Form 540NR Short California Nonresident or Part Year Resident Income Tax Return Ftb Ca

What is the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

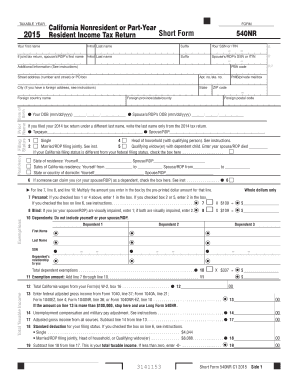

The Form 540NR Short is a tax return specifically designed for individuals who are nonresidents or part-year residents of California. This form is used to report income earned in California and to calculate the state income tax owed. It simplifies the filing process for those who do not have complex tax situations, allowing for a more straightforward approach to meeting state tax obligations. The form is issued by the California Franchise Tax Board (FTB) and is essential for ensuring compliance with California tax laws.

Steps to complete the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

Completing the Form 540NR Short involves several key steps to ensure accurate reporting of income and tax obligations. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out your personal information, including your name, address, and Social Security number. Then, report your income earned while in California, ensuring to include only the income that is taxable in the state. After calculating your total income, apply any deductions or credits you may qualify for. Finally, review your completed form for accuracy before submitting it to the FTB.

How to obtain the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

The Form 540NR Short can be obtained through various channels. It is available for download directly from the California Franchise Tax Board's website. Additionally, physical copies can be requested through the mail or found at local tax offices and libraries. Many tax preparation software programs also include this form, allowing for electronic completion and submission. Ensure to use the most current version of the form to comply with the latest tax regulations.

Legal use of the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

The legal use of the Form 540NR Short requires adherence to specific regulations set forth by the California Franchise Tax Board. This form must be completed accurately and submitted by the designated filing deadline to avoid penalties. Electronic submissions are legally recognized, provided they comply with eSignature laws, ensuring that the form is valid and enforceable. It is crucial to maintain copies of the submitted form and any supporting documents for your records, as they may be needed for future reference or in case of an audit.

Key elements of the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

The Form 540NR Short includes several key elements that are essential for accurate tax reporting. These elements consist of personal identification information, details regarding income earned in California, applicable deductions, and credits. Additionally, the form requires a calculation of the total tax owed based on the reported income. Understanding these components is vital for ensuring that all necessary information is provided, which helps to avoid errors that could lead to delays or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540NR Short are crucial for compliance with California tax laws. Typically, the form must be submitted by April 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to these dates, as late submissions can result in penalties and interest on unpaid taxes.

Quick guide on how to complete form 540nr short california nonresident or part year resident income tax return ftb ca

Effortlessly Prepare Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and eSign Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca with Ease

- Find Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the provided information and then click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540nr short california nonresident or part year resident income tax return ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca is a simplified version of the California income tax return designed specifically for nonresidents or part-year residents. This form allows you to report income earned within California while exempting income not earned in the state. It's essential for ensuring compliance with California tax laws and correctly calculating your tax liability.

-

How can airSlate SignNow assist with the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

airSlate SignNow streamlines the process of filling out and submitting the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca. Using our platform, you can easily collaborate and eSign your documents, ensuring all relevant information is included and accurately reported before submission. This signNowly reduces paperwork delays and enhances efficiency.

-

Is there a cost associated with filing the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca using airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing plans that allow you to access features for eSigning and document management tailored to your needs. While there may be a fee for utilizing our services, the cost is often outweighed by the time and hassle you save when filing your Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca efficiently.

-

What features does airSlate SignNow offer for the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Our platform provides several features helpful for managing your Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca, such as document templates, eSignature capabilities, and real-time collaboration. These tools make it easier to share documents with tax professionals or stakeholders, ensuring that everyone's input is accurately reflected in the final submission.

-

Are there any integration options for the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca?

Absolutely! airSlate SignNow seamlessly integrates with numerous applications, allowing you to incorporate your Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca into your existing workflows. Popular integrations include Google Drive, Dropbox, and CRM systems to enhance your document management and filing processes.

-

What are the benefits of using airSlate SignNow for filing taxes?

Using airSlate SignNow for filing the Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca offers numerous benefits, including increased efficiency, reduced errors, and secure storage of your documents. Our electronic signature feature accelerates the approval process, saving you valuable time during tax season while ensuring compliance.

-

Can I track the status of my Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca. You will receive notifications regarding document views, signings, and completion, giving you peace of mind that your tax return is being processed efficiently.

Get more for Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

Find out other Form 540NR Short California Nonresident Or Part Year Resident Income Tax Return Ftb Ca

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors