Book Donation Form

What is the Book Donation Form

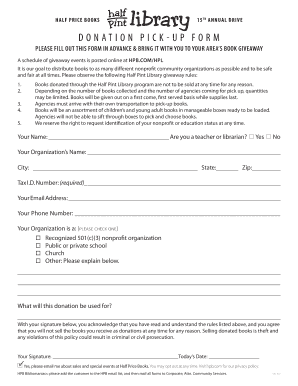

The book donation form is a document used by individuals or organizations to formally donate books to a library, school, or charitable organization. This form typically includes details about the donor, the items being donated, and any specific conditions related to the donation. By using this form, donors can ensure that their contributions are documented and acknowledged appropriately, which can be beneficial for both record-keeping and potential tax deductions.

How to Use the Book Donation Form

Using the book donation form involves several straightforward steps. First, obtain the form from a relevant organization or download it from their website. Next, fill in your personal information, including your name, contact details, and address. Then, list the books you are donating, including titles and authors. If applicable, specify any conditions regarding the donation, such as whether you require a receipt for tax purposes. Finally, sign and date the form, and submit it according to the organization’s guidelines.

Steps to Complete the Book Donation Form

Completing the book donation form can be done efficiently by following these steps:

- Download or request the book donation form from the intended recipient organization.

- Fill in your personal information accurately.

- List each book you are donating, ensuring to include the title and author for each item.

- Indicate any specific conditions or requirements regarding the donation.

- Sign and date the form to validate your donation.

- Submit the form as instructed, either online, via mail, or in person.

Legal Use of the Book Donation Form

The legal use of the book donation form is essential for ensuring that the donation is recognized by the receiving organization and for potential tax benefits. In the United States, donations to qualified charitable organizations can be tax-deductible. To qualify, the form must be filled out correctly and submitted in accordance with IRS guidelines. It is important to keep a copy of the completed form for your records, as it may be required when filing taxes.

Key Elements of the Book Donation Form

Several key elements are essential for a complete and effective book donation form. These include:

- Donor Information: Full name, address, and contact information.

- Donation Details: A comprehensive list of the books being donated, including titles and authors.

- Conditions of Donation: Any specific requests or conditions, such as the need for a receipt.

- Signature: The donor's signature and date to validate the donation.

Form Submission Methods

The book donation form can typically be submitted through various methods depending on the receiving organization’s preferences. Common submission methods include:

- Online: Many organizations allow for electronic submission through their websites.

- Mail: You can print the completed form and send it via postal service to the organization.

- In-Person: Some organizations accept forms submitted directly at their location.

Quick guide on how to complete book donation form

Complete Book Donation Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the correct form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage Book Donation Form on any device with airSlate SignNow Android or iOS applications and streamline any document-based processes today.

The easiest way to modify and electronically sign Book Donation Form without hassle

- Find Book Donation Form and click on Get Form to begin.

- Utilize the instruments we provide to complete your document.

- Highlight important sections of the document or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature by using the Sign tool, which only takes seconds and holds the same legal authority as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form – via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from your preferred device. Modify and eSign Book Donation Form and ensure clear communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the book donation form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a book donation form?

A book donation form is a digital document that allows individuals or organizations to collect essential information about donated books. This form simplifies the donation process, making it easy for donors to provide details like book condition, title, and contact information, streamlining the entire donation experience.

-

How does airSlate SignNow handle book donation forms?

airSlate SignNow provides an intuitive platform for creating and managing book donation forms. Users can customize templates, add logos, and specify required fields to capture all necessary details from donors, ensuring a professionally branded experience that enhances engagement.

-

Is the book donation form customizable?

Yes, the book donation form is fully customizable with airSlate SignNow. You can easily modify fields, adjust formatting, and incorporate your organization’s branding, making the form fit perfectly with your overall aesthetic and functional needs.

-

What are the benefits of using an electronic book donation form?

Using an electronic book donation form offers several benefits, including ease of access, instant data collection, and reduced paperwork. This method enhances efficiency, allows for better tracking of donations, and provides a seamless experience for both the donor and your organization.

-

Are there any costs associated with using the book donation form?

airSlate SignNow offers various pricing plans, making it affordable for all organizations to use a book donation form. You can choose a plan that suits your needs, whether you’re a small nonprofit or a large institution, ensuring you get the features you require without breaking the bank.

-

Can the book donation form integrate with other systems?

Absolutely! The book donation form from airSlate SignNow can seamlessly integrate with various third-party applications. This allows for data synchronization with donor management systems, email marketing tools, and CRMs, ensuring all your workflows are connected and efficient.

-

How can I track donations made through the book donation form?

Tracking donations through the book donation form is straightforward with airSlate SignNow. The platform offers robust reporting and analytics features, enabling organizations to easily monitor and manage incoming donations and donor information in real-time.

Get more for Book Donation Form

- Formulario mls de oferta de compra y alquiler de un inmueble indd

- New patient form link mercy medical center

- Sdi award letter form

- Pamf sleep clinic form

- Dd form 1896

- Parent worksheet for oregon birth certificate word version form

- Please provide a map or zone atlas page showing property location form

- 111 union square st form

Find out other Book Donation Form

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement