Traditional Ira Contribution Direction Form 2315 America's Christian

What is the Traditional IRA Contribution Direction form 2315 America's Christian

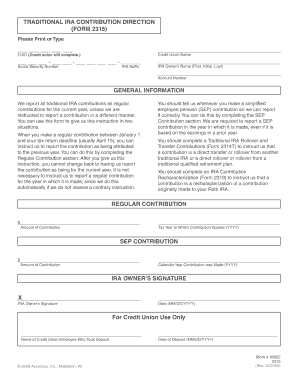

The Traditional IRA Contribution Direction form 2315 America's Christian is a specific document used to facilitate contributions to a Traditional Individual Retirement Account (IRA). This form is essential for individuals who wish to direct their contributions in a manner compliant with both IRS regulations and the guidelines set forth by America's Christian. It serves as a formal request to the financial institution managing the IRA, detailing the amount to be contributed and any specific instructions related to the contribution.

How to use the Traditional IRA Contribution Direction form 2315 America's Christian

To effectively use the Traditional IRA Contribution Direction form 2315 America's Christian, individuals must first obtain the form from a reliable source, such as a financial institution or an official website. Once the form is in hand, users should carefully fill in their personal information, including their account details and the contribution amount. After completing the form, it is crucial to review all entries for accuracy before submitting it to the financial institution, ensuring that all instructions are clear and complete.

Steps to complete the Traditional IRA Contribution Direction form 2315 America's Christian

Completing the Traditional IRA Contribution Direction form 2315 America's Christian involves several straightforward steps:

- Obtain the form: Access the form from your financial institution or an authorized provider.

- Fill in personal information: Include your name, address, and account number.

- Specify the contribution amount: Clearly indicate how much you wish to contribute.

- Provide additional instructions: If applicable, add any specific directions regarding the contribution.

- Review the form: Check all entries for accuracy to avoid any processing delays.

- Submit the form: Send the completed form to your financial institution via the preferred submission method.

Legal use of the Traditional IRA Contribution Direction form 2315 America's Christian

The Traditional IRA Contribution Direction form 2315 America's Christian is legally binding when completed and submitted according to the regulations set by the IRS and the guidelines of America's Christian. To ensure its legal standing, it must be filled out accurately and submitted in a timely manner. Compliance with eSignature laws is also essential if the form is submitted electronically, ensuring that all necessary security and verification measures are in place.

Key elements of the Traditional IRA Contribution Direction form 2315 America's Christian

Several key elements are vital to the Traditional IRA Contribution Direction form 2315 America's Christian:

- Personal Information: Accurate details about the contributor, including name and contact information.

- Account Information: Identification of the IRA account to which the contribution will be made.

- Contribution Amount: The specific dollar amount intended for contribution.

- Signature: The contributor's signature, which verifies the authenticity of the form.

- Date: The date on which the form is completed and submitted.

Eligibility Criteria

To utilize the Traditional IRA Contribution Direction form 2315 America's Christian, individuals must meet certain eligibility criteria. Generally, contributors should be under the age of seventy and a half at the time of contribution and must have earned income that qualifies for IRA contributions. Additionally, it is important to adhere to the annual contribution limits set by the IRS to avoid penalties.

Quick guide on how to complete traditional ira contribution direction form 2315 americaamp39s christian

Complete Traditional Ira Contribution Direction form 2315 America's Christian effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Traditional Ira Contribution Direction form 2315 America's Christian on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Traditional Ira Contribution Direction form 2315 America's Christian with ease

- Find Traditional Ira Contribution Direction form 2315 America's Christian and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Edit and eSign Traditional Ira Contribution Direction form 2315 America's Christian and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the traditional ira contribution direction form 2315 americaamp39s christian

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Traditional Ira Contribution Direction form 2315 America's Christian?

The Traditional Ira Contribution Direction form 2315 America's Christian is a specialized document used to direct contributions to a Traditional IRA. This form ensures that contributions are accurately recorded and compliant with IRS regulations, providing peace of mind for investors.

-

How can I fill out the Traditional Ira Contribution Direction form 2315 America's Christian?

Filling out the Traditional Ira Contribution Direction form 2315 America's Christian is straightforward. Users can either complete the form digitally using our platform or print it out for manual entry. Our user-friendly interface guides you through each step, ensuring all necessary information is correctly inputted.

-

Is there a fee associated with using the Traditional Ira Contribution Direction form 2315 America's Christian?

airSlate SignNow offers competitive pricing for users looking to utilize the Traditional Ira Contribution Direction form 2315 America's Christian. Our cost-effective solution allows you to manage your document signing needs without breaking the bank, with various plans available to suit different budgets.

-

What features does airSlate SignNow offer for managing the Traditional Ira Contribution Direction form 2315 America's Christian?

Our platform provides a range of features for managing the Traditional Ira Contribution Direction form 2315 America's Christian. Users can take advantage of eSignature capabilities, document storage, and real-time collaboration, enhancing efficiency and accuracy in your IRA contributions.

-

Can I integrate airSlate SignNow with other platforms when using the Traditional Ira Contribution Direction form 2315 America's Christian?

Yes, airSlate SignNow seamlessly integrates with various platforms to streamline the use of the Traditional Ira Contribution Direction form 2315 America's Christian. Whether it's accounting software or customer relationship management systems, our integrations help enhance productivity and data accuracy.

-

What are the benefits of using airSlate SignNow for the Traditional Ira Contribution Direction form 2315 America's Christian?

Using airSlate SignNow for the Traditional Ira Contribution Direction form 2315 America's Christian provides numerous benefits. Our solution ensures compliance, enhances security through encrypted signatures, and simplifies the submission process, making it easier for users to manage their IRA contributions effectively.

-

Is my information safe when using the Traditional Ira Contribution Direction form 2315 America's Christian?

Absolutely! airSlate SignNow prioritizes user security, employing industry-leading protection for the Traditional Ira Contribution Direction form 2315 America's Christian. Your personal and financial information is safeguarded through advanced encryption, ensuring that your data remains confidential throughout the process.

Get more for Traditional Ira Contribution Direction form 2315 America's Christian

- Anamnese google forms

- Mize fastpitch diamonds tryout information sheet

- Waiver release of liability amp form

- Umsatzbruttonsbruttoinkommenns ersatz brutto20 form

- Effects of forward head posture on static and dynamic balance control form

- Loan request form v322 2 forms

- Loan guide and application forms

- Whats dig how to become a dig member form

Find out other Traditional Ira Contribution Direction form 2315 America's Christian

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free