online, certain documents may be necessary. Users typically need:

- Sales records for the reporting period.

- Business identification details, such as a tax ID number.

- Any previous tax filings for reference.

Having these documents ready can facilitate a smoother application process and help ensure accuracy in reporting.

Filing Deadlines for the Application for Livingston Parish Sales Tax Online

Filing deadlines for the Application for Livingston Parish Sales Tax Online are crucial for compliance. Generally, businesses must submit their sales tax applications on a monthly or quarterly basis, depending on their sales volume. It is vital to check the specific deadlines set by the Livingston Parish tax authority to avoid penalties. Late submissions may incur fines or interest on unpaid taxes, emphasizing the importance of timely filing.

Quick guide on how to complete application for livingston parish school board sales amp use

Effortlessly prepare Application For Livingston Parish School Board Sales & Use on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed papers, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any holdups. Manage Application For Livingston Parish School Board Sales & Use on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to alter and eSign Application For Livingston Parish School Board Sales & Use effortlessly

- Locate Application For Livingston Parish School Board Sales & Use and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your choice. Adjust and eSign Application For Livingston Parish School Board Sales & Use and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for livingston parish school board sales amp use

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for paying the Livingston Parish sales tax online?

To pay the Livingston Parish sales tax online, you can use the airSlate SignNow platform, which provides a streamlined interface for electronic submissions. Simply log into your account, navigate to the tax payment section, and follow the prompts to complete your payment securely. This convenient method ensures that you stay compliant with local tax regulations.

-

Is there a fee associated with using airSlate SignNow for Livingston Parish sales tax payments?

Yes, airSlate SignNow may charge a nominal fee for processing Livingston Parish sales tax payments online. However, this fee is typically outweighed by the time and cost savings from using an efficient electronic solution. You can check our pricing page for detailed information on transaction fees.

-

Can I use airSlate SignNow to eSign tax documents related to Livingston Parish sales tax?

Absolutely! airSlate SignNow not only allows you to pay Livingston Parish sales tax online but also enables you to electronically sign any required tax documents. This feature simplifies the documentation process, ensuring that you can manage everything from one user-friendly platform.

-

What are the benefits of paying Livingston Parish sales tax online?

Paying Livingston Parish sales tax online via airSlate SignNow offers numerous benefits, including faster processing times and enhanced convenience. With online payments, you can submit your taxes anytime and anywhere, avoiding long lines and administrative burdens. Additionally, digital records are easily accessible for future reference.

-

Are there integrations available with airSlate SignNow for tax-related processes?

Yes, airSlate SignNow offers various integrations with accounting software and tax preparation tools, making it easier to manage your Livingston Parish sales tax online. These integrations help streamline your workflow, allowing for efficient tracking and reporting of sales tax payments and associated documents.

-

How secure is the airSlate SignNow platform for paying Livingston Parish sales tax?

Security is a top priority at airSlate SignNow. When you pay Livingston Parish sales tax online, your data is encrypted and stored securely, ensuring that your sensitive information remains protected. Additionally, our platform complies with industry-standard security protocols to give you peace of mind while transacting.

-

Can businesses set up recurring payments for Livingston Parish sales tax?

Yes, airSlate SignNow allows businesses to set up recurring payments for Livingston Parish sales tax, helping ensure timely submissions. This feature minimizes the risk of late fees and penalties, making tax management much easier. Contact our support team for guidance on setting up this function.

Get more for Application For Livingston Parish School Board Sales & Use

Find out other Application For Livingston Parish School Board Sales & Use

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form