05 158 a Form

What is the 05 158 A

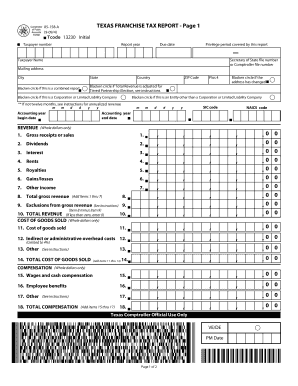

The 05 158 A is a form used in Texas, typically associated with specific legal or administrative processes. It serves various purposes, including documentation for certain transactions or compliance with state regulations. Understanding the function of this form is essential for individuals and businesses to ensure they meet legal requirements and avoid potential issues.

Steps to complete the 05 158 A

Completing the 05 158 A involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, such as personal details and any relevant documentation. Next, carefully fill out each section of the form, ensuring that all fields are completed accurately. After filling out the form, review it for any errors or omissions before submitting it. This careful approach helps prevent delays or complications in processing.

Legal use of the 05 158 A

The legal use of the 05 158 A is crucial for ensuring that the document is recognized by relevant authorities. To be legally binding, the form must be completed in accordance with state laws and regulations. This may include obtaining necessary signatures and ensuring that the form is submitted within specified timeframes. Understanding these legal requirements helps individuals and businesses maintain compliance and avoid potential penalties.

How to obtain the 05 158 A

Obtaining the 05 158 A is a straightforward process. Individuals can typically access the form through official state websites or relevant government offices. It may also be available at local administrative offices or through legal service providers. Ensuring that you have the most current version of the form is essential, as regulations and requirements may change over time.

Form Submission Methods

The 05 158 A can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include online submission through designated state portals, mailing the completed form to the appropriate office, or delivering it in person. Each method may have specific guidelines and processing times, so it's important to choose the one that best suits your needs.

Key elements of the 05 158 A

Key elements of the 05 158 A include critical information that must be accurately provided for the form to be valid. This often includes identifying information such as names, addresses, and contact details, as well as any specific data required for the form's purpose. Ensuring that all key elements are correctly filled out is essential for the form's acceptance and processing.

Examples of using the 05 158 A

Examples of using the 05 158 A can vary widely based on its intended purpose. For instance, it may be used in real estate transactions, legal proceedings, or business registrations. Understanding these examples can provide clarity on how the form fits into specific scenarios, helping users to navigate their obligations effectively.

Quick guide on how to complete 05 158 a

Prepare 05 158 A easily on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly and without delays. Handle 05 158 A on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and eSign 05 158 A with ease

- Obtain 05 158 A and click Get Form to begin.

- Make use of the features we provide to finish your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form-finding, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 05 158 A to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 158 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the texas form 05 158 instructions 2023, and why do I need it?

The texas form 05 158 instructions 2023 outlines the mandatory steps for submitting this specific form related to Texas business regulations. You need these instructions to ensure compliance and to avoid potential fines or delays in processing your documents.

-

How can airSlate SignNow assist with the texas form 05 158 instructions 2023?

airSlate SignNow provides a streamlined platform for electronically signing and sending the texas form 05 158. With our easy-to-use interface, you can follow the instructions accurately and complete your paperwork efficiently.

-

Are there specific features in airSlate SignNow for handling the texas form 05 158 instructions 2023?

Yes, airSlate SignNow offers features such as document templates, customizable workflows, and secure e-signatures that align with the texas form 05 158 instructions 2023. These tools help simplify the document management process, saving you time and effort.

-

What are the pricing options for using airSlate SignNow for the texas form 05 158 instructions 2023?

airSlate SignNow offers various pricing plans to fit different business needs, starting with a cost-effective option for small businesses. Each plan provides access to tools that can help you manage the texas form 05 158 instructions 2023 efficiently.

-

Is airSlate SignNow reliable for submitting the texas form 05 158 instructions 2023?

Absolutely! airSlate SignNow ensures secure and reliable submissions for documents like the texas form 05 158 instructions 2023. We prioritize data security and compliance, allowing you to submit forms with confidence.

-

Can I integrate airSlate SignNow with other software for managing the texas form 05 158 instructions 2023?

Yes, airSlate SignNow offers seamless integrations with various platforms such as CRM systems and cloud storage solutions. This allows you to manage the texas form 05 158 instructions 2023 alongside your existing business tools.

-

How can I track the status of my texas form 05 158 when using airSlate SignNow?

With airSlate SignNow, you can easily track the status of your documents, including the texas form 05 158. Our platform provides real-time notifications and updates, keeping you informed throughout the submission process.

Get more for 05 158 A

Find out other 05 158 A

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile