Ifta Form

What is the IFTA Form

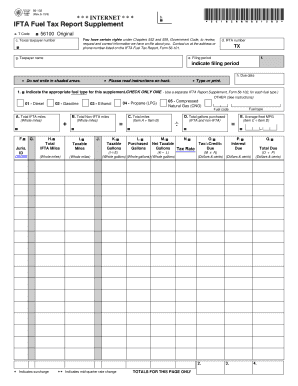

The International Fuel Tax Agreement (IFTA) form is a crucial document for commercial vehicle operators who travel across state lines in the United States and Canada. This form is used to report fuel usage and calculate the fuel tax owed to various jurisdictions. By consolidating fuel tax reporting, the IFTA form simplifies the process for trucking companies and independent operators, allowing them to comply with tax regulations efficiently. The form helps ensure that taxes are paid to the appropriate states based on the miles driven and fuel consumed in each jurisdiction.

Steps to complete the IFTA Form

Completing the IFTA form involves several key steps to ensure accuracy and compliance. First, gather all necessary data, including total miles driven in each state, total fuel purchased, and any fuel tax paid. Next, accurately fill in the form with this information. It's essential to double-check calculations to avoid errors that could lead to penalties. After completing the form, review it for completeness and accuracy before submission. Finally, submit the IFTA form by the designated deadline to avoid late fees and ensure compliance with state regulations.

Legal use of the IFTA Form

The IFTA form is legally binding when completed correctly and submitted on time. Compliance with IFTA regulations is essential for operators to avoid penalties and maintain good standing with tax authorities. The form must be signed and dated by the authorized representative of the business. Additionally, electronic signatures are valid as long as they meet the requirements set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). Ensuring that the form is filled out accurately and submitted promptly is key to its legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA form are critical for compliance. Generally, the IFTA form must be filed quarterly, with specific deadlines set by each jurisdiction. Typically, the deadlines fall on the last day of the month following the end of each quarter. For example, the deadlines for the first quarter (January to March) are usually April 30, while the second quarter (April to June) is July 31. It is essential for operators to be aware of these dates to avoid late fees and ensure compliance with tax regulations.

Required Documents

To complete the IFTA form, several documents are required. Operators must provide records of total miles driven in each jurisdiction, fuel purchase receipts, and any previous IFTA tax returns. Maintaining accurate records is crucial for substantiating the information reported on the IFTA form. Additionally, operators should keep documentation of any fuel tax paid to other jurisdictions, as this may affect the total tax liability calculated on the form.

Form Submission Methods (Online / Mail / In-Person)

Submitting the IFTA form can be done through various methods, depending on the jurisdiction's requirements. Many states offer online submission options, allowing for quick and efficient filing. Alternatively, operators may choose to mail the completed form to the appropriate state agency. In some cases, in-person submission may also be an option, particularly for those who prefer direct interaction with tax officials. Understanding the submission methods available can help streamline the filing process and ensure timely compliance.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties. Common penalties include late filing fees, interest on unpaid taxes, and potential audits by state tax authorities. In severe cases, operators may face suspension of their IFTA license, which can hinder their ability to operate across state lines. It is essential for operators to stay informed about their filing obligations and adhere to deadlines to avoid these consequences.

Quick guide on how to complete ifta form 66204823

Complete Ifta Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without interruptions. Handle Ifta Form seamlessly on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Ifta Form without hassle

- Find Ifta Form and then click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ifta Form to ensure excellent communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta form 66204823

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IFTA form and why is it important for trucking companies?

An IFTA form is a crucial document for trucking companies that participate in the International Fuel Tax Agreement. This form simplifies the reporting of fuel use and taxes collected in various jurisdictions, which helps streamline the compliance process for interstate travel. By accurately completing your IFTA form, you can avoid penalties and ensure smooth operations.

-

How does airSlate SignNow assist with IFTA form submissions?

airSlate SignNow provides a user-friendly platform that allows you to easily fill out and eSign your IFTA form online. Our solution simplifies the submission process, ensuring that you can manage your paperwork efficiently and meet all deadlines without hassle. By using airSlate SignNow, you can save time and reduce the risk of errors in your submissions.

-

What are the features of airSlate SignNow related to IFTA forms?

airSlate SignNow offers several features tailored for IFTA forms, including customizable templates, eSignature capabilities, and real-time tracking. This empowers you to create, send, and manage your IFTA forms seamlessly. Additionally, our platform supports cloud storage, ensuring you can access your essential documents anytime, anywhere.

-

Is there a pricing plan specifically for IFTA form-related services?

Yes, airSlate SignNow offers flexible pricing plans that cater to all businesses, ensuring you have access to the tools you need for handling your IFTA form. We provide scalable solutions that can fit your budget, whether you're a small business or a large fleet operator. You can choose a plan that meets your specific document signing and management needs.

-

Can I collaborate with my team on IFTA forms using airSlate SignNow?

Absolutely! airSlate SignNow enables teams to collaborate seamlessly on IFTA forms. You can invite team members to review, edit, and eSign these documents together, enhancing communication and ensuring everyone is on the same page. This collaborative feature helps to speed up the process and ensures accuracy in your submissions.

-

What integrations does airSlate SignNow offer for managing IFTA forms?

airSlate SignNow seamlessly integrates with various applications, such as accounting software and fleet management systems, to help you manage your IFTA forms and related documents more effectively. These integrations provide you with a holistic approach to managing your business processes associated with fuel tax compliance. Utilizing these tools can streamline operations and reduce administrative burdens.

-

How can I ensure the security of my IFTA forms in airSlate SignNow?

Security is a top priority at airSlate SignNow. All IFTA forms and documents are protected with advanced encryption and secure cloud storage to prevent unauthorized access. Additionally, our platform complies with industry-standard regulations to provide you with the peace of mind you need while managing sensitive information.

Get more for Ifta Form

- Waxie sanitary supply 800 995 4466 www waxie com form

- Checking account simulation activity form

- Dichiarazione sostitutiva atto di notoriet eredi comune di capannori comune capannori lu form

- Dusd student health information form dublin unified school district

- Sample client tanning record dshs state tx form

- Beneficial ownership form pdf

- Property lease agreement template form

- Prorated rent lease agreement template form

Find out other Ifta Form

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word