Sba Form 1086 2010

What is the Sba Form 1086

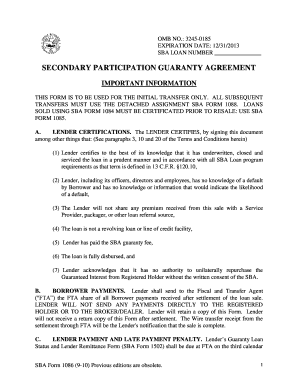

The Sba Form 1086 is a document utilized by the Small Business Administration (SBA) for specific purposes related to business loans and financial assistance. This form is essential for businesses seeking to apply for SBA programs, allowing them to provide necessary information regarding their financial status and operational structure. The form helps the SBA assess the eligibility of applicants for various loan programs, ensuring that the funds are allocated to businesses that meet the required criteria.

How to use the Sba Form 1086

Using the Sba Form 1086 involves several key steps. First, ensure that you have the most current version of the form, which can be obtained from the SBA's official website or authorized sources. Next, gather all required information, such as business details, financial statements, and any supporting documentation. Complete the form accurately, paying close attention to each section to avoid errors. Once filled out, the form must be submitted according to the instructions provided, either electronically or via mail, depending on the specific requirements of the program you are applying for.

Steps to complete the Sba Form 1086

Completing the Sba Form 1086 requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the form from the SBA website.

- Review the instructions carefully to understand the requirements.

- Gather necessary documents, including financial records and business information.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the form as directed, either online or by mailing it to the appropriate address.

Legal use of the Sba Form 1086

The legal use of the Sba Form 1086 is crucial for ensuring compliance with federal regulations. When completed and submitted correctly, the form serves as a binding document that verifies the information provided by the applicant. It is essential to adhere to all legal requirements associated with the form, including accurate representation of financial data and business operations. Failure to comply with these regulations may result in penalties or denial of loan applications.

Key elements of the Sba Form 1086

Several key elements must be included in the Sba Form 1086 for it to be considered complete. These elements typically include:

- Business identification information, such as name, address, and contact details.

- Financial statements, including income statements and balance sheets.

- Details about the business structure, such as ownership and management.

- Specific loan request information, including the amount and purpose of the funds.

Filing Deadlines / Important Dates

Filing deadlines for the Sba Form 1086 can vary based on the specific loan program and the fiscal calendar. It is essential to be aware of these deadlines to ensure timely submission. Missing a deadline may result in the inability to apply for funding or a delay in processing your application. Regularly check the SBA's official communications for updates on important dates related to the form and associated programs.

Quick guide on how to complete sba form 1086

Complete Sba Form 1086 effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without hindrance. Manage Sba Form 1086 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Sba Form 1086 with ease

- Find Sba Form 1086 and then click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark signNow portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Sba Form 1086 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sba form 1086

Create this form in 5 minutes!

How to create an eSignature for the sba form 1086

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Sba Form 1086 and why is it important?

Sba Form 1086 is a crucial document used in the Small Business Administration's loan guarantee program. It outlines the borrower's details and the terms of the guarantee, ensuring that businesses can access necessary funding. By utilizing airSlate SignNow, you can efficiently complete and eSign this form, streamlining the loan application process.

-

How does airSlate SignNow facilitate the completion of Sba Form 1086?

airSlate SignNow provides an intuitive platform for businesses to complete Sba Form 1086 electronically. With features like eSignature and template management, our solution minimizes paperwork and simplifies the submission process. This ensures your form is filled out accurately and quickly, enabling faster loan approvals.

-

What are the pricing options for using airSlate SignNow with Sba Form 1086?

airSlate SignNow offers flexible pricing plans to cater to various business sizes and needs. Whether you're a startup or an established company, we have a plan that fits your budget while providing access to essential features for handling Sba Form 1086. Plus, we offer a free trial, allowing you to experience our services before committing.

-

Can I integrate airSlate SignNow with other applications for Sba Form 1086?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, enhancing your workflow when dealing with Sba Form 1086. Whether you use CRM systems, cloud storage solutions, or project management tools, our integrations allow you to manage documents more effectively. This interoperability helps streamline the process of sending and signing your forms.

-

What are the benefits of using airSlate SignNow for Sba Form 1086?

Using airSlate SignNow for Sba Form 1086 offers numerous benefits, including increased efficiency, reduced errors, and improved tracking capabilities. Our platform enables you to manage all your documents in one place, ensuring that you can eSign securely and monitor the status of your forms. Additionally, this organized approach can help enhance your overall productivity.

-

Is airSlate SignNow compliant with regulatory requirements for Sba Form 1086?

Absolutely! airSlate SignNow complies with regulatory standards and industry practices, ensuring that your Sba Form 1086 is handled securely and legally. Our platform uses encrypted technology to safeguard sensitive information, providing peace of mind as you eSign and submit documents. Compliance with regulations is a top priority for us.

-

How do I get started with airSlate SignNow for Sba Form 1086?

Getting started with airSlate SignNow for Sba Form 1086 is easy. Simply sign up for an account on our website, choose a pricing plan, and you’ll have access to all the features needed to manage your documents. Our user-friendly interface guides you through the process, making it simple to complete and eSign your Sba Form 1086 in no time.

Get more for Sba Form 1086

- Xisx form

- Ri 009 form

- Waiver of confidentiality for candidate for aliyahreturn to israelolim form

- Ecological footprint activity answer key form

- Email relocation agreement form

- Westmoreland county community college scholarships all form

- Request for conviction history lara mi department of dleg state mi form

- Tm r2 052919 6 form

Find out other Sba Form 1086

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP