Ftb 2924 Form

What is the FTB 2924?

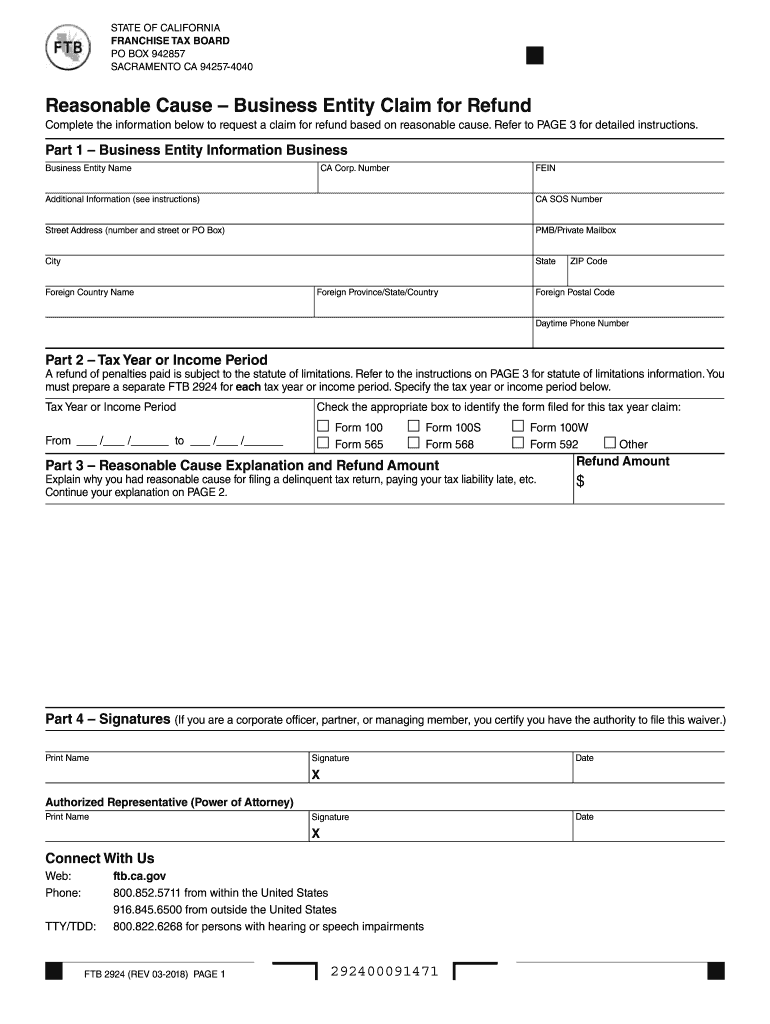

The FTB 2924, also known as the California Claim for Refund form, is a document used by taxpayers in California to request a refund for overpaid taxes. This form is particularly relevant for business entities, allowing them to claim refunds for various tax types, including income and franchise taxes. Understanding the purpose and requirements of the FTB 2924 is essential for ensuring that taxpayers can accurately and efficiently recover funds that they are entitled to.

How to use the FTB 2924

Using the FTB 2924 involves several key steps. Taxpayers must first determine their eligibility for a refund and gather all necessary documentation that supports their claim. Once the relevant information is collected, the form can be filled out, ensuring that all sections are completed accurately. After completing the form, it should be submitted to the California Franchise Tax Board (FTB) for processing. It is important to keep copies of all submitted documents for personal records.

Steps to complete the FTB 2924

Completing the FTB 2924 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including prior tax returns and any supporting evidence for the refund claim.

- Fill out the FTB 2924 form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the FTB, either online or via mail, as per the instructions provided.

- Retain a copy of the submitted form and any supporting documents for your records.

Legal use of the FTB 2924

The legal use of the FTB 2924 is governed by California tax laws. To ensure the form is considered valid, it must be completed in accordance with the guidelines set forth by the California Franchise Tax Board. This includes providing accurate information and submitting the form within the designated time frames for claiming refunds. Adhering to these regulations helps protect taxpayers and ensures their claims are processed smoothly.

Key elements of the FTB 2924

Several key elements must be included when filling out the FTB 2924. These include:

- Taxpayer identification information, such as name, address, and taxpayer identification number.

- Details of the tax year for which the refund is being requested.

- A clear explanation of the reason for the refund request.

- Any supporting documentation that substantiates the claim.

Form Submission Methods

The FTB 2924 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the California Franchise Tax Board website.

- Mailing a physical copy of the completed form to the appropriate FTB address.

- In-person submission at designated FTB offices, if applicable.

Quick guide on how to complete ftb 2924

Complete Ftb 2924 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Ftb 2924 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Ftb 2924 with ease

- Locate Ftb 2924 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Purge the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Ftb 2924 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 2924

The way to create an eSignature for your PDF online

The way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is a form 2924 and how can airSlate SignNow help with it?

A form 2924 is a specific document often used for official purposes. Using airSlate SignNow, you can easily create, send, and eSign your form 2924, ensuring that your documents are completed quickly and securely, streamlining your workflow.

-

What are the key features of airSlate SignNow related to form 2924?

AirSlate SignNow offers a variety of features for handling form 2924, including customizable templates, real-time tracking of signatures, and automated reminders. These features help enhance document management efficiency, ensuring that your form 2924 is processed without delays.

-

Is there a free trial available for airSlate SignNow to work with form 2924?

Yes, airSlate SignNow offers a free trial that allows you to test the platform's functionality with form 2924. This trial helps you explore its user-friendly interface and powerful features before committing to a subscription.

-

What pricing plans does airSlate SignNow offer for managing form 2924?

AirSlate SignNow provides various pricing plans tailored to the needs of businesses managing form 2924. Plans are designed to accommodate different user volumes and features, offering cost-effective solutions for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications while working on form 2924?

Absolutely! AirSlate SignNow allows seamless integration with various applications, making it easy to manage form 2924 alongside your existing tools like CRM systems and cloud storage services. This enhances your workflow and productivity.

-

How secure is airSlate SignNow for handling form 2924?

Security is a top priority for airSlate SignNow when managing form 2924. The platform uses industry-standard encryption and complies with legal regulations to protect your sensitive information and ensure secure eSigning.

-

What are the benefits of using airSlate SignNow for form 2924?

Using airSlate SignNow for form 2924 offers several benefits, including faster turnaround times and reduced paperwork. The platform simplifies the signing process, allowing multiple parties to sign simultaneously, which enhances efficiency.

Get more for Ftb 2924

Find out other Ftb 2924

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service