Tax Invoice Receipt Form

What is the Tax Invoice Receipt

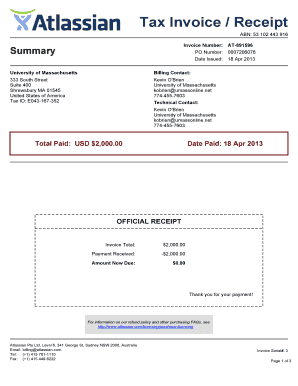

A tax invoice receipt is a formal document that outlines the details of a transaction between a buyer and a seller. It serves as proof of purchase and includes important information such as the seller's name, address, and tax identification number, as well as the buyer's information, itemized list of goods or services, and applicable tax rates. This document is crucial for both parties, as it helps the buyer keep track of expenses and enables the seller to report income accurately for tax purposes.

Key elements of the Tax Invoice Receipt

To be considered valid, a tax invoice receipt must contain specific elements. These include:

- Seller's Information: Name, address, and tax identification number.

- Buyer's Information: Name and address of the purchaser.

- Date of Transaction: The date when the sale occurred.

- Description of Goods or Services: A detailed list of what was purchased.

- Tax Amount: The total amount of tax charged on the sale.

- Total Amount Due: The total cost including the price of goods or services and taxes.

How to use the Tax Invoice Receipt

The tax invoice receipt is used in various ways by both buyers and sellers. Buyers can use it for record-keeping and to claim tax deductions where applicable. Sellers utilize the receipt to maintain accurate financial records and ensure compliance with tax regulations. When filing taxes, both parties can refer to these receipts to substantiate their claims and report income or expenses accurately.

Steps to complete the Tax Invoice Receipt

Completing a tax invoice receipt involves several steps:

- Gather necessary information, including both parties' details.

- List the goods or services provided, including descriptions and quantities.

- Calculate the applicable tax based on the total sale amount.

- Fill in the total amount due, ensuring all calculations are accurate.

- Review the document for completeness and accuracy before issuing it.

Legal use of the Tax Invoice Receipt

The tax invoice receipt is a legally recognized document in the United States, provided it meets specific criteria. It serves as evidence of a transaction and can be used in disputes or audits. Both buyers and sellers must retain these receipts for a certain period, typically three to seven years, depending on state regulations. Compliance with tax laws is essential, and proper documentation helps avoid penalties.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines on how to handle tax invoice receipts. It is essential to keep these documents organized and accessible for tax filing purposes. The IRS recommends that taxpayers maintain records of all receipts related to income and expenses to ensure accurate reporting. This practice not only aids in tax preparation but also helps in case of an audit.

Quick guide on how to complete tax invoice receipt

Complete Tax Invoice Receipt effortlessly on any device

Managing documents online has gained signNow popularity among organizations and individuals. It offers an ideal environmentally friendly replacement for conventional printed and signed forms, allowing you to access the necessary template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Tax Invoice Receipt on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related activity today.

How to modify and electronically sign Tax Invoice Receipt with ease

- Obtain Tax Invoice Receipt and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tax Invoice Receipt and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax invoice receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax invoice meaning?

The tax invoice meaning refers to a document that outlines the details of a transaction where goods or services are provided, including the tax amount charged. It is important for both businesses and customers as it serves as proof of purchase and is required for claiming tax deductions.

-

How can airSlate SignNow help with tax invoices?

airSlate SignNow allows businesses to easily create, send, and eSign tax invoices electronically. This streamlines the invoicing process, ensuring that your tax documents are accurate and compliant, which is crucial for understanding the tax invoice meaning in your financial records.

-

Is there a cost associated with using airSlate SignNow for tax invoices?

Yes, while airSlate SignNow offers a variety of pricing plans, it's designed to be cost-effective for businesses of all sizes. Understanding the tax invoice meaning and utilizing our eSigning features can lead to signNow savings in time and resources compared to traditional invoicing methods.

-

What features does airSlate SignNow offer for managing tax invoices?

airSlate SignNow includes features like customizable templates, automated reminders, and secure cloud storage for your tax invoices. These features enhance the accuracy and efficiency of your invoicing process, making it easier to understand the tax invoice meaning and its implications for your business.

-

Can I integrate airSlate SignNow with other accounting software for tax invoice management?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your tax invoices effectively. This integration ensures you have all relevant financial data at your fingertips, enhancing your understanding of the tax invoice meaning in your overall financial strategy.

-

Are there benefits of using airSlate SignNow for eSigning tax invoices?

Using airSlate SignNow for eSigning tax invoices offers numerous benefits, including quicker turnaround times and reduced paperwork. By embracing digital signatures, businesses can enhance efficiency while ensuring that the tax invoice meaning is properly captured in a secure manner.

-

How does airSlate SignNow ensure the security of my tax invoices?

airSlate SignNow employs advanced encryption and security measures to protect your tax invoices from unauthorized access. Understanding the tax invoice meaning also involves ensuring the integrity of these documents, and our security protocols help guarantee that your sensitive information is safeguarded.

Get more for Tax Invoice Receipt

Find out other Tax Invoice Receipt

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed