740 Ez Form

What is the 740 EZ?

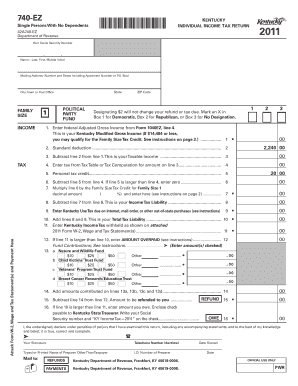

The 740 EZ form is a simplified tax return used by residents of Kentucky to file their state income taxes. This form is designed for individuals with straightforward tax situations, such as those who do not have complex deductions or multiple sources of income. The 740 EZ allows eligible taxpayers to report their income and calculate their tax liability in a streamlined manner, making it easier to complete compared to more detailed forms.

How to use the 740 EZ

Using the 740 EZ form involves several straightforward steps. First, gather all necessary financial documents, including W-2 forms and any other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Follow the instructions to report your income, calculate your tax liability, and determine any refund or amount owed. Finally, review your completed form for accuracy before submitting it to the Kentucky Department of Revenue.

Steps to complete the 740 EZ

Completing the 740 EZ form involves a series of organized steps:

- Collect all relevant income documents, such as W-2s and 1099s.

- Fill in your personal information at the top of the form.

- Report your total income on the designated lines.

- Calculate your tax liability using the provided tax tables.

- Determine any credits or deductions you may qualify for.

- Calculate your total refund or amount due.

- Sign and date the form before submission.

Legal use of the 740 EZ

The 740 EZ form is legally recognized by the Kentucky Department of Revenue for filing state income taxes. To ensure its legal validity, it is essential to complete the form accurately and submit it by the designated deadline. Electronic submissions through authorized e-filing systems are accepted, and these methods provide a secure way to file your taxes while maintaining compliance with state regulations.

Filing Deadlines / Important Dates

Timely filing of the 740 EZ form is crucial to avoid penalties. Typically, the deadline for submitting your state income tax return is April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to filing deadlines each tax year to ensure compliance.

Who Issues the Form

The 740 EZ form is issued by the Kentucky Department of Revenue. This state agency is responsible for administering tax laws and ensuring that residents comply with state tax regulations. The form can be obtained directly from the department's website or through various tax preparation services that offer state tax filing assistance.

Quick guide on how to complete 740 ez

Complete 740 Ez effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Handle 740 Ez on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and eSign 740 Ez effortlessly

- Find 740 Ez and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or black out confidential information with features specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid documents, cumbersome form navigation, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Modify and eSign 740 Ez and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 740 ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 740 ez 2018 and how does it work?

The 740 ez 2018 is a simplified tax return form for individuals that allows them to report income and determine tax liability. It is designed for taxpayers with straightforward tax situations, aiming for ease of use and efficiency. Using airSlate SignNow can help you securely eSign and submit your 740 ez 2018 documents quickly.

-

What features does airSlate SignNow offer for managing the 740 ez 2018?

airSlate SignNow provides a range of features to help you manage your 740 ez 2018 filings, including customizable templates, secure cloud storage, and seamless eSigning capabilities. With its user-friendly interface, you can easily fill out and send your forms for electronic signatures. This ensures your 740 ez 2018 documents are processed smoothly.

-

Is airSlate SignNow affordable for filing the 740 ez 2018?

Yes, airSlate SignNow offers cost-effective solutions that are budget-friendly for individuals needing to file their 740 ez 2018. With various pricing plans available, users can choose an option that best suits their needs. The platform’s value lies in its efficiency, saving time and resources compared to traditional filing methods.

-

How can I integrate airSlate SignNow with my accounting software for the 740 ez 2018?

AirSlate SignNow easily integrates with numerous accounting software solutions, allowing you to streamline your 740 ez 2018 filing process. By connecting your software, you can transfer information directly into the necessary forms, ensuring accuracy and efficiency. This integration simplifies document management and eSigning, making tax season less stressful.

-

What security measures are in place for eSigning the 740 ez 2018 with airSlate SignNow?

When using airSlate SignNow to eSign your 740 ez 2018, you can rest assured that your data is secure. The platform utilizes advanced encryption protocols and follows industry standards to protect your personal and financial information. This level of security ensures your 740 ez 2018 documents are safe during transmission and storage.

-

Can I track the status of my 740 ez 2018 documents in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your documents, including the 740 ez 2018 forms. You can easily monitor who has accessed your document, signed it, or if additional action is required. This feature enhances transparency and communication for all parties involved.

-

What are the benefits of using airSlate SignNow for the 740 ez 2018?

Using airSlate SignNow for your 740 ez 2018 offers signNow benefits, including time savings and greater convenience. The platform simplifies the process of filling out and signing tax documents, which can reduce errors and enhance compliance. Additionally, it allows for remote collaboration, making it easier to get necessary signatures without delays.

Get more for 740 Ez

- Account opening form for resident individuals part 1 465125355

- Application for lot line adjustment riverside county form

- Online portuguese schengen visa form

- Form39

- Electrical journeyman application form

- Practice 9 1 introduction to geometry points lines and planes pdf form

- Form nvb 1a

- Fssa ddrs developmental disabilities services form

Find out other 740 Ez

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free