Wells Fargo Mortgage 2012-2026

What is the Wells Fargo Mortgage?

The Wells Fargo mortgage is a financial product offered by Wells Fargo Bank that allows individuals to borrow money to purchase a home. This mortgage can be tailored to meet various needs, including fixed-rate and adjustable-rate options. Borrowers can choose from different terms, typically ranging from fifteen to thirty years, depending on their financial situation and long-term goals. The mortgage process includes an application, approval, and closing stages, ensuring that all necessary checks and balances are in place for both the lender and borrower.

How to obtain the Wells Fargo Mortgage

To obtain a Wells Fargo mortgage, potential borrowers should follow a structured approach. First, assess your financial situation, including credit score, income, and debt-to-income ratio. Next, gather necessary documentation, such as tax returns, pay stubs, and bank statements. After preparing your financial profile, you can apply online or visit a local branch. Wells Fargo will review your application, conduct a credit check, and provide a loan estimate detailing terms and costs. Once approved, you will proceed to the closing stage to finalize the mortgage.

Steps to complete the Wells Fargo Mortgage

Completing the Wells Fargo mortgage involves several key steps:

- Pre-approval: Submit your financial information to receive a pre-approval letter, which indicates how much you can borrow.

- Home search: Begin searching for a property within your budget, considering factors such as location and size.

- Loan application: Complete the mortgage application with detailed financial information and submit supporting documents.

- Processing: Wells Fargo will process your application, which includes verifying your financial information and conducting an appraisal of the property.

- Closing: Review and sign the closing documents, pay any closing costs, and receive the keys to your new home.

Eligibility Criteria

Eligibility for a Wells Fargo mortgage typically includes several criteria. Borrowers must have a stable income, a satisfactory credit score, and a manageable debt-to-income ratio. Additionally, the property must meet certain standards, including being a primary residence or an investment property. Wells Fargo may also consider factors such as employment history and savings when determining eligibility. It is advisable to check with a Wells Fargo representative for specific requirements that may apply to your situation.

Required Documents

When applying for a Wells Fargo mortgage, applicants should prepare a set of essential documents. These commonly include:

- Proof of income (pay stubs, tax returns, W-2s)

- Bank statements for the last two to three months

- Identification (driver's license or passport)

- Credit history information

- Details of any outstanding debts or loans

Having these documents ready can streamline the application process and help ensure a smoother experience.

Form Submission Methods

Wells Fargo offers various methods for submitting mortgage-related forms. Borrowers can complete applications and other necessary documents online through the Wells Fargo website. Alternatively, forms can be submitted in person at a local branch or sent via mail. Each method has its advantages, with online submissions often providing quicker processing times. It is essential to choose the method that best fits your needs and comfort level with technology.

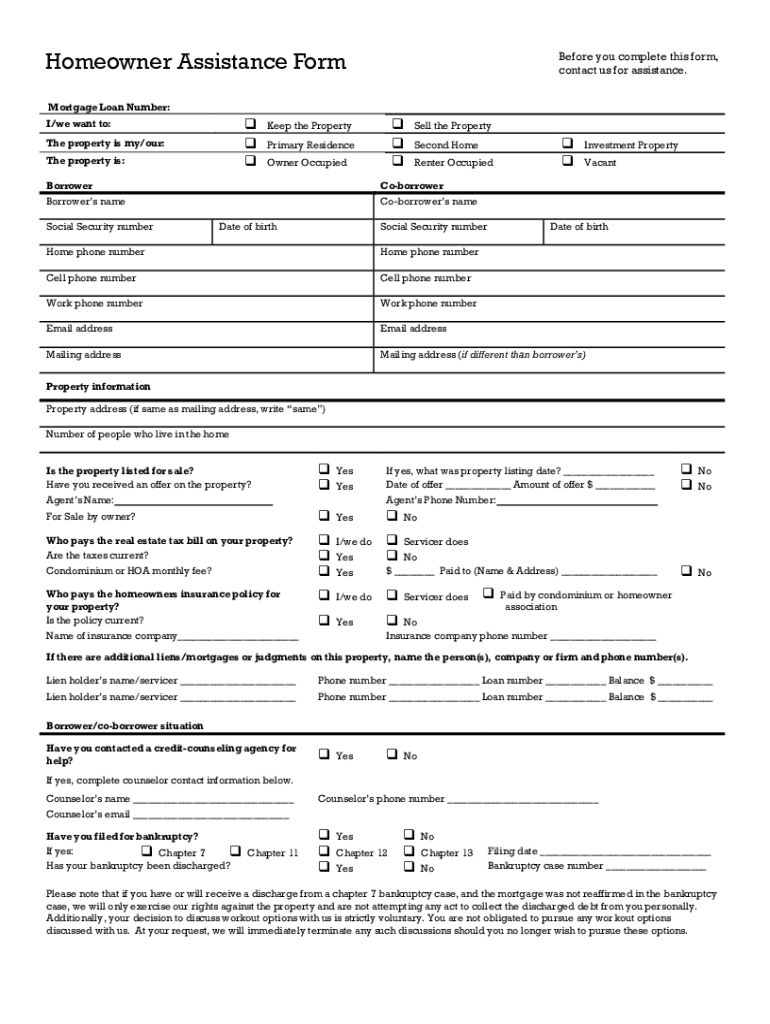

Quick guide on how to complete wells fargo mortgage assistance form

The optimal approach to obtain and endorse Wells Fargo Mortgage

On the scale of an entire organization, ineffective procedures surrounding document approvals can take up a signNow amount of work time. Endorsing documents like Wells Fargo Mortgage is a standard aspect of operations in any enterprise, which is why the effectiveness of each agreement’s lifecycle is so crucial to the overall performance of the organization. With airSlate SignNow, endorsing your Wells Fargo Mortgage is as straightforward and rapid as possible. On this platform, you will discover the latest version of nearly every form. Even better, you can endorse it instantly without needing to install external software on your computer or printing anything as physical copies.

Steps to obtain and endorse your Wells Fargo Mortgage

- Browse our collection by category or use the search bar to find the form you require.

- Check the form preview by clicking Learn more to confirm it’s the correct one.

- Click Get form to start editing immediately.

- Fill out your form and include any essential information using the toolbar.

- Once complete, click the Sign tool to endorse your Wells Fargo Mortgage.

- Select the signature option that works best for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents effectively. You can find, complete, edit, and even send your Wells Fargo Mortgage all in one tab without any hassle. Simplify your operations with a single, smart eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How does a mortgage loan with Wells Fargo work?

How does a mortgage loan with Wells Fargo work?Same as any other loan, pretty much.How does a home or condo loan work?You apply. They appraise & look at your income proofs. Then they (hopefully) approve the loan. In the USA 99% of the time, deal is handled by a title company in an escrow. What’s that? You & the bank put up the purchase money, the seller furnishes a deed, the Title Company is the intermediary. The prior loan is paid off, and POOF you get the keys and move in. Then you pay off the loan over the next 20 to 30 years. For really good advice on property deals, see my book Think Like A Tycoon, my other answers on QUORA and at ///peterTaradash.com//

-

How many home loans does Wells Fargo have?

Wells Fargo is the undisputed leader in terms of US mortgage volume. The best data I was able to find without spending too much time hunting is as follows:At the end of 2013 Wells Fargo serviced (processed monthly payments of home loans) $1.9 trillion in mortgages - one of every six mortgage holders nationwide - making it the largest servicer of mortgages in the U.S.Use the following source link for additional info.Wells Fargo & company -- Trefis

-

How do I find out if wells Fargo opened an account in my name?

In order to ensure that you are not a victim of the phony account scandal, the basic thing you can do is:Go through your monthly statements, look at the fees you have been charged, and any other charges for that matter. See if there are charges for a product or service you have not signet for.Login to your account, see what products and services are assigned to you. See if there is some product or services you should not have.Go to a Wells Fargo branch (other than the one you are constantly going), ask from the employee to give you a list of all products you have with the bank. See if their is something that you didn’t apply for.When doing this, look primarily at your deposit accounts as well as credit card accounts. See if you were paying any fees for this type of accounts. If yes, see if you have signed up for these accounts. Maybe, one of the reason that have resulted in the possibility for the phony accounts scandal is that we do not control what are we being charged for by the banks.

-

I have a home mortgage with Wells Fargo. How can I learn whether or not Wells Fargo opened an unlawful other account in my name?

I know first hand Wells Fargo is dead serious about fixing the mess around unauthorized accounts. On its part the bank is sending mail informing the victims and offering fix. Do this on your part: call up Wells Fargo customer service or walk into a bank branch and ask them to list all accounts under your name. Tell them you are concerned. By no means they would shy away from helping you.Going anonymous because I work for strategy group in Wells. I have worked for other banks and I can tell you Wells is among the ones on the good side, trust me.

-

How do you order checks form Wells Fargo?

Simply log into your Wells Fargo online account and hover over “Accounts,” then “Checks & Deposit Tickets.” Or call 1–800-TO-WELLS to speak to a personal banker.

-

How long does it take to find out your pre-approval home loan from Wells Fargo?

Wells Fargo issues three types of approval letters. These vary by the level of analysis they perform on the file prior to issuing the letter and therefor the level of certainty the letter provides to the borrower and to potential sellers that the loan financing will come through.The types of letters are -Pre-qualificationGives you an option of your home price range and estimated closing costs based on non-verified information you provided. Doesn’t require a full mortgage applicationCan often be issued same-day through a Loan Officer or an Online ApplicationPre-approvalGives you an estimate of your home price range based on an initial review of your application and limited credit information only. It requires a mortgage application. Doesn’t require you to provide actual documentsTypically issued within two or three daysCredit approvalGives you an estimated loan amount based on an initial underwriter review of your credit and the information you provided. This letter is their highest standard of credit approval. Requires copies of financial documents (e.g. paystubs, tax returns, bank statements, etc.)This is the type of letter you want to obtain prior to making offers on homes as it will make your offer more solid and competitiveTypically issued within five days

Create this form in 5 minutes!

How to create an eSignature for the wells fargo mortgage assistance form

How to make an electronic signature for the Wells Fargo Mortgage Assistance Form in the online mode

How to generate an electronic signature for the Wells Fargo Mortgage Assistance Form in Google Chrome

How to generate an eSignature for signing the Wells Fargo Mortgage Assistance Form in Gmail

How to create an electronic signature for the Wells Fargo Mortgage Assistance Form right from your mobile device

How to make an electronic signature for the Wells Fargo Mortgage Assistance Form on iOS devices

How to generate an eSignature for the Wells Fargo Mortgage Assistance Form on Android OS

People also ask

-

What is a Wells Fargo mortgage account?

A Wells Fargo mortgage account is a financial product offered by Wells Fargo that allows homeowners to finance the purchase of a property. This account typically provides various loan options, terms, and interest rates, making it easier for customers to choose the right mortgage solution for their needs.

-

How can I access my Wells Fargo mortgage account online?

You can access your Wells Fargo mortgage account online by visiting the Wells Fargo website and logging in with your username and password. Once logged in, you can view your account details, make payments, and manage your mortgage information.

-

What are the benefits of having a Wells Fargo mortgage account?

Having a Wells Fargo mortgage account provides several benefits, including competitive interest rates, flexible payment options, and personalized customer support. Additionally, you can easily manage your account online or through the mobile app, making it convenient to track your mortgage payments.

-

Are there any fees associated with a Wells Fargo mortgage account?

Yes, there may be fees associated with a Wells Fargo mortgage account, such as closing costs, late payment fees, or other service charges. It is recommended to review your loan agreement to understand all potential fees before signing your mortgage.

-

Can I refinance my Wells Fargo mortgage account?

Yes, you can refinance your Wells Fargo mortgage account to take advantage of lower interest rates or change your loan terms. Wells Fargo offers various refinancing options that can help reduce your monthly payments or shorten your loan duration.

-

What features does the Wells Fargo mortgage account offer?

The Wells Fargo mortgage account offers a range of features, including fixed-rate and adjustable-rate mortgage options, online account management, and a dedicated customer support team. These features help simplify the mortgage process and provide you with tools to manage your finances effectively.

-

How does airSlate SignNow integrate with my Wells Fargo mortgage account?

airSlate SignNow seamlessly integrates with your Wells Fargo mortgage account by allowing you to eSign important mortgage documents securely and efficiently. This integration streamlines the document signing process, ensuring you can complete transactions quickly without the hassle of printing or mailing.

Get more for Wells Fargo Mortgage

Find out other Wells Fargo Mortgage

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy