MONTHLY OPERATING REPORT for CORPORATE or PARTNERSHIP DEBTOR Justice 2011-2026

Understanding the monthly operating report for corporate or partnership debtor

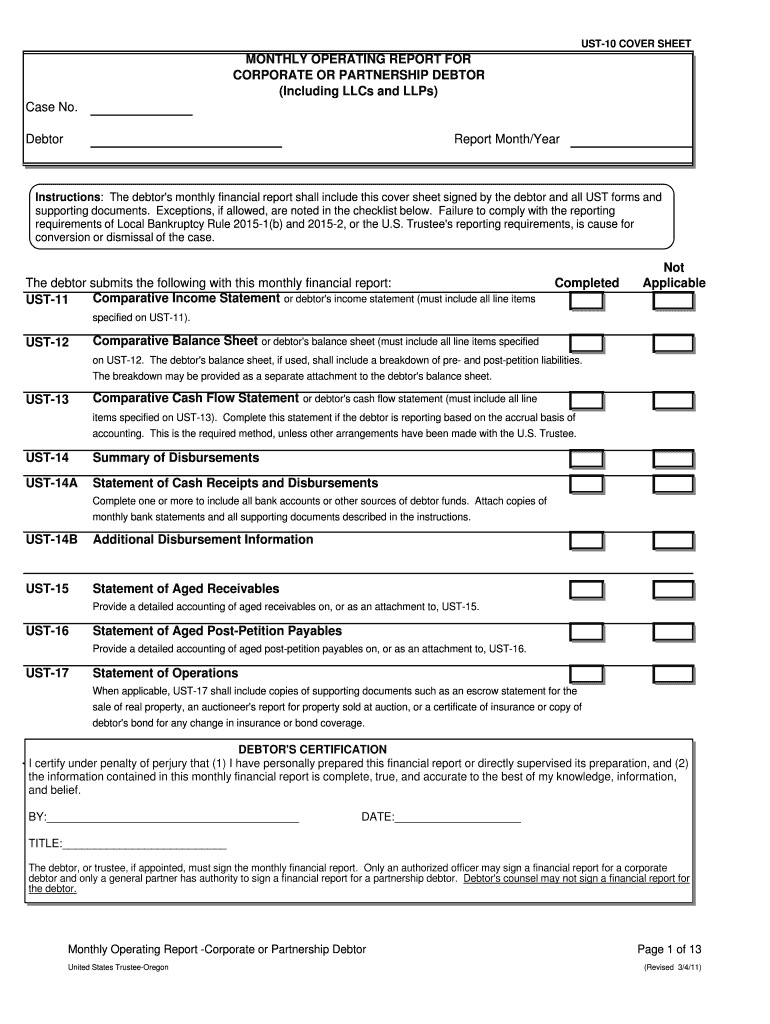

The monthly operating report for corporate or partnership debtor is a crucial document used in bankruptcy proceedings. It provides a detailed overview of a debtor's financial performance and operations during a specific month. This report is essential for the court and creditors to assess the debtor's financial health and make informed decisions regarding the bankruptcy case. It typically includes information such as income, expenses, cash flow, and any significant changes in the debtor's operations.

Steps to complete the monthly operating report for corporate or partnership debtor

Completing the monthly operating report requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather financial data: Collect all relevant financial information for the reporting period, including income statements, balance sheets, and cash flow statements.

- Fill out the form: Input the collected data into the appropriate sections of the report. Ensure that all figures are accurate and reflect the current financial status.

- Review for completeness: Double-check the report for any missing information or discrepancies. It is important that all required sections are filled out correctly.

- Obtain necessary approvals: If applicable, have the report reviewed and approved by relevant stakeholders, such as financial officers or legal counsel.

- Submit the report: File the completed report with the appropriate court or agency by the specified deadline.

Legal use of the monthly operating report for corporate or partnership debtor

The monthly operating report serves a legal purpose in bankruptcy proceedings. It is used by the court to monitor the financial situation of the debtor and ensure compliance with bankruptcy laws. Failure to submit this report on time or providing inaccurate information can lead to penalties, including dismissal of the bankruptcy case or sanctions against the debtor. Therefore, it is vital to understand the legal implications of this report and adhere to all guidelines.

Key elements of the monthly operating report for corporate or partnership debtor

Several key elements are essential to include in the monthly operating report. These elements provide a comprehensive view of the debtor's financial status:

- Income statement: A summary of revenues and expenses for the reporting period.

- Balance sheet: A snapshot of the debtor's assets, liabilities, and equity at the end of the reporting period.

- Cash flow statement: An overview of cash inflows and outflows, highlighting the debtor's liquidity position.

- Operational changes: Any significant changes in operations, such as layoffs, business closures, or new contracts.

- Future projections: Insights into expected future performance based on current trends and operational changes.

Filing deadlines and important dates for the monthly operating report

Timely submission of the monthly operating report is critical in bankruptcy cases. Each jurisdiction may have specific deadlines for filing these reports. It is essential to be aware of the following:

- Monthly submission deadlines: Reports are typically due within a specific number of days after the end of each month.

- Initial filing requirements: The first report may have a different deadline than subsequent reports.

- Extensions: If additional time is needed, it is crucial to request an extension from the court as early as possible.

Examples of using the monthly operating report for corporate or partnership debtor

Understanding practical applications of the monthly operating report can clarify its importance. Here are some scenarios where this report is utilized:

- Monitoring financial health: Creditors may use the report to assess the ongoing viability of the debtor's business operations.

- Evaluating compliance: The court reviews the report to ensure the debtor is adhering to bankruptcy regulations and maintaining transparency.

- Guiding restructuring efforts: Debtors can analyze their financial data to make informed decisions about restructuring and operational adjustments.

Quick guide on how to complete monthly operating report for corporate or partnership debtor justice

Finalize and submit your MONTHLY OPERATING REPORT FOR CORPORATE OR PARTNERSHIP DEBTOR Justice swiftly

Robust tools for digital document exchange and verification are now essential for optimizing processes and the ongoing enhancement of your forms. When managing legal forms and signing a MONTHLY OPERATING REPORT FOR CORPORATE OR PARTNERSHIP DEBTOR Justice, the right signature solution can conserve signNow time and resources with each submission.

Locate, complete, modify, endorse, and distribute your legal documents with airSlate SignNow. This platform provides all you need to streamline your document submission workflow. Its vast library of legal forms and intuitive navigation can assist you in finding your MONTHLY OPERATING REPORT FOR CORPORATE OR PARTNERSHIP DEBTOR Justice instantly, and the editor equipped with our signature feature will enable you to fill it out and approve it promptly.

Sign your MONTHLY OPERATING REPORT FOR CORPORATE OR PARTNERSHIP DEBTOR Justice in a few easy steps

- Discover the MONTHLY OPERATING REPORT FOR CORPORATE OR PARTNERSHIP DEBTOR Justice you need in our library by utilizing search or catalog pages.

- Examine the form information and preview it to ensure it meets your requirements and legal standards.

- Click Obtain form to access it for modification.

- Complete the form using the all-inclusive toolbar.

- Double-check the information you've entered and click the Sign tool to validate your document.

- Choose one of three options to incorporate your signature.

- Conclude editing and save the document in your storage, then download it to your device or share it right away.

Simplify each phase of your document creation and verification with airSlate SignNow. Experience a more effective online solution that considers all aspects of handling your paperwork.

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What is wrong with the hiring process and how could it be fixed? Endless forms have to be filled out, nothing is unified, and GitHub, StackOverflow (for developers) or Dribbble (for designers) are not taken into consideration.

Finding the right job candidates is one of the biggest recruiting challenges. Recruiters and other HR professionals that don’t use best recruiting strategies are often unable to find high-quality job applicants. With all the changes and advances in HR technologies, new recruiting and hiring solutions have emerged. Many recruiters are now implementing these new solutions to become more effective and productive in their jobs.According to Recruitment strategies report 2017 done by GetApp, the biggest recruiting challenge in 2017 was the shortage of skilled candidates.The process of finding job candidates has changed signNowly since few years ago. Back then, it was enough to post a job on job boards and wait for candidates to apply. Also called “post and pray” strategy.Today, it is more about building a strong Employer Branding strategy that attracts high quality applicants for hard-to-fill roles.Steps for finding the right job candidates1. Define your ideal candidate a.k.a candidate personaNot knowing who your ideal candidate is, will make finding one impossible. To be able to attract and hire them, you need to know their characteristics, motivations, skills and preferences.Defining a candidate persona requires planning and evaluation. The best way is to start from your current talent star employees. Learn more about their personalities, preferences, motivations and characteristics. Use these findings to find similar people for your current and future job openings.2. Engage your current employeesYou probably already know that your current employees are your best brand ambassadors. Same as current product users are best ambassadors for product brands. Their word of mouth means more than anyone else’s.Encourage their engagement and let them communicate their positive experiences to the outside. Remember, your employees are your best ambassadors, and people trust people more than brands, CEOs and other C-level executives.Involving your current employees can not only help you build a strong Employer Branding strategy, but it can also help your employees feel more engaged and satisfied with their jobs.3. Write a clear job descriptionsEven though many recruiters underestimate this step, it is extremely important to do it right! Writing a clear and detailed job description plays a huge role in finding and attracting candidates with a good fit. Don’t only list duties, responsibilities and requirements, but talk about your company’s culture and Employee Value Proposition.To save time, here are our free job description templates.4. Streamline your efforts with a Recruitment Marketing toolIf you have right tools, finding the right job candidates is much easier and faster than without them. Solutions offered by recruitment marketing software are various, and with them you can build innovative recruiting strategies such as Inbound Recruiting and Candidate Relationship Management to improve Candidate Experience and encourage Candidate Engagement.Sending useful, timely and relevant information to the candidates from your talent pool is a great way for strengthening your Employer Brand and communicating your Employee Value Proposition.5. Optimize your career site to invite visitors to applyWhen candidates want to learn about you, they go to your career site. Don-t loose this opportunity to impress them. Create content and look that reflects your company’s culture, mission and vision. Tell visitors about other employees success and career stories.You can start by adding employee testimonials, fun videos, introduce your team, and write about cool project that your company is working on.Don’t let visitors leave before hitting “Apply Now” button.6. Use a recruiting software with a powerful sourcing toolToday, there are powerful sourcing tools that find and extract candidates profiles. They also add them directly to your talent pool. Manual search takes a lot of time and effort, and is often very inefficient. With a powerful sourcing tool, you can make this process much faster, easier and more productive. These tools help you find candidates that match both the position and company culture.7. Use an Applicant Tracking SystemSolutions offered by applicant tracking systems are various, but their main purpose is to fasten and streamline the selections and hiring processes. By fastening the hiring and selection process, you can signNowly improve Candidate Experience. With this, you can increase your application and hire rate for hard-to-fill roles. Did you know that top talent stays available on the market for only 10 days?8. Implement and use employee referral programsReferrals are proven to be best employees! Referrals can improve your time, cost and quality of hire, and make your hiring strategy much more productive. Yet, many companies still don’t have developed strategies for employee referrals.This is another great way to use your current employee to help you find the best people. To start, use these referral email templates for recruiters, and start engaging your employees today!GetApp‘s survey has proven that employee referrals take shortest to hire, and bring the highest quality job applicants.If you don’t have ideas about how to reward good referrals, here’s our favorite list of ideas for employee referral rewards.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

How can someone get a translator for a USA tourist visa interview? Is there any form to fill out or do they give a translator during interview time?

The officer who interviews the visa applicant will usually speak and understand the most common local language. If not, another officer or a local consular employee will probably be able to translate. If the language is obscure enough, the consular officer might still find, somewhere in the embassy/consulate, an employee who has it.I remember an instance when the only employee who spoke both the primary local language and the very rare language of the visa applicant was one of the oldest, shyest, most reticent, lowest-level gardeners. He was so proud of the officers’ need of and appreciation for that rare skill that one time, that he began to dress better, stand straighter, feel and act more confident, and volunteer for and learn from special, complicated jobs. He eventually earned a permanent promotion to head gardener and did an excellent job at it.

Create this form in 5 minutes!

How to create an eSignature for the monthly operating report for corporate or partnership debtor justice

How to create an electronic signature for your Monthly Operating Report For Corporate Or Partnership Debtor Justice in the online mode

How to generate an electronic signature for your Monthly Operating Report For Corporate Or Partnership Debtor Justice in Google Chrome

How to make an eSignature for signing the Monthly Operating Report For Corporate Or Partnership Debtor Justice in Gmail

How to create an eSignature for the Monthly Operating Report For Corporate Or Partnership Debtor Justice right from your smart phone

How to generate an eSignature for the Monthly Operating Report For Corporate Or Partnership Debtor Justice on iOS

How to generate an eSignature for the Monthly Operating Report For Corporate Or Partnership Debtor Justice on Android devices

People also ask

-

What is a sheet monthly debtor print?

A sheet monthly debtor print is a formatted document that outlines the outstanding debts owed to your business on a monthly basis. airSlate SignNow allows you to create and eSign this type of document efficiently, ensuring that you have an accurate record of debtors each month.

-

How can airSlate SignNow help with managing sheet monthly debtor prints?

airSlate SignNow provides tools that streamline the creation and distribution of sheet monthly debtor prints. Its user-friendly interface enables businesses to customize these prints, track signatures, and ensure that all necessary parties can easily view and acknowledge the documents.

-

Is there a cost associated with using airSlate SignNow for sheet monthly debtor prints?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Whether you are a small startup or a large corporation, you can find a cost-effective solution for creating and managing your sheet monthly debtor prints.

-

What features does airSlate SignNow provide for eSigning sheet monthly debtor prints?

With airSlate SignNow, you can eSign sheet monthly debtor prints securely and quickly. Features include customizable templates, automated reminders for signatures, and a secure platform that ensures your documents are legally binding and protected.

-

Can I integrate airSlate SignNow with other applications for managing sheet monthly debtor prints?

Yes, airSlate SignNow integrates seamlessly with many popular business applications such as CRM and project management tools. This allows you to automate the process of creating sheet monthly debtor prints and helps you manage your debtor information more effectively.

-

What are the benefits of using airSlate SignNow for my sheet monthly debtor prints?

Using airSlate SignNow for your sheet monthly debtor prints enhances efficiency and reduces errors. It allows you to track document status in real-time, provides secure storage, and ensures that every debtor print is signed and acknowledged, helping you maintain clear financial records.

-

Is it easy to customize sheet monthly debtor prints in airSlate SignNow?

Absolutely! airSlate SignNow provides easy-to-use customization tools that enable you to tailor your sheet monthly debtor prints to meet your specific business needs. You can adjust layouts, add logos, and modify fields to reflect the unique requirements of your organization.

Get more for MONTHLY OPERATING REPORT FOR CORPORATE OR PARTNERSHIP DEBTOR Justice

- Air commercial real estate association standard industrial commercial single tenant lease form

- Blm form 1260

- Dhcs form 6237 department of health care services state of dhcs ca

- Ishihara test pdf form

- Project request form

- West virginia amended income tax return state of west virginia state wv form

- Conflict management styles national ag risk education library form

- Ps form 3152

Find out other MONTHLY OPERATING REPORT FOR CORPORATE OR PARTNERSHIP DEBTOR Justice

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself