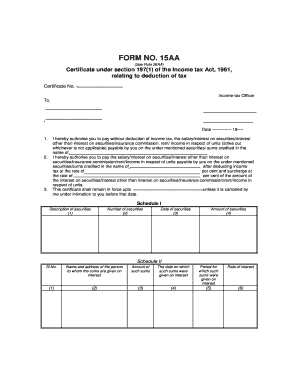

15aa Form

What is the 15aa Form

The 15aa form is a specific document used for income tax purposes in India. It serves as a declaration for individuals or entities who wish to claim tax benefits under the Double Taxation Avoidance Agreement (DTAA) between India and another country. This form is essential for ensuring that the correct tax rates are applied, preventing double taxation on income earned abroad. It is particularly relevant for non-resident taxpayers who receive income from Indian sources.

How to use the 15aa Form

Using the 15aa form involves a few straightforward steps. First, the taxpayer must accurately fill out the form, providing necessary details such as personal information, income sources, and the applicable DTAA provisions. Once completed, the form must be submitted to the relevant tax authorities or the withholding agent responsible for deducting tax at source. It is crucial to ensure that all information is correct to avoid delays or issues with tax compliance.

Steps to complete the 15aa Form

Completing the 15aa form requires careful attention to detail. Here are the steps involved:

- Gather all necessary documents, including proof of income and details of the DTAA.

- Fill in personal information, such as name, address, and taxpayer identification number.

- Provide details of the income for which the form is being submitted.

- Indicate the country of residence and relevant provisions of the DTAA.

- Review the form for accuracy and completeness.

- Submit the form to the relevant tax authority or withholding agent.

Legal use of the 15aa Form

The legal use of the 15aa form is governed by tax regulations in India. It is a legally binding document that must be submitted to claim tax benefits under the DTAA. Proper completion and submission of the form ensure compliance with Indian tax laws, allowing taxpayers to avoid excess taxation on their income. Failure to use the form correctly may result in penalties or increased tax liabilities.

Required Documents

To complete the 15aa form successfully, several documents are typically required:

- Proof of identity, such as a passport or national identification card.

- Documents evidencing the income earned in India.

- Details of the applicable DTAA provisions.

- Any previous tax returns or assessments, if applicable.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 15aa form. Generally, the form should be submitted before the income is paid or credited to the taxpayer. Specific deadlines may vary based on the income type and the applicable tax regulations. Staying informed about these dates helps ensure timely compliance and avoids potential penalties.

Quick guide on how to complete 15aa form

Complete 15aa Form effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage 15aa Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and electronically sign 15aa Form without hassle

- Find 15aa Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign 15aa Form to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 15aa form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 15aa form and why is it important?

The 15aa form is a crucial document used for tax exemption purposes, particularly in various business transactions. Ensuring accurate filing of the 15aa form can streamline processes and potentially save money for your business. airSlate SignNow simplifies the signing and submission of your 15aa form, making compliance easier.

-

How can airSlate SignNow help with filling out a 15aa form?

airSlate SignNow provides an intuitive platform where you can easily fill out and eSign your 15aa form electronically. With features like templates and auto-fill options, you can complete your 15aa form without hassle. This efficiency ensures that your documentation is always ready when you need it.

-

Is there a cost associated with using airSlate SignNow for the 15aa form?

Yes, airSlate SignNow offers various pricing plans to cater to different business sizes and needs. Our plans are designed to be cost-effective and provide exceptional value, especially for those frequently requiring the 15aa form and other document management solutions. You can choose a plan that best fits your budget and requirements.

-

What are the key features of airSlate SignNow for managing the 15aa form?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking that enhance the management of your 15aa form. Additionally, our platform allows for team collaboration, helping you efficiently manage and share your documents. These features streamline the entire process, making it faster and more effective.

-

How does airSlate SignNow ensure the security of the 15aa form?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure cloud storage to protect your 15aa form and other documents from unauthorized access. You can confidently manage your sensitive data knowing that we adhere to industry standards for security.

-

Can I integrate airSlate SignNow with my existing software for the 15aa form?

Absolutely! airSlate SignNow supports integration with various popular applications and tools, ensuring seamless workflow when handling your 15aa form. This integration capability allows you to sync your data easily and enhances your overall efficiency.

-

What are the benefits of using airSlate SignNow for businesses that handle the 15aa form?

Using airSlate SignNow for your 15aa form can lead to signNow time savings and reduced administrative burden. Our platform automates repetitive tasks, minimizes human error, and enhances collaboration among team members. Ultimately, this leads to improved compliance and streamlined operations.

Get more for 15aa Form

- Termite soil pretreattreatment graph form

- R privilege form

- Arc participant information form city of toronto toronto

- Sky harbor badging office form

- Nlrb complaint form

- Myrepublic interbank giro form

- Pto invoice form

- Cms1files revize comrevizeclintoniavehicle for hire drivers date issued application for city form

Find out other 15aa Form

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe