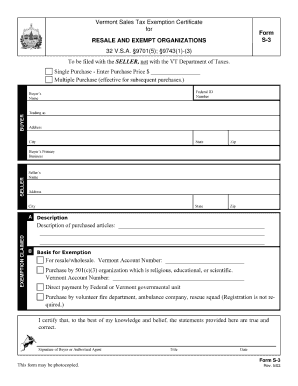

Vermont Sales Tax Exemption Certificate Fillable Form

What is the Vermont resale certificate?

The Vermont resale certificate is a legal document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. This certificate is essential for retailers and wholesalers who wish to buy inventory without incurring sales tax costs. By presenting the Vermont resale certificate, a buyer certifies that the items purchased will be resold in the regular course of business, thus qualifying for tax exemption.

How to obtain the Vermont resale certificate

To obtain a Vermont resale certificate, a business must first register with the Vermont Department of Taxes. This involves completing a business registration form and providing necessary information such as the business name, address, and tax identification number. Once registered, businesses can access the resale certificate form, which can be filled out and printed for use. It is important to ensure that all information is accurate to avoid issues during transactions.

Steps to complete the Vermont resale certificate

Completing the Vermont resale certificate involves several straightforward steps:

- Gather necessary information, including the seller's name, address, and sales tax identification number.

- Fill in the buyer's details, ensuring that the business name and address match those on file with the Vermont Department of Taxes.

- Clearly state the type of property being purchased and confirm that these items are intended for resale.

- Sign and date the certificate to validate it.

Once completed, the certificate should be presented to the seller at the time of purchase.

Legal use of the Vermont resale certificate

The Vermont resale certificate must be used in accordance with state regulations to ensure its legality. It is crucial that businesses only use this certificate for items they genuinely intend to resell. Misuse of the certificate, such as using it for personal purchases or non-resale items, can lead to penalties, including fines and back taxes owed. Sellers are advised to keep copies of the resale certificates they accept for their records.

Key elements of the Vermont resale certificate

A valid Vermont resale certificate includes several key elements:

- The buyer's name and address.

- The seller's name and address.

- A description of the property being purchased.

- The buyer's sales tax identification number.

- A declaration that the property is intended for resale.

- The signature of the buyer and the date of signing.

These elements ensure that the certificate is complete and compliant with Vermont tax laws.

Penalties for non-compliance

Failure to comply with the regulations surrounding the Vermont resale certificate can result in serious consequences. Businesses may face penalties, including fines and interest on unpaid sales tax. Additionally, if a business is found to have misused the resale certificate, they may be required to pay the sales tax that should have been collected at the time of sale. It is essential for businesses to understand and adhere to the rules governing the use of resale certificates to avoid these penalties.

Quick guide on how to complete vermont sales tax exemption certificate fillable form

Complete Vermont Sales Tax Exemption Certificate Fillable Form seamlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without hindrances. Handle Vermont Sales Tax Exemption Certificate Fillable Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

How to modify and eSign Vermont Sales Tax Exemption Certificate Fillable Form with ease

- Obtain Vermont Sales Tax Exemption Certificate Fillable Form and click Get Form to begin.

- Make use of the tools provided to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign Vermont Sales Tax Exemption Certificate Fillable Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vermont sales tax exemption certificate fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Vermont resale certificate?

A Vermont resale certificate is a document that allows businesses to purchase goods and services without paying sales tax, provided those items are intended for resale. This certificate is essential for retailers and wholesalers who want to ensure their purchases do not incur unnecessary costs. With airSlate SignNow, you can easily manage and share your Vermont resale certificate digitally, streamlining your tax-exempt transactions.

-

How do I obtain a Vermont resale certificate?

To obtain a Vermont resale certificate, you need to complete the application form provided by the Vermont Department of Taxes. Once approved, you can start using your certificate for tax-exempt purchases. With airSlate SignNow, you can efficiently fill out and eSign this application to speed up the process.

-

What are the benefits of using a Vermont resale certificate?

Using a Vermont resale certificate allows businesses to purchase inventory without incurring sales tax, resulting in signNow savings. Additionally, it simplifies bookkeeping and accounting, as it provides a clear record of tax-exempt purchases. With airSlate SignNow, you can conveniently store and manage your resale certificate in a digital format for easy access.

-

How does airSlate SignNow help with managing Vermont resale certificates?

airSlate SignNow offers a secure and efficient way to manage your Vermont resale certificate. You can easily send, eSign, and store your documents in one place, reducing paperwork and enhancing compliance. Furthermore, our platform ensures that your resale certificate is accessible whenever you need it.

-

Are there any fees associated with obtaining a Vermont resale certificate?

There are no fees for obtaining a Vermont resale certificate from the state; however, you may incur costs related to the purchase of goods intended for resale. It’s essential to maintain accurate records to ensure proper use. Using airSlate SignNow, you can track these transactions effectively and stay organized.

-

Can I use my Vermont resale certificate in other states?

A Vermont resale certificate is typically only valid within Vermont. However, many states have reciprocal agreements that allow for the use of out-of-state resale certificates. To use your Vermont resale certificate in another state, check the specific regulations and requirements of that state.

-

What features does airSlate SignNow offer for eSigning Vermont resale certificates?

airSlate SignNow simplifies the eSigning process for Vermont resale certificates with user-friendly features such as templates and automated workflows. You can invite multiple signers, set signing orders, and track document statuses all in one platform. This ensures that your resale certificate is processed quickly and efficiently.

Get more for Vermont Sales Tax Exemption Certificate Fillable Form

- Nunez community college transcript request form

- Request medical records vidant health form

- Concentriclink time sheets form

- Dep action request darpotential dep problemrequ form

- Form 592 b resident and nonresident withholding statement

- Behavior for teenager contract template form

- Behavior for students contract template form

- Exit plan contract template form

Find out other Vermont Sales Tax Exemption Certificate Fillable Form

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple