Questions and Answers About Express Enrollment Q Q Q Q Q for New Businesses to Begin Making Their Federal Tax Deposits FTDs More Form

Understanding the Express Enrollment Process for Federal Tax Deposits

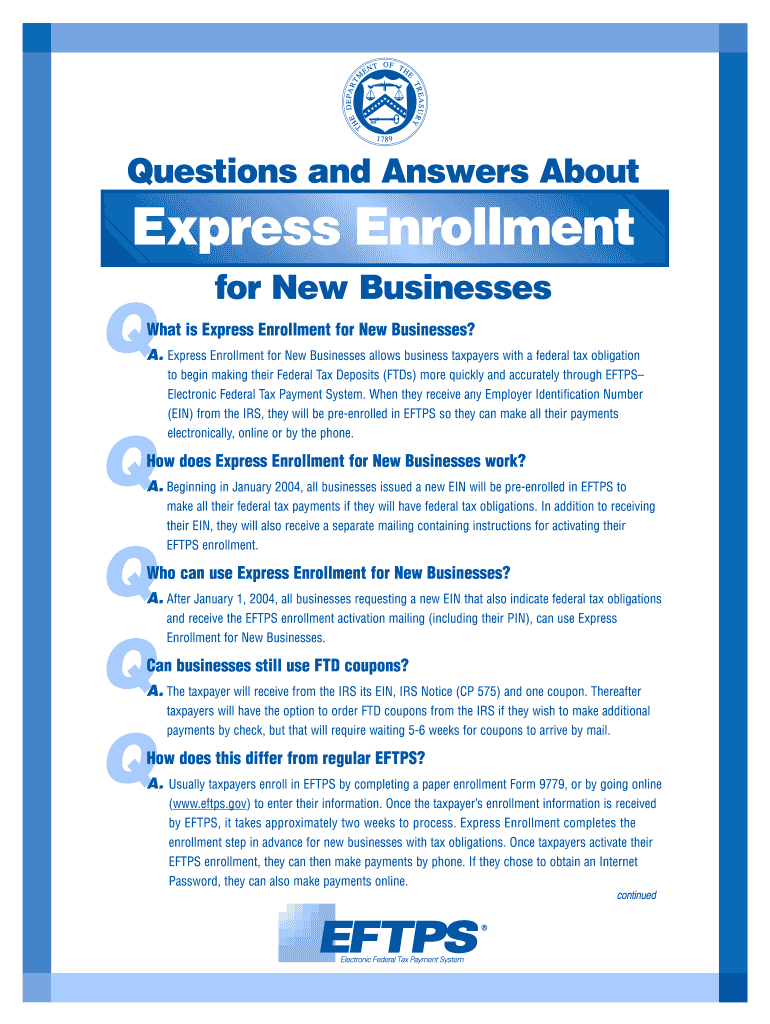

The Questions and Answers About Express Enrollment for new businesses provide essential information on how to efficiently begin making Federal Tax Deposits (FTDs) through the Electronic Federal Tax Payment System (EFTPS). This system allows businesses to manage their tax payments electronically, ensuring accuracy and timeliness. Understanding this process is crucial for new business owners to avoid penalties and maintain compliance with federal tax regulations.

Steps to Complete the Express Enrollment

To successfully complete the Express Enrollment for EFTPS, follow these steps:

- Gather necessary information, including your Employer Identification Number (EIN) and banking details.

- Visit the official EFTPS website to access the enrollment form.

- Fill out the form accurately, ensuring all information matches your business records.

- Submit the form electronically or via mail, as per your preference.

- Await confirmation from the IRS regarding your enrollment status.

Key Elements of the Enrollment Process

Several key elements are vital for the Express Enrollment process:

- Eligibility Criteria: Ensure your business meets the eligibility requirements set by the IRS.

- Required Documents: Have your EIN, business name, and bank account information ready.

- Confirmation: After submission, you will receive a confirmation email or letter from the IRS.

IRS Guidelines for EFTPS Enrollment

The IRS provides specific guidelines for enrolling in EFTPS. Businesses must ensure they follow these guidelines to avoid complications:

- Complete the enrollment form accurately.

- Use the correct EIN associated with your business.

- Keep your contact information updated to receive important notifications.

Filing Deadlines for Federal Tax Deposits

Awareness of filing deadlines is crucial for compliance. New businesses should mark important dates on their calendars, including:

- Quarterly estimated tax payment deadlines.

- Annual tax filing deadlines.

- Any specific deadlines for FTDs based on your business structure.

Common Scenarios for New Businesses Using EFTPS

Understanding how different business types interact with EFTPS can help new owners navigate the system effectively. Common scenarios include:

- Self-employed individuals making estimated tax payments.

- Corporations filing quarterly FTDs.

- Partnerships managing tax obligations collectively.

Penalties for Non-Compliance with Tax Deposits

Non-compliance with federal tax deposit requirements can lead to significant penalties. Businesses should be aware of the potential consequences, which may include:

- Late payment penalties based on the amount owed.

- Interest charges on unpaid taxes.

- Increased scrutiny from the IRS in future filings.

Quick guide on how to complete questions and answers about express enrollment q q q q q for new businesses to begin making their federal tax deposits ftds

Complete Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers a superior eco-friendly solution to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents promptly without holdups. Handle Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More on any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to edit and eSign Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More effortlessly

- Locate Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the drudgery of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the questions and answers about express enrollment q q q q q for new businesses to begin making their federal tax deposits ftds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Express Enrollment for EFTPS?

Express Enrollment is a streamlined process designed for new businesses to begin making their Federal Tax Deposits (FTDs) more quickly and accurately. This service allows users to register for the Electronic Federal Tax Payment System (EFTPS) efficiently, saving time and reducing errors associated with traditional enrollment methods. In this FAQ, we provide comprehensive 'Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More Quickly And Accurately Through EFTPS Electronic Federal Tax Payment System.'

-

How does airSlate SignNow facilitate the EFTPS enrollment process?

airSlate SignNow simplifies the EFTPS enrollment process by offering an easy-to-use platform that allows businesses to access essential forms and guidance. Providing an efficient digital solution helps ensure that users can navigate through the 'Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More Quickly And Accurately Through EFTPS Electronic Federal Tax Payment System.' This ensures a smooth start for new business owners.

-

What are the fees associated with using EFTPS?

The Electronic Federal Tax Payment System (EFTPS) is free to use, which means no fees for enrollment or payments. New businesses can take advantage of this cost-effective option to begin their Federal Tax Deposits (FTDs) without worrying about hidden costs. If you have more questions, check our 'Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More Quickly And Accurately Through EFTPS Electronic Federal Tax Payment System.'

-

What benefits does EFTPS provide for new businesses?

EFTPS offers numerous benefits for new businesses, including enhanced accuracy in tax payments and confirmation receipts for each transaction. This system helps users avoid late fees and ensures they remain compliant with federal tax obligations. For a deeper understanding and answers to your queries, refer to our 'Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More Quickly And Accurately Through EFTPS Electronic Federal Tax Payment System.'

-

Can I enroll in EFTPS without prior registration?

Yes, new businesses can directly enroll in EFTPS without the need for previous registration. This simplifies the process and allows for quicker access to Federal Tax Deposit (FTD) capabilities. For further clarification on this process, please consult our 'Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More Quickly And Accurately Through EFTPS Electronic Federal Tax Payment System.'

-

Is there a mobile app for managing EFTPS payments?

While there is currently no dedicated mobile app for EFTPS, users can access the EFTPS website via mobile devices to manage their payments effectively. This ensures that new business owners can handle their Federal Tax Deposits (FTDs) conveniently on the go. Learn more about mobile options in our 'Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More Quickly And Accurately Through EFTPS Electronic Federal Tax Payment System.'

-

What integration options are available with airSlate SignNow?

airSlate SignNow offers integration options that enhance workflow efficiency by connecting with various business tools. This means new businesses can manage documents, contracts, and EFTPS payments seamlessly within their existing systems. Explore how these integrations can benefit you through our 'Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More Quickly And Accurately Through EFTPS Electronic Federal Tax Payment System.'

Get more for Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More

Find out other Questions And Answers About Express Enrollment Q Q Q Q Q For New Businesses To Begin Making Their Federal Tax Deposits FTDs More

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online