Form 8865

What is the Form 8865

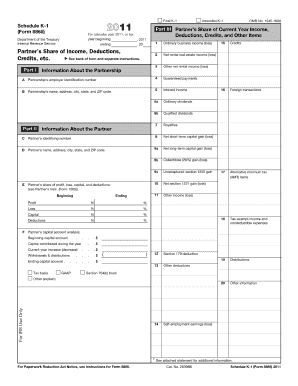

The Form 8865 is a tax form used by U.S. taxpayers who are partners in a foreign partnership. It is essential for reporting information regarding the partnership's income, deductions, and credits. This form is particularly relevant for individuals and entities that have a significant interest in foreign partnerships, ensuring compliance with U.S. tax regulations. By accurately completing Form 8865, taxpayers can avoid potential penalties and maintain transparency with the IRS regarding their foreign investments.

How to use the Form 8865

Using Form 8865 involves several steps to ensure accurate reporting of partnership information. Taxpayers must first determine their filing requirement based on their level of involvement with the foreign partnership. Once this is established, they can gather necessary financial information, including income, expenses, and ownership percentages. The form must be filled out carefully, providing detailed information about the partnership's activities and financials. After completing the form, it should be submitted alongside the taxpayer's annual tax return to the IRS.

Steps to complete the Form 8865

Completing Form 8865 requires attention to detail and a systematic approach. Here are the essential steps:

- Determine your filing requirement based on your ownership interest in the foreign partnership.

- Gather financial statements and relevant documents from the partnership.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- File the form with your tax return by the due date.

Legal use of the Form 8865

Form 8865 serves a critical legal purpose in the U.S. tax system. It ensures that taxpayers report their foreign partnership interests, which is essential for compliance with U.S. tax laws. The form must be filed accurately to avoid penalties associated with non-compliance. Legal use of Form 8865 includes understanding the implications of foreign partnerships and adhering to IRS guidelines. Failure to file or incorrect reporting can lead to significant financial consequences.

Filing Deadlines / Important Dates

Timely filing of Form 8865 is crucial to avoid penalties. The form is generally due on the same date as the taxpayer's annual tax return, including extensions. For most taxpayers, this means the form must be filed by April 15. However, if an extension is filed, the deadline may be extended to October 15. It is important to keep track of these dates to ensure compliance and avoid unnecessary penalties.

Required Documents

To complete Form 8865 accurately, several documents are necessary. Taxpayers should gather:

- Financial statements from the foreign partnership.

- Documentation of ownership interest and contributions.

- Records of income, deductions, and credits related to the partnership.

- Any prior year Form 8865 submissions for reference.

Having these documents on hand will facilitate a smoother completion process and ensure all necessary information is reported.

Quick guide on how to complete form 8865

Accomplish Form 8865 seamlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Form 8865 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 8865 with ease

- Obtain Form 8865 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, or invitation link—or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and eSign Form 8865 to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8865

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8865 and why do I need it?

Form 8865 is a tax form required for certain U.S. persons with interests in foreign partnerships. It's essential for reporting your share of the income, deductions, and credits from these partnerships. Completing Form 8865 accurately is crucial for compliance, avoiding penalties, and ensuring that you can take advantage of benefits associated with your foreign investment.

-

How does airSlate SignNow facilitate the eSigning of Form 8865?

airSlate SignNow offers a straightforward platform for electronically signing Form 8865, making the process efficient and hassle-free. Users can upload their documents, add signatures, and send them securely without any need for printing or mailing. This not only saves time but also enhances the security of your sensitive tax documents.

-

What features does airSlate SignNow provide for managing Form 8865?

airSlate SignNow provides robust features such as customizable templates, reusable workflows, and automated reminders that simplify handling Form 8865. Users can easily track document status and ensure timely submissions. These features help streamline the completion and signing of Form 8865, making tax season less stressful.

-

Is airSlate SignNow cost-effective for filing Form 8865?

Yes, airSlate SignNow is a cost-effective solution for filing Form 8865 as it eliminates the need for costly printing and mailing. By providing an affordable subscription model, users can save money while enjoying a feature-rich platform. This value ensures that businesses can manage their tax forms efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Form 8865 management?

Absolutely, airSlate SignNow integrates seamlessly with various software applications, such as accounting and tax software, to enhance the management of Form 8865. These integrations facilitate data sharing and improve workflow efficiency. By connecting airSlate SignNow with your existing tools, you can simplify the entire process of preparing and submitting Form 8865.

-

What benefits does airSlate SignNow offer for businesses handling Form 8865?

Using airSlate SignNow for Form 8865 provides numerous benefits including increased efficiency, reduced errors, and enhanced document security. Businesses can ensure compliance with IRS requirements while saving time through automated workflows. The platform's ease of use means that both finance teams and individuals can confidently manage their Form 8865 without extensive training.

-

How secure is the airSlate SignNow platform for signing Form 8865?

The airSlate SignNow platform prioritizes security with advanced encryption and secure cloud storage, ensuring that your Form 8865 and other sensitive documents are protected. User authentication processes further enhance security, making it safe to eSign and share your tax forms. This commitment to security provides peace of mind for users concerned about their financial information.

Get more for Form 8865

- Community service timesheet pdf form

- Recliners for recovery program application information

- Leslie patient intake form

- Quotnf 57 03 01 3 15 diving incident reportquot noaa form 57 03 01

- Cd 224 form

- Inpatient referral assessment form

- Old english game bantam club of america form

- Anew health care services notice of privacy practices form

Find out other Form 8865

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed