Form 8986 Fillable

What is the Form 8986 Fillable

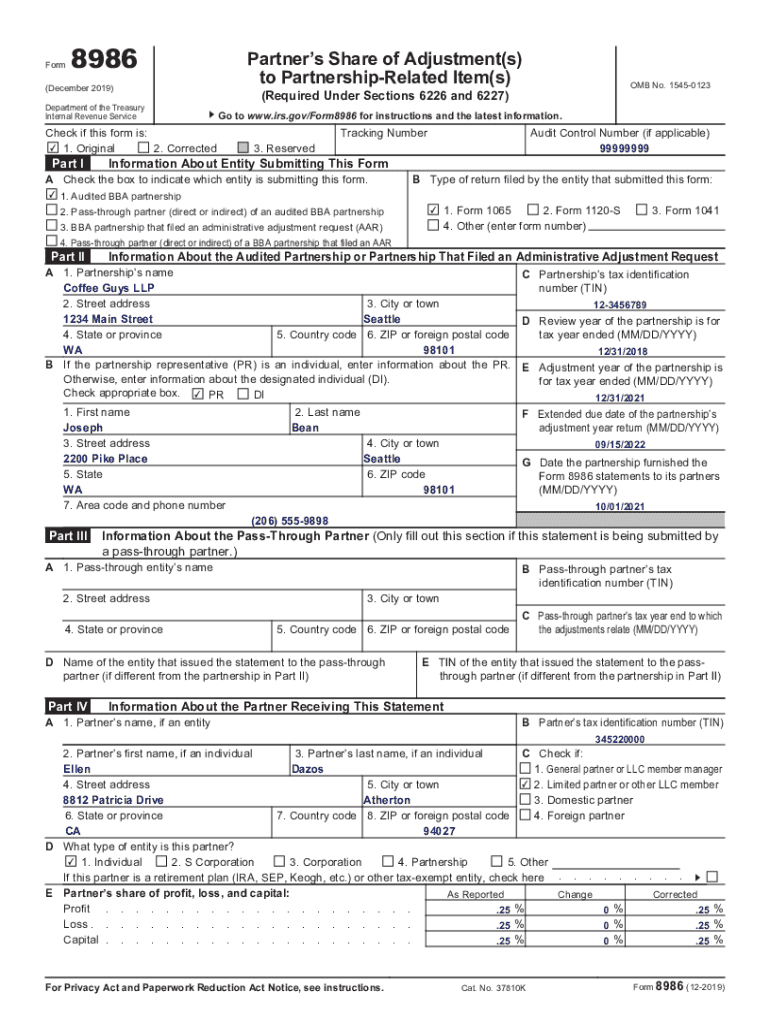

The Form 8986 is an important document used by taxpayers in the United States, specifically related to the reporting of certain tax information. This fillable form allows individuals to provide necessary details to the IRS regarding their tax situation. It is designed to streamline the process of submitting tax-related information electronically, making it more efficient for both taxpayers and the IRS. The fillable version of the form ensures that users can easily input their data, reducing the likelihood of errors and facilitating quicker processing.

How to use the Form 8986 Fillable

Using the Form 8986 fillable is straightforward. First, access the form in a digital format, which allows for easy completion. Users can fill in their personal and financial information directly into the fields provided. It is essential to follow the instructions carefully to ensure all required sections are completed accurately. Once the form is filled out, it can be electronically signed and submitted to the IRS. This method not only saves time but also enhances the security of the submission process.

Steps to complete the Form 8986 Fillable

Completing the Form 8986 fillable involves several key steps:

- Download the form in PDF format or access it through an e-signature platform.

- Begin by entering your personal information, including your name, address, and Social Security number.

- Fill in the relevant financial details as required by the form.

- Review the information for accuracy to avoid any mistakes that could delay processing.

- Sign the form electronically, ensuring compliance with legal requirements.

- Submit the completed form to the IRS, either online or through mail, as per your preference.

Legal use of the Form 8986 Fillable

The legal use of the Form 8986 fillable is governed by IRS regulations. To be considered legally binding, the form must be completed accurately and submitted in accordance with IRS guidelines. Electronic signatures are recognized under the ESIGN Act, provided the necessary conditions are met. This means that using a reputable e-signature service can ensure that the form holds up in legal contexts, making it essential for users to choose a compliant platform for their submissions.

IRS Guidelines

IRS guidelines for the Form 8986 emphasize the importance of accuracy and completeness. Taxpayers are advised to refer to the official IRS instructions accompanying the form to understand the specific requirements for their situation. This includes details on eligibility, required documentation, and filing deadlines. Adhering to these guidelines helps prevent delays in processing and potential penalties for non-compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form 8986 can be submitted through various methods, offering flexibility to taxpayers. The online submission is the most efficient, allowing for immediate processing. Alternatively, individuals can print the completed form and mail it to the appropriate IRS address. In-person submissions are also possible in certain situations, particularly for those who prefer direct interaction with IRS representatives. Each method has its own set of guidelines, so it is crucial to choose the one that best fits your needs.

Quick guide on how to complete form 8986 fillable

Complete Form 8986 Fillable effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly, without delays. Manage Form 8986 Fillable on any gadget using airSlate SignNow apps for Android or iOS, and enhance any document-driven workflow today.

How to edit and electronically sign Form 8986 Fillable with ease

- Locate Form 8986 Fillable and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 8986 Fillable and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8986 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8986 and how is it used?

Form 8986 is a form used by businesses for various tax-related purposes. It streamlines the documentation process, making it easier to submit required information to tax authorities. By using airSlate SignNow, you can electronically sign and send form 8986, ensuring compliance and reducing delays.

-

How does airSlate SignNow help with form 8986 submissions?

airSlate SignNow simplifies the process of filling out and submitting form 8986 electronically. Our platform allows users to create, eSign, and manage their documents efficiently, ensuring that you can track your submissions and obtain necessary approvals without physical paperwork.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Our plans include features that support form 8986 submissions, ensuring you have access to the tools necessary for efficient document handling. You can choose a plan that best suits your budget and requirements.

-

Can I integrate form 8986 with other applications using airSlate SignNow?

Yes, airSlate SignNow supports integrations with a variety of applications, enhancing your workflow with form 8986. By connecting with systems like CRM or file storage solutions, you can automate the process of generating and sending form 8986, saving you valuable time.

-

What features does airSlate SignNow offer for managing form 8986?

airSlate SignNow offers features such as customizable templates, secure eSignature options, and real-time tracking for form 8986. These tools empower businesses to handle their documentation needs efficiently while ensuring compliance and security.

-

Why should I choose airSlate SignNow for my form 8986 needs?

Choosing airSlate SignNow for your form 8986 requirements means opting for a user-friendly, cost-effective solution that streamlines your document management. Our platform is designed to enhance productivity and ensure that your forms are signed and submitted promptly, maintaining compliance and efficiency.

-

Is airSlate SignNow secure for handling sensitive documents like form 8986?

Absolutely, airSlate SignNow takes security seriously with advanced encryption and compliance with industry standards. This ensures that sensitive documents, including form 8986, are protected throughout the signing process, providing peace of mind for your business.

Get more for Form 8986 Fillable

- Form 540nr short california nonresident or part year resident income tax return ftb ca

- Membership renewal application final 0130 bni form

- Nppi employment application national pipe and plastic form

- Renewal application for cna form

- Master builders contract template form

- Master grower contract template form

- Florist contract template form

- Florist for wedding contract template form

Find out other Form 8986 Fillable

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now