Escrow Waiver Form

What is the escrow waiver?

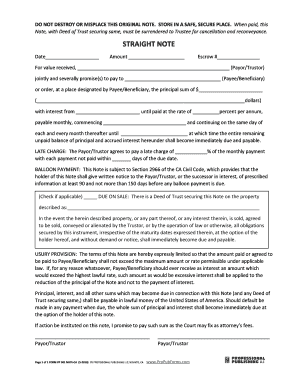

An escrow waiver form is a legal document that allows a buyer or borrower to forgo the requirement of placing funds into an escrow account during a real estate transaction or loan agreement. This waiver can be particularly useful in situations where the parties involved agree that an escrow account is unnecessary, often due to the trust established between them or the nature of the transaction. The form outlines the terms under which the waiver is granted and typically requires signatures from all parties involved to ensure mutual consent.

How to use the escrow waiver

Using an escrow waiver involves several key steps. First, all parties must agree on the terms of the waiver, ensuring that it is suitable for their specific situation. Once agreed upon, the escrow waiver form should be filled out accurately, detailing the relevant transaction information and the reasons for the waiver. After completing the form, it must be signed by all parties to validate the waiver. It is advisable to keep a copy of the signed document for future reference, as it serves as proof of the agreement to waive escrow.

Key elements of the escrow waiver

Several important elements should be included in an escrow waiver form to ensure its legal validity. These elements typically include:

- Parties involved: Names and contact information of all parties involved in the transaction.

- Transaction details: A clear description of the transaction, including property address and loan amount.

- Reason for waiver: A statement explaining why the escrow requirement is being waived.

- Signatures: Signatures of all parties, indicating their agreement to the terms of the waiver.

- Date: The date on which the waiver is signed.

Steps to complete the escrow waiver

Completing an escrow waiver form involves a straightforward process. Follow these steps to ensure accuracy and compliance:

- Gather necessary information about all parties involved in the transaction.

- Clearly outline the details of the transaction, including the property and loan specifics.

- Provide a valid reason for waiving the escrow requirement.

- Fill out the escrow waiver form, ensuring all information is accurate and complete.

- Have all parties review and sign the form to confirm their agreement.

- Distribute copies of the signed form to all parties for their records.

Legal use of the escrow waiver

The legal use of an escrow waiver is contingent upon mutual consent between all parties involved in the transaction. It is essential to ensure that the waiver complies with state laws and regulations governing real estate transactions. In many cases, the waiver must be executed in writing and signed by all parties to be enforceable. Failure to properly execute the waiver may result in legal complications, particularly if disputes arise regarding the transaction.

Examples of using the escrow waiver

Escrow waivers can be utilized in various scenarios, including:

- A buyer purchasing a home from a trusted seller without the need for an escrow account.

- A borrower securing a loan from a family member who trusts them to repay without escrow protection.

- Transactions involving properties that do not require extensive due diligence, where trust between parties is established.

Quick guide on how to complete escrow waiver

Accomplish Escrow Waiver seamlessly on any gadget

Digital document organization has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with everything you require to create, alter, and electronically sign your documents swiftly without delays. Manage Escrow Waiver on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Escrow Waiver effortlessly

- Locate Escrow Waiver and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow efficiently manages your document needs in just a few clicks from any device you choose. Alter and eSign Escrow Waiver and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the escrow waiver

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an escrow waiver letter example?

An escrow waiver letter example is a document used to release funds held in escrow, often related to real estate transactions. This letter specifies the conditions under which the waiver is granted, ensuring clarity and legal compliance. Utilizing an escrow waiver letter example can simplify your dealings when funds are disputed or conditions change.

-

How can I create an escrow waiver letter using airSlate SignNow?

With airSlate SignNow, creating an escrow waiver letter is a straightforward process. You can easily access customizable templates, including an escrow waiver letter example, and fill in the necessary details quickly. Once completed, you can send it for eSignature directly through our platform, ensuring a seamless workflow.

-

Are there any costs associated with using the escrow waiver letter example template?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including access to templates like the escrow waiver letter example. Our plans start with a free trial, allowing you to explore the features before committing. This ensures you can evaluate the value we provide without upfront costs.

-

What are the main benefits of using an escrow waiver letter example?

Using an escrow waiver letter example can streamline your document processes and enhance clarity in transactions. It helps formalize agreements, which can prevent disputes and miscommunication. Additionally, airSlate SignNow enables quick eSigning, speeding up transaction closures.

-

Can I integrate airSlate SignNow with other applications for managing escrow documents?

Yes, airSlate SignNow offers integration with various applications, including CRM and project management tools. This allows you to manage your escrow documents and the escrow waiver letter example in sync with your existing workflows. These integrations enhance productivity and ensure a seamless experience.

-

How does airSlate SignNow ensure the security of my escrow waiver letter?

airSlate SignNow prioritizes security, employing industry-standard encryption and authentication protocols to protect your documents. Your escrow waiver letter example is safely stored and can only be accessed by authorized users. We constantly monitor our platform to ensure the integrity and confidentiality of your documents.

-

Is it easy to share my escrow waiver letter example with clients or partners?

Absolutely! airSlate SignNow allows for effortless sharing of your escrow waiver letter example via email or secure links. You can also track who has opened or signed the document, providing you with valuable insights into your document's progress and ensuring timely responses.

Get more for Escrow Waiver

- The formal description of the childs mental state known as mental state examination or mse

- V0100 formular

- Accc weekly schedule form

- Life insurance survey questionnaire sample form

- N3m officer applicant coversheetquality assurance qa cnrc navy form

- Forest fire prevention exemption form cal fire ca gov

- Student physical form

- Agent contract template form

Find out other Escrow Waiver

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple