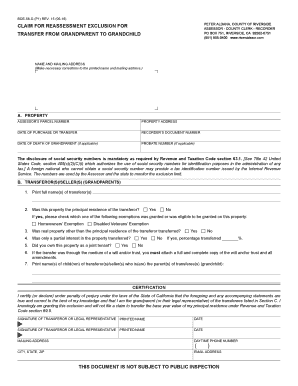

Claim for Reassessment Exclusion for Transfer from Grandparent to Grandchild Claim for Reassessment Exclusion for Transfer from Form

Understanding the Claim for Reassessment Exclusion for Transfer from Grandparent to Grandchild

The Claim for Reassessment Exclusion for Transfer from Grandparent to Grandchild is a legal provision that allows for the reassessment of property taxes to be excluded when property is transferred between these family members. This exclusion is designed to help maintain family wealth and ensure that property remains affordable for future generations. In many jurisdictions, this transfer can occur without triggering a reassessment of the property's value, which would typically lead to higher property taxes.

How to Use the Claim for Reassessment Exclusion

To utilize the Claim for Reassessment Exclusion for Transfer from Grandparent to Grandchild, the involved parties must complete the necessary forms and provide required documentation. This often includes proof of the relationship between the grandparent and grandchild, as well as any relevant property documents. It is essential to follow the specific guidelines set forth by local tax authorities to ensure the claim is processed correctly and efficiently.

Steps to Complete the Claim for Reassessment Exclusion

Completing the Claim for Reassessment Exclusion involves several key steps:

- Gather necessary documents, including proof of relationship and property deed.

- Complete the required forms accurately, ensuring all information is correct.

- Submit the claim to the appropriate local tax authority by the specified deadline.

- Follow up to confirm receipt and processing of the claim.

Eligibility Criteria for the Claim

Eligibility for the Claim for Reassessment Exclusion typically requires that the transfer occurs directly from a grandparent to a grandchild. Additionally, there may be limits on the value of the property transferred to qualify for the exclusion. It is important to check local regulations, as these criteria can vary significantly by state and locality.

Required Documents for Submission

When submitting the Claim for Reassessment Exclusion, several documents are generally required:

- Proof of the grandparent-grandchild relationship, such as birth certificates or family trees.

- Property deed or title documents indicating ownership.

- Completed claim form, which may vary by jurisdiction.

State-Specific Rules and Guidelines

Each state may have its own rules and guidelines regarding the Claim for Reassessment Exclusion. It is crucial to familiarize yourself with the specific requirements of your state, including any deadlines for submission and additional documentation that may be needed. Consulting with a local tax professional can provide valuable insights into navigating these regulations.

Quick guide on how to complete claim for reassessment exclusion for transfer from grandparent to grandchild claim for reassessment exclusion for transfer from

Handle [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely preserve it online. airSlate SignNow provides you with all the tools required to create, amend, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to amend and electronically sign [SKS] without hassle

- Find [SKS] and click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize crucial parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild Claim For Reassessment Exclusion For Transfer From

Create this form in 5 minutes!

How to create an eSignature for the claim for reassessment exclusion for transfer from grandparent to grandchild claim for reassessment exclusion for transfer from

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild?

The Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild is a legal provision that allows property transfers between grandparents and grandchildren to be excluded from reassessment. This means that the property taxes are not increased upon transfer. Understanding this claim is crucial for estate planning.

-

How can airSlate SignNow help with the Claim For Reassessment Exclusion?

airSlate SignNow simplifies the process of documenting and eSigning the Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild. Our platform ensures that all necessary documents are prepared accurately and efficiently, reducing the time and effort needed for compliance.

-

What are the costs associated with filing the Claim For Reassessment Exclusion?

Filing a Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild may involve minimal fees, mainly associated with property assessment or local government processing charges. Using airSlate SignNow can help minimize these costs by streamlining the paperwork process.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow provides features such as customizable templates, eSigning, and secure document storage. These features facilitate the smooth handling of documents related to the Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild, ensuring that everything is organized and accessible.

-

Are there any integrations with airSlate SignNow that can support my claims process?

Yes, airSlate SignNow offers various integrations with popular applications such as Google Drive, Dropbox, and CRM systems. These integrations help streamline the workflow for handling the Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild, making it easier to manage your documents.

-

What are the benefits of using airSlate SignNow for property transfer claims?

Using airSlate SignNow for the Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild ensures a user-friendly experience, quick document turnaround, and enhanced security. Our platform helps simplify complex processes, making it easier for you to focus on what matters most.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! AirSlate SignNow is designed to be intuitive and easy to navigate, even for those unfamiliar with eSigning. Our platform will guide you through the steps needed to complete the Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild effortlessly.

Get more for Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild Claim For Reassessment Exclusion For Transfer From

Find out other Claim For Reassessment Exclusion For Transfer From Grandparent To Grandchild Claim For Reassessment Exclusion For Transfer From

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple