PARTNERSHIP ACCOUNT FORM

What is the Partnership Account Form

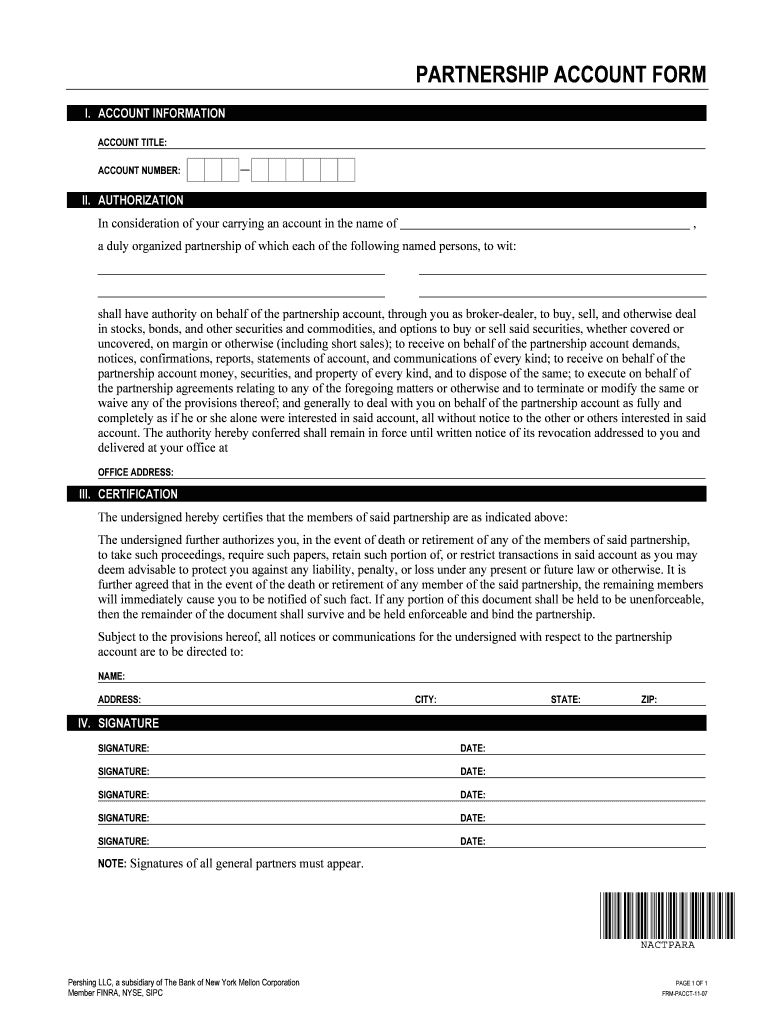

The Partnership Account Form is a crucial document used by partnerships to establish and manage their business accounts. This form typically collects essential information about the partnership, including the names of the partners, the business address, and the nature of the business activities. It serves as a foundational document for tax purposes and is often required by financial institutions when opening a partnership bank account.

Steps to Complete the Partnership Account Form

Completing the Partnership Account Form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary information about the partnership and its partners, including:

- Full names and contact information of all partners

- Partnership's legal name and registered address

- Description of the business activities

- Tax identification numbers for each partner

Once you have this information, fill out the form carefully, ensuring that all sections are completed. Review the form for any errors or omissions before submission.

How to Obtain the Partnership Account Form

The Partnership Account Form can typically be obtained from various sources. Most state government websites provide downloadable versions of the form. Additionally, financial institutions may offer the form directly at their branches or on their websites. It is advisable to ensure you are using the most current version of the form to avoid any compliance issues.

Legal Use of the Partnership Account Form

The Partnership Account Form is legally binding and essential for establishing the partnership's identity in financial and legal matters. It is used to report the partnership's income and expenses to the IRS and is necessary for opening bank accounts. Proper completion and submission of this form help ensure that the partnership operates within the legal framework established by state and federal laws.

Required Documents

When filling out the Partnership Account Form, several supporting documents may be required to verify the information provided. These documents often include:

- Partnership agreement outlining the roles and responsibilities of each partner

- Proof of business registration, if applicable

- Identification documents for each partner, such as driver's licenses or Social Security cards

Having these documents ready can facilitate a smoother application process and help avoid delays.

Form Submission Methods

The Partnership Account Form can be submitted through various methods, depending on the requirements of the institution or agency receiving it. Common submission methods include:

- Online submission via the institution's website

- Mailing a hard copy of the completed form

- In-person submission at a designated office or branch

It is important to check the specific submission guidelines provided by the institution to ensure compliance.

Quick guide on how to complete partnership account form

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PARTNERSHIP ACCOUNT FORM

Create this form in 5 minutes!

How to create an eSignature for the partnership account form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Partnership Account Form?

The Partnership Account Form is a key document used to establish a partnership with airSlate SignNow. It outlines the terms, benefits, and requirements for businesses looking to leverage our eSigning solutions. Completing this form is the first step toward collaboration and unlocking special features tailored for partners.

-

How can I fill out the Partnership Account Form?

Filling out the Partnership Account Form is simple and straightforward. Visit our website, locate the form under the partnerships section, and provide the necessary information about your business. Once submitted, our team will review your application and get back to you promptly.

-

Are there any fees associated with the Partnership Account Form?

No, there are no fees to complete the Partnership Account Form. Our goal is to facilitate partnerships and provide value to businesses looking to integrate airSlate SignNow's eSigning capabilities. Upon approval, you can explore different pricing plans based on your needs.

-

What benefits do I get after submitting the Partnership Account Form?

After submitting the Partnership Account Form, approved partners gain access to exclusive features, dedicated support, and potential revenue-sharing opportunities. You will also receive marketing resources to enhance your outsignNow efforts and maximize the benefits of our eSigning platform.

-

Can the Partnership Account Form be used for multiple users?

Yes, the Partnership Account Form can accommodate multiple users under a single partnership agreement. This flexibility allows your entire team to benefit from airSlate SignNow’s features, making it easier to streamline document signing and improve collaboration across your organization.

-

What integrations are available for partnership accounts?

Our partnership accounts come with various integrations to enhance your workflow. Depending on your business needs, you can integrate airSlate SignNow with popular tools such as CRM systems, project management apps, and cloud storage solutions. These integrations facilitate seamless document management and ensure a cohesive user experience.

-

How long does it take to process the Partnership Account Form?

Processing the Partnership Account Form typically takes 3-5 business days. After submitting the form, our team will review the information and contact you with further steps. If any additional details are needed, we’ll signNow out directly to ensure a smooth approval process.

Get more for PARTNERSHIP ACCOUNT FORM

- Nwmls form 22uu kitsap county septic addendum northwest

- Homefarm electrical permit application saskpower form

- K5 learning the sun and the stars form

- Cori form for melrose

- How to fill in a source document form

- Jerrys liquor form

- Form luzerne county luzernecounty

- Affidavit of abandonment template 257972681 form

Find out other PARTNERSHIP ACCOUNT FORM

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement