Renters Rebate Utah Form

What is the Renters Rebate Utah

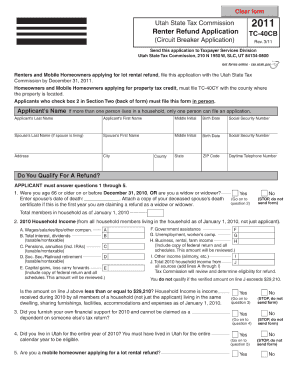

The Renters Rebate Utah is a financial assistance program designed to help low-income renters in the state of Utah. This program provides eligible individuals with a rebate to offset rental costs, making housing more affordable. The rebate is based on the amount of rent paid and the applicant's income level, ensuring that those who need assistance the most receive the support they require. Understanding the specifics of the program can help potential applicants determine their eligibility and the potential benefits available to them.

Eligibility Criteria

To qualify for the Renters Rebate Utah, applicants must meet specific criteria. Generally, eligibility is based on factors such as income, age, and residency. Key requirements include:

- Applicants must be Utah residents.

- Income must fall below a certain threshold, which varies by household size.

- Applicants must have paid rent for at least six months during the year.

- Those who are 65 years or older, or who are disabled, may have additional considerations for eligibility.

Understanding these criteria is essential for determining if you can apply for the rebate.

Steps to complete the Renters Rebate Utah

Completing the Renters Rebate application online involves several straightforward steps. Following this process can help ensure that your application is filled out correctly and submitted on time:

- Gather necessary documentation, including proof of income and rental payments.

- Access the online application form through the Utah State Tax Commission website.

- Fill out the application form with accurate information, ensuring all required fields are completed.

- Review the application for any errors or omissions before submission.

- Submit the application electronically and keep a copy for your records.

By following these steps, applicants can efficiently navigate the online application process.

Required Documents

When applying for the Renters Rebate Utah, specific documents are necessary to support your application. These documents typically include:

- Proof of income, such as pay stubs or tax returns.

- Rental agreements or leases to verify the amount of rent paid.

- Identification documents, like a driver's license or state ID.

- Any additional documentation that may be requested by the Utah State Tax Commission.

Having these documents ready can streamline the application process and increase the likelihood of approval.

Form Submission Methods

Applicants can submit the Renters Rebate application through various methods to accommodate different preferences. The primary methods include:

- Online: The most efficient way is to complete and submit the application through the Utah State Tax Commission's online portal.

- Mail: Applicants can print the completed application and send it via postal mail to the appropriate office.

- In-Person: For those who prefer face-to-face assistance, applications can be submitted in person at designated state offices.

Choosing the right submission method can help ensure that your application is processed in a timely manner.

Legal use of the Renters Rebate Utah

The Renters Rebate Utah must be used in accordance with state laws and regulations. This means that the rebate is intended solely for assisting with rental payments and cannot be used for other expenses. Understanding the legal framework surrounding the rebate is crucial for ensuring compliance and avoiding potential penalties. Additionally, applicants must provide accurate information on their applications, as any discrepancies can lead to disqualification or legal repercussions.

Quick guide on how to complete renters rebate utah

Complete Renters Rebate Utah effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the needed form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Renters Rebate Utah on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Renters Rebate Utah with ease

- Locate Renters Rebate Utah and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, be it via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Modify and electronically sign Renters Rebate Utah to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the renters rebate utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the renters rebate application online process?

The renters rebate application online process simplifies submitting your rebate claim through a user-friendly platform. You can easily fill out the required forms, upload any supporting documents, and submit your application all from the convenience of your home or office. This ensures a faster turnaround and reduces the hassle of traditional paper-based applications.

-

How much does it cost to submit a renters rebate application online?

Submitting a renters rebate application online through airSlate SignNow is cost-effective and typically involves minimal fees. The overall costs depend on your specific state regulations and any potential service fees charged by the platform. Unlike traditional methods, our solution saves you time and money while ensuring seamless processing of your application.

-

What features does the airSlate SignNow platform offer for renters rebate applications?

The airSlate SignNow platform offers a range of features designed for efficient renters rebate application online. Key features include easy document eSigning, secure file storage, and real-time tracking of your application status. This streamlines the entire submission process, ensuring all your documents are organized and readily available.

-

What are the benefits of using airSlate SignNow for renters rebate applications?

Using airSlate SignNow for your renters rebate application online provides numerous benefits, including increased efficiency and reduced processing times. You’ll have access to an intuitive interface that makes document management easy. Additionally, our platform enhances security and compliance, protecting your sensitive information throughout the process.

-

Is it safe to submit my renters rebate application online?

Yes, it is completely safe to submit your renters rebate application online through airSlate SignNow. We implement robust security measures, including encryption and authentication protocols, to safeguard your data. Our platform is designed to ensure that your personal information remains confidential and secure during the application process.

-

Can I track the status of my renters rebate application online?

Absolutely! With airSlate SignNow, you can easily track the status of your renters rebate application online. Our dashboard provides real-time updates, allowing you to monitor your application progress from submission to approval. You’ll receive notifications so you can stay informed every step of the way.

-

Do I need any specific documents to complete my renters rebate application online?

Yes, when completing your renters rebate application online, you will need to provide specific documents such as proof of residency, income statements, and any prior tax returns. airSlate SignNow makes it easy to upload these documents directly through our platform, ensuring that all necessary information is submitted with your application.

Get more for Renters Rebate Utah

Find out other Renters Rebate Utah

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template