California Sales Tax Exemption Certificate Form

What is the California Sales Tax Exemption Certificate?

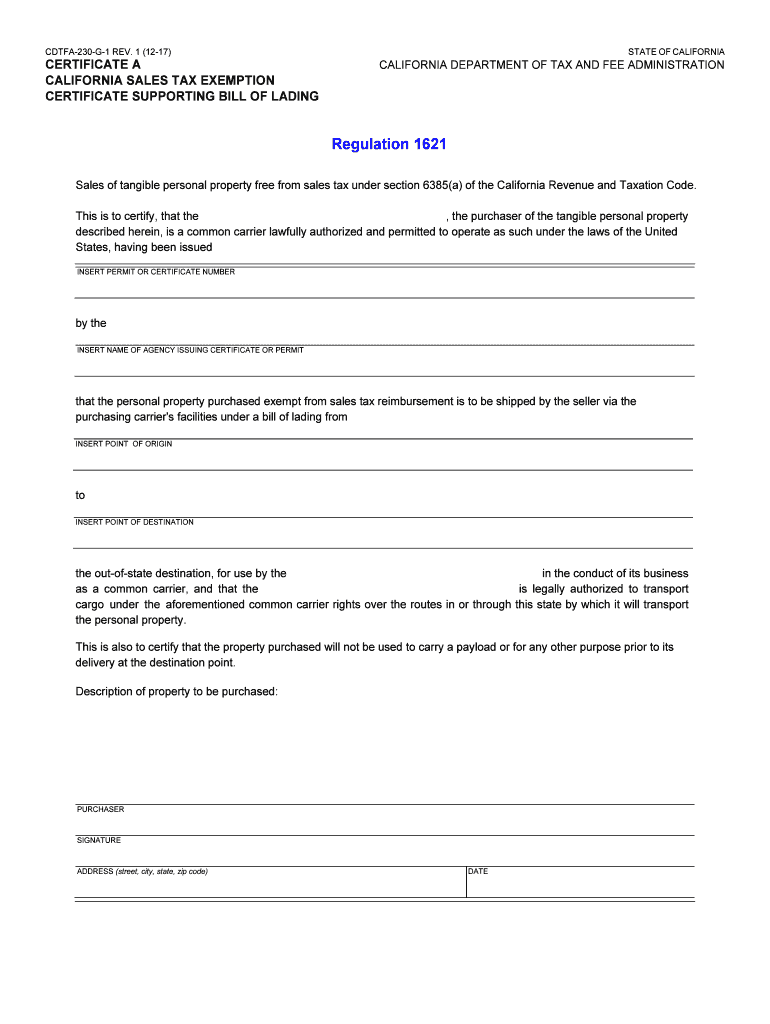

The California Sales Tax Exemption Certificate, often referred to as the CDTFA-230, is a crucial document that allows eligible purchasers to buy goods without paying sales tax. This certificate is primarily used by businesses and organizations that qualify for tax-exempt status under California law. The exemption applies to specific types of purchases, such as items intended for resale, certain types of manufacturing equipment, or goods used in charitable activities.

Understanding the purpose of this certificate is essential for businesses looking to save on costs associated with sales tax. By properly utilizing the CDTFA-230, organizations can ensure compliance with California tax regulations while maximizing their financial resources.

Steps to Complete the California Sales Tax Exemption Certificate

Completing the CDTFA-230 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide to help you through the process:

- Gather Required Information: Collect all necessary details, including your business name, address, and California seller's permit number.

- Identify the Type of Exemption: Determine the specific reason for the exemption, such as resale, manufacturing, or nonprofit status.

- Complete the Form: Fill out the CDTFA-230, ensuring all fields are accurately completed. Include your signature and date to validate the document.

- Submit the Certificate: Provide the completed form to the seller from whom you are purchasing goods. Keep a copy for your records.

Following these steps will help ensure that your exemption certificate is filled out correctly and can be accepted by sellers in California.

Legal Use of the California Sales Tax Exemption Certificate

The legal use of the CDTFA-230 is governed by California tax laws. It is essential to understand that this certificate is only valid when used by eligible purchasers for qualifying purchases. Misuse of the exemption certificate can lead to penalties, including back taxes and interest charges.

To maintain compliance, businesses should regularly review their eligibility for tax exemption and ensure that the CDTFA-230 is used only for permissible transactions. Proper record-keeping and adherence to state guidelines are vital for avoiding legal issues related to sales tax exemptions.

Key Elements of the California Sales Tax Exemption Certificate

The CDTFA-230 includes several important elements that must be accurately filled out to ensure its validity. Key components of the certificate include:

- Purchaser Information: Name, address, and seller's permit number of the buyer.

- Seller Information: Name and address of the seller from whom the goods are being purchased.

- Reason for Exemption: A clear indication of the type of exemption being claimed.

- Signature: The signature of the authorized representative of the purchaser, along with the date of signing.

Ensuring that all these elements are correctly completed is crucial for the acceptance of the exemption certificate by sellers.

Eligibility Criteria for the California Sales Tax Exemption Certificate

To qualify for the CDTFA-230, certain eligibility criteria must be met. Generally, the following entities may be eligible:

- Businesses that hold a valid California seller's permit.

- Nonprofit organizations recognized under section 501(c)(3) of the Internal Revenue Code.

- Government agencies and certain educational institutions.

It is important for applicants to review these criteria carefully and ensure that they meet all requirements before applying for the exemption certificate.

Examples of Using the California Sales Tax Exemption Certificate

Utilizing the CDTFA-230 can take various forms depending on the nature of the purchase. Here are some common examples:

- A retail business purchasing inventory for resale can use the certificate to avoid paying sales tax on those items.

- A nonprofit organization acquiring supplies for a charitable event may present the exemption certificate to the vendor.

- Manufacturers purchasing machinery or equipment for production purposes can utilize the exemption to reduce upfront costs.

These examples illustrate how different entities can effectively leverage the CDTFA-230 to benefit their operations while remaining compliant with California tax laws.

Quick guide on how to complete california sales tax exemption certificate

Prepare California Sales Tax Exemption Certificate effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage California Sales Tax Exemption Certificate on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign California Sales Tax Exemption Certificate with ease

- Locate California Sales Tax Exemption Certificate and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to deliver your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign California Sales Tax Exemption Certificate and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california sales tax exemption certificate

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is cdtfa230?

Cdtfa230 refers to a specific code that may be relevant for tax-related documentation. Understanding cdtfa230 is crucial for businesses using airSlate SignNow as it helps in ensuring compliance with state regulations. By incorporating cdtfa230 into your document processes, you can streamline your operations and maintain accuracy.

-

How can airSlate SignNow help with cdtfa230 compliance?

AirSlate SignNow offers a user-friendly platform that assists businesses in managing cdtfa230 documents efficiently. The integrated tools ensure that your documents meet necessary compliance standards, reducing the risk of errors. With airSlate SignNow, you can confidently handle all aspects of cdtfa230 requirements.

-

What features should I look for in cdtfa230 document solutions?

When seeking solutions for cdtfa230 documentation, focus on features such as eSignature capabilities, customizable templates, and secure cloud storage. AirSlate SignNow provides these features, allowing you to create and manage your cdtfa230 documents easily. These functionalities enhance your workflow and ensure your documents are legally binding.

-

Is airSlate SignNow a cost-effective solution for cdtfa230 documentation?

Yes, airSlate SignNow is a cost-effective solution for managing cdtfa230 documentation. With competitive pricing plans, businesses of all sizes can utilize its powerful features without breaking the bank. This accessibility makes airSlate SignNow a great choice for efficient document handling.

-

What benefits does airSlate SignNow offer for cdtfa230 related documents?

AirSlate SignNow provides several benefits for managing cdtfa230 related documents, including improved turnaround times and reduced paperwork. The platform allows for quick eSigning and sending of documents, ultimately saving businesses time and resources. Additionally, it enhances collaboration among teams dealing with cdtfa230 tasks.

-

Are there integrations available for cdtfa230 document management?

Absolutely, airSlate SignNow offers integrations with various applications that can enhance your cdtfa230 document management. These integrations facilitate seamless data transfer, making it simpler to manage and work with cdtfa230 forms. By utilizing these integrations, businesses can optimize their document workflows.

-

How secure is airSlate SignNow for handling cdtfa230 documents?

Security is a top priority for airSlate SignNow, especially for sensitive cdtfa230 documents. The platform employs advanced encryption and robust security protocols to protect your data. Businesses can rest assured that their cdtfa230 documentation is safe and secure while using airSlate SignNow.

Get more for California Sales Tax Exemption Certificate

Find out other California Sales Tax Exemption Certificate

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document