Fillable Schedule B Form

What is the Fillable Schedule B

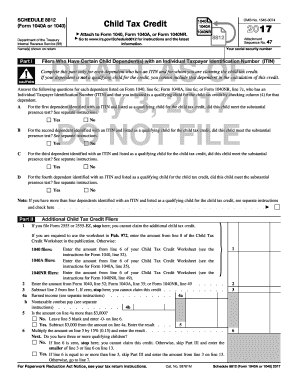

The fillable Schedule B is a form used by taxpayers in the United States to report interest and dividend income. This form is a crucial part of the federal income tax return, specifically for individuals who receive income from various sources, such as savings accounts, stocks, or bonds. By completing this form, taxpayers can accurately disclose their earnings, ensuring compliance with IRS regulations. The fillable Schedule B is designed to simplify the reporting process, making it easier for individuals to fill out and submit their information electronically.

How to Use the Fillable Schedule B

Using the fillable Schedule B involves several straightforward steps. First, access the form through a reliable source, such as the IRS website or a trusted tax software. Once you have the form, enter your personal information at the top, including your name and Social Security number. Next, report your interest and dividend income in the designated sections, ensuring that you include all relevant sources. After completing the form, review your entries for accuracy before submitting it with your tax return, either electronically or by mail.

Steps to Complete the Fillable Schedule B

Completing the fillable Schedule B requires careful attention to detail. Follow these steps for a smooth process:

- Access the fillable Schedule B form online.

- Fill in your personal information, including your name and Social Security number.

- List all sources of interest income, specifying the amount for each source.

- Do the same for dividend income, ensuring you include all applicable amounts.

- Check for any additional questions, such as foreign accounts, and respond accordingly.

- Review your entries for accuracy and completeness.

- Submit the completed form with your tax return.

Legal Use of the Fillable Schedule B

The fillable Schedule B is legally binding when filled out correctly and submitted as part of your tax return. To ensure its legal validity, it is essential to comply with IRS guidelines regarding reporting income. This includes accurately disclosing all interest and dividend earnings, as failure to do so may lead to penalties. Additionally, using a reliable electronic signature solution can enhance the security and authenticity of your submission, ensuring that it meets legal standards.

IRS Guidelines

The IRS provides specific guidelines for completing the fillable Schedule B. Taxpayers must report all interest and dividend income received during the tax year, regardless of the amount. The IRS also requires that taxpayers check the box if they have foreign accounts or if they received more than $1,500 in interest or dividends. Following these guidelines is crucial for accurate reporting and compliance with tax laws, helping to avoid potential audits or penalties.

Filing Deadlines / Important Dates

When using the fillable Schedule B, it is important to be aware of key filing deadlines. Typically, individual tax returns, including Schedule B, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers who require additional time can file for an extension, but it is essential to pay any taxes owed by the original deadline to avoid penalties and interest.

Required Documents

To accurately complete the fillable Schedule B, certain documents are necessary. Taxpayers should gather all relevant financial statements, including:

- Bank statements showing interest earned.

- Brokerage statements detailing dividend income.

- Form 1099-INT for interest income.

- Form 1099-DIV for dividend income.

Having these documents on hand will facilitate the completion of the form and ensure accurate reporting of income.

Quick guide on how to complete fillable schedule b

Effortlessly Prepare Fillable Schedule B on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Fillable Schedule B on any device with airSlate SignNow apps available for Android or iOS, and simplify your document-related tasks today.

Efficiently Edit and eSign Fillable Schedule B with Ease

- Locate Fillable Schedule B and click Get Form to commence.

- Utilize the tools at your disposal to complete your document.

- Highlight key sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious searches for forms, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Fillable Schedule B and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable schedule b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fillable Schedule B?

A fillable Schedule B is a form used to report interest and dividend income to the IRS. With airSlate SignNow, users can easily create, share, and fill out a Schedule B digitally, streamlining tax reporting for both businesses and individuals.

-

How can I create a fillable Schedule B using airSlate SignNow?

Creating a fillable Schedule B with airSlate SignNow is simple. Users can select from customizable templates, input relevant information, and make it fillable for easy data entry. The platform provides a user-friendly interface that makes the process quick and efficient.

-

Does airSlate SignNow support eSignature for fillable Schedule B forms?

Yes, airSlate SignNow fully supports eSignature for fillable Schedule B forms. This feature allows users to electronically sign documents, ensuring a fast and legally binding way to finalize tax-related submissions, saving time and resources.

-

What are the benefits of using a fillable Schedule B template?

Using a fillable Schedule B template simplifies tax reporting by reducing errors and save time on paperwork. With airSlate SignNow, users can also collaborate in real-time and access their forms from anywhere, enhancing overall efficiency in document management.

-

Can I integrate airSlate SignNow with other applications for filling Schedule B forms?

Yes, airSlate SignNow offers various integrations with popular applications like Google Drive and Dropbox. This allows users to import and export fillable Schedule B forms easily, enhancing workflow and collaboration capabilities across different platforms.

-

What pricing options are available for airSlate SignNow that include fillable Schedule B features?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, which include features for creating and managing fillable Schedule B forms. Users can choose from monthly or annual subscriptions, ensuring they can find a plan that fits their budget while still benefiting from advanced features.

-

Is it safe to use airSlate SignNow for filling out fillable Schedule B forms?

Absolutely! airSlate SignNow prioritizes the security of your data with industry-standard encryption and compliance protocols. Users can safely fill out and submit their Schedule B forms knowing their information is protected throughout the entire process.

Get more for Fillable Schedule B

Find out other Fillable Schedule B

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer