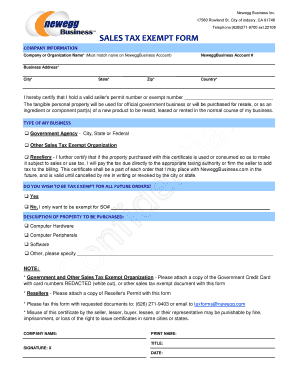

Newegg Tax Exempt Form

What is the Newegg Tax Exempt

The Newegg tax exempt status allows qualifying businesses to make purchases without paying sales tax. This exemption is typically granted to organizations that are registered as tax-exempt entities, such as non-profits, government agencies, and certain educational institutions. By utilizing this status, these organizations can save money on their purchases, which can be particularly beneficial for budget-constrained operations.

How to Obtain the Newegg Tax Exempt

To obtain tax-exempt status with Newegg, businesses must first ensure they are eligible under state laws. This often involves registering with the appropriate state tax authority and obtaining a tax-exempt certificate. Once the certificate is acquired, it can be submitted to Newegg to activate the tax-exempt status for future purchases. It is essential to keep this documentation up to date and ensure compliance with state regulations.

Steps to Complete the Newegg Tax Exempt

Completing the Newegg tax exempt process involves several key steps:

- Verify eligibility for tax-exempt status based on state laws.

- Obtain a tax-exempt certificate from the relevant state tax authority.

- Log into your Newegg account and navigate to the tax exemption section.

- Upload the tax-exempt certificate as required.

- Confirm that the tax-exempt status has been applied to your account.

Legal Use of the Newegg Tax Exempt

Utilizing the Newegg tax exempt status legally requires adherence to specific guidelines. Only eligible organizations should apply for tax exemption, and the purchases made under this status must be for qualifying purposes. Misuse of tax-exempt status can lead to penalties, including back taxes and fines. It is crucial for organizations to maintain accurate records of tax-exempt purchases to demonstrate compliance during audits.

Key Elements of the Newegg Tax Exempt

Several key elements define the Newegg tax exempt process:

- Eligibility: Only certain types of organizations qualify.

- Documentation: A valid tax-exempt certificate must be provided.

- Compliance: Adherence to state and federal tax laws is mandatory.

- Record-Keeping: Accurate records of tax-exempt purchases must be maintained.

Examples of Using the Newegg Tax Exempt

Organizations can use the Newegg tax exempt status for various purchases, including:

- Computers and electronics for educational purposes.

- Software licenses for non-profit operations.

- Office supplies for government agencies.

By taking advantage of tax exemption, these entities can allocate more resources toward their primary missions.

Quick guide on how to complete newegg tax exempt

Effortlessly Prepare Newegg Tax Exempt on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and sign your documents swiftly without any hold-ups. Manage Newegg Tax Exempt on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and Sign Newegg Tax Exempt with Ease

- Locate Newegg Tax Exempt and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Newegg Tax Exempt and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the newegg tax exempt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to obtain Newegg tax exempt status?

To obtain Newegg tax exempt status, businesses must complete and submit a tax-exempt certificate specific to their state. Once approved, you can make purchases without incurring sales tax. Ensure that all required documentation is provided to avoid delays in processing your Newegg tax exempt status.

-

How does airSlate SignNow facilitate the management of Newegg tax exempt documents?

airSlate SignNow simplifies the management of Newegg tax exempt documents by allowing users to send, eSign, and store tax-related documents securely. This user-friendly platform ensures that your tax exempt certificates are easily accessible and organized, helping you maintain compliance effortlessly.

-

Are there any fees associated with becoming Newegg tax exempt?

Typically, there are no fees associated with applying for Newegg tax exempt status itself. However, businesses might incur costs related to preparing and submitting required documentation. It's best to consult with your tax advisor to understand any potential fees linked to maintaining your Newegg tax exempt status.

-

What features of airSlate SignNow support eSigning for Newegg tax exempt documents?

AirSlate SignNow offers several features that support eSigning for Newegg tax exempt documents, including customizable templates, in-person signing, and comprehensive audit trails. These features enhance the efficiency of your tax document management and ensure that all signers can complete the process quickly and securely.

-

Is airSlate SignNow compliant with IRS regulations for Newegg tax exempt transactions?

Yes, airSlate SignNow is compliant with IRS regulations for eSigning tax documents, including those relevant to Newegg tax exempt transactions. This compliance ensures that all electronic signatures are legally binding, making it easier for businesses to handle tax-exempt purchases with confidence.

-

What benefits does airSlate SignNow offer for managing Newegg tax exempt workflows?

AirSlate SignNow provides multiple benefits for managing Newegg tax exempt workflows, such as increased efficiency, improved document security, and enhanced collaboration. By streamlining the signing process and automating workflows, businesses can save time and reduce errors associated with tax exempt transactions.

-

Can I integrate airSlate SignNow with other platforms for Newegg tax exempt documentation?

Absolutely! airSlate SignNow integrates seamlessly with various platforms, allowing you to manage Newegg tax exempt documentation alongside your existing business applications. This integration helps ensure that your workflow remains efficient and organized while reducing the hassle of handling multiple systems.

Get more for Newegg Tax Exempt

Find out other Newegg Tax Exempt

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement