Wisconsin Form 5s

What is the Wisconsin Form 5s

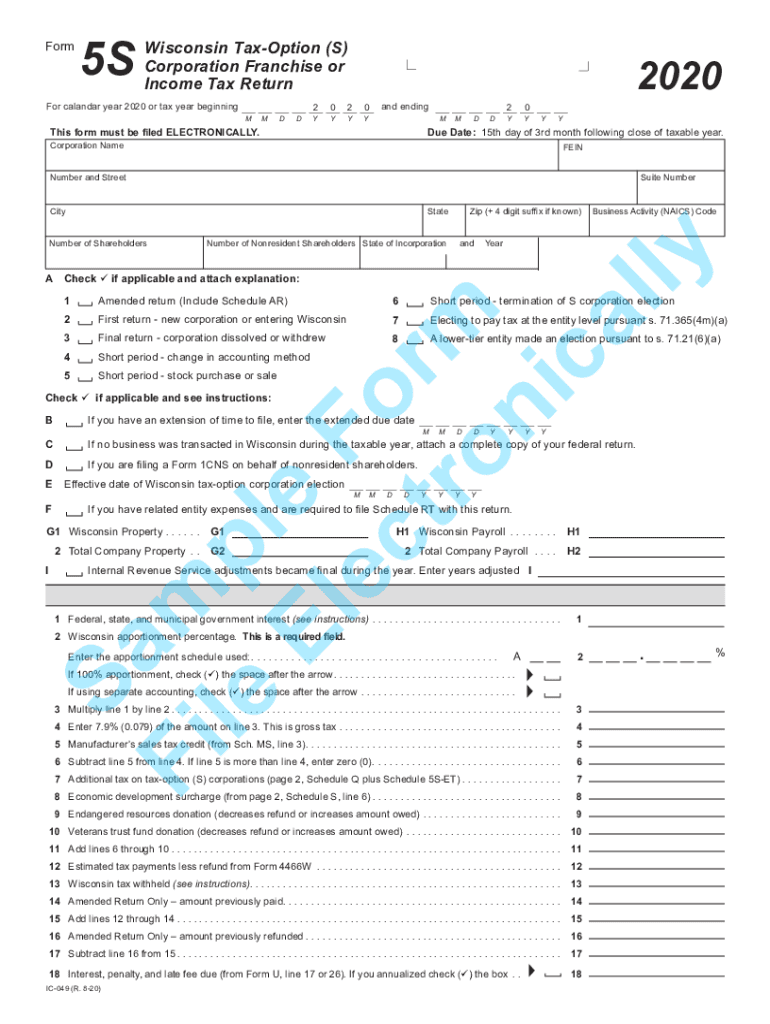

The Wisconsin Form 5s is a tax form used by individuals and businesses in Wisconsin to report specific income and tax information. This form is essential for ensuring compliance with state tax regulations and is typically utilized in conjunction with other tax documents. It serves as a means for taxpayers to disclose their earnings and calculate any taxes owed to the state of Wisconsin.

How to use the Wisconsin Form 5s

Using the Wisconsin Form 5s involves several steps to ensure accurate reporting. First, gather all necessary financial documents, such as W-2s, 1099s, and any other income statements. Next, fill out the form with the required information, including personal details and income sources. Once completed, review the form for accuracy before submission. It is important to keep a copy for your records.

Steps to complete the Wisconsin Form 5s

Completing the Wisconsin Form 5s requires a systematic approach:

- Begin by downloading the form from the Wisconsin Department of Revenue website or accessing it through an e-filing service.

- Enter your personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your W-2s and 1099s in the appropriate sections.

- Calculate your total income and any deductions you qualify for, following the instructions provided on the form.

- Determine your tax liability based on the calculations and applicable tax rates.

- Sign and date the form, then submit it according to the specified submission methods.

Legal use of the Wisconsin Form 5s

The Wisconsin Form 5s is legally binding when filled out and submitted according to state regulations. To ensure its legality, it is crucial to provide accurate information and adhere to filing deadlines. Electronic signatures are accepted, provided they comply with the relevant eSignature laws. This compliance helps maintain the integrity of the document and ensures it is recognized by the state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Form 5s are typically aligned with federal tax deadlines. Generally, the form must be submitted by April fifteenth of the following tax year. If you require additional time, you may file for an extension, but it is important to pay any taxes owed by the original deadline to avoid penalties. Keeping track of these dates is essential for maintaining compliance and avoiding unnecessary fees.

Form Submission Methods

The Wisconsin Form 5s can be submitted through various methods, including:

- Online submission via the Wisconsin Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address provided on the form.

- In-person submission at designated state tax offices, if applicable.

Choosing the right submission method can help ensure timely processing of your tax return.

Quick guide on how to complete wisconsin form 5s 533327422

Complete Wisconsin Form 5s effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any hold-ups. Manage Wisconsin Form 5s on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Wisconsin Form 5s with ease

- Locate Wisconsin Form 5s and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, and mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Wisconsin Form 5s and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wisconsin form 5s 533327422

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wisconsin form 5s 2020?

The Wisconsin form 5s 2020 is a state-specific tax form used for reporting certain information to the Wisconsin Department of Revenue. It is crucial for individuals and businesses to ensure accurate tax reporting, and airSlate SignNow can help streamline the signing and submission process.

-

How can airSlate SignNow help me with the Wisconsin form 5s 2020?

airSlate SignNow allows users to easily upload, fill out, and eSign the Wisconsin form 5s 2020 online. Our platform simplifies the process, ensuring that all required signatures are obtained quickly and securely, saving you time and effort.

-

Is airSlate SignNow cost-effective for handling the Wisconsin form 5s 2020?

Yes, airSlate SignNow offers a cost-effective solution for managing the Wisconsin form 5s 2020. With various pricing plans tailored to businesses of all sizes, you can select a plan that best fits your needs without overspending on unnecessary features.

-

What features does airSlate SignNow offer for the Wisconsin form 5s 2020?

AirSlate SignNow provides a variety of features for handling the Wisconsin form 5s 2020, including customizable templates, electronic signatures, and real-time tracking of document status. These features ensure a seamless experience from start to finish, enhancing your document management workflow.

-

Are there any integrations available for using the Wisconsin form 5s 2020 with airSlate SignNow?

Absolutely! airSlate SignNow offers powerful integrations with popular software tools that can assist in managing the Wisconsin form 5s 2020. Integrations with CRM systems and cloud storage ensure your documents are easily accessible and manageable within your existing workflows.

-

How secure is my information when using airSlate SignNow for the Wisconsin form 5s 2020?

Security is a top priority at airSlate SignNow. When working with the Wisconsin form 5s 2020, all data is encrypted and stored securely, ensuring that your personal and business information remains confidential and protected.

-

Can I access the Wisconsin form 5s 2020 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage the Wisconsin form 5s 2020 from anywhere. This convenience helps you complete your paperwork on-the-go, ensuring that you never miss a deadline.

Get more for Wisconsin Form 5s

- Gov form snf 2903

- Verification employment verification form hud

- Fair market valuation form advanta ira

- Nycers 310 form

- Aaron mcemrys form

- Name probability introduction 1 date class prealgebra the spinner shown is spun once sewanhaka k12 ny form

- Horse partial lease agreement template form

- Horse lease agreement template form

Find out other Wisconsin Form 5s

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure