Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny

What is the MT Tax Return?

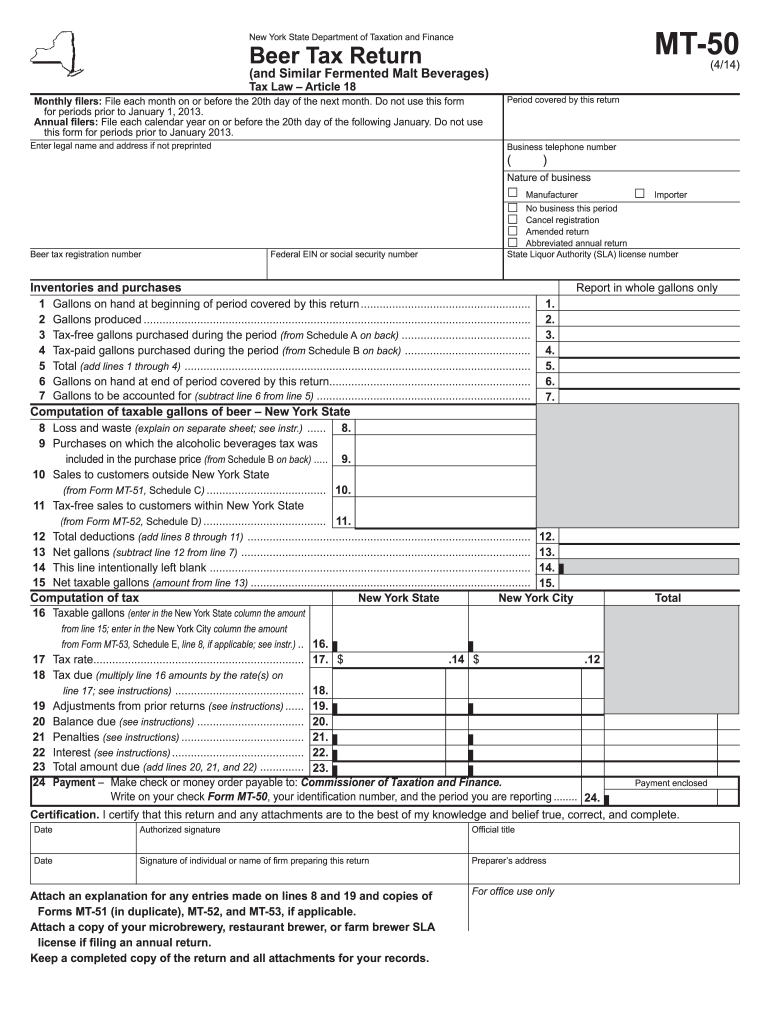

The MT tax return is a specific form used for reporting and paying taxes related to the production and sale of malt beverages in the state of Montana. This form, often referred to as the MT 50414, is essential for businesses involved in brewing, distributing, or selling beer and similar fermented malt beverages. It ensures compliance with state tax regulations and helps maintain accurate records of tax obligations.

How to Use the MT Tax Return

To use the MT tax return effectively, businesses must first gather all necessary financial data related to their malt beverage sales. This includes production volumes, sales figures, and any applicable deductions. Once the data is compiled, the form can be filled out electronically or on paper. It is crucial to ensure that all information is accurate and complete to avoid potential penalties or delays in processing.

Steps to Complete the MT Tax Return

Completing the MT tax return involves several key steps:

- Gather financial records, including sales and production data.

- Access the MT tax return form, either online or in paper format.

- Fill out the form with accurate information, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the MT tax return. Typically, these deadlines align with quarterly tax periods. Businesses should mark their calendars for the end of each quarter to ensure timely submission. Late filings may incur penalties, so staying informed about these dates is crucial for compliance.

Penalties for Non-Compliance

Failure to file the MT tax return on time or providing inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal repercussions. Businesses are encouraged to maintain accurate records and submit their forms promptly to avoid these consequences.

Digital vs. Paper Version

Both digital and paper versions of the MT tax return are available, but using the digital format offers several advantages. Electronic submissions can be processed more quickly, reducing the risk of delays. Additionally, digital tools often provide features such as automatic calculations and secure storage, enhancing the overall efficiency of the filing process.

Who Issues the MT Tax Return?

The MT tax return is issued by the Montana Department of Revenue. This state agency oversees tax collection and compliance for various types of taxes, including those related to malt beverages. Businesses should ensure they are using the most current version of the form as provided by the department to comply with state regulations.

Quick guide on how to complete form mt 50414 beer tax return and similar fermented malt tax ny

Effortlessly Prepare Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny with Ease

- Find Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all details and click on the Done button to finalize your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, the hassle of searching for forms, or the need to print new copies due to errors. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 50414 beer tax return and similar fermented malt tax ny

How to generate an electronic signature for the Form Mt 50414 Beer Tax Return And Similar Fermented Malt Tax Ny in the online mode

How to make an eSignature for the Form Mt 50414 Beer Tax Return And Similar Fermented Malt Tax Ny in Chrome

How to generate an eSignature for putting it on the Form Mt 50414 Beer Tax Return And Similar Fermented Malt Tax Ny in Gmail

How to generate an eSignature for the Form Mt 50414 Beer Tax Return And Similar Fermented Malt Tax Ny from your mobile device

How to generate an electronic signature for the Form Mt 50414 Beer Tax Return And Similar Fermented Malt Tax Ny on iOS

How to generate an eSignature for the Form Mt 50414 Beer Tax Return And Similar Fermented Malt Tax Ny on Android

People also ask

-

What is Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY?

Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY is a tax form used by businesses in New York to report and pay taxes on the production and sale of beer and other fermented malt beverages. This form ensures compliance with state tax regulations and helps breweries accurately calculate their tax obligations.

-

How can airSlate SignNow help with Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY?

airSlate SignNow streamlines the process of completing and submitting Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY by offering easy-to-use eSignature tools. This allows businesses to gather necessary signatures quickly, ensuring timely submission and compliance with state requirements.

-

What are the pricing options for using airSlate SignNow for Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. Whether you're a small brewery or a larger enterprise, you can choose a plan that best fits your needs, making it a cost-effective solution for managing Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY.

-

Is airSlate SignNow secure for filing Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY?

Yes, airSlate SignNow prioritizes the security of your documents. With advanced encryption and compliance with industry standards, you can confidently use our platform to handle sensitive information related to Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY.

-

Can I integrate airSlate SignNow with other software for Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing for efficient data transfer and document management. This means you can easily incorporate your tax data and streamline your workflow related to Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY.

-

What features does airSlate SignNow offer for completing Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY?

airSlate SignNow provides a range of features, including customizable templates, reusable fields, and automated workflows. These tools simplify the completion of Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY, ensuring accuracy and compliance.

-

How can I track the status of my Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your documents in real-time. This feature allows you to see when your Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax NY is viewed, signed, and completed, providing peace of mind throughout the submission process.

Get more for Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny

- Consent cum declaration form

- The psychology of achievement pdf form

- Lampiran c form

- Fund transfer request form mtb securities ltd

- Emotional sobriety worksheets pdf form

- Form 2125 home and community based service hcs texas home living txhml and community first choice cfc implementation plan form

- Report of case and patient services date form sent to hsr phr

- Eci respite funding agreement darsstatetxus form

Find out other Form MT 50414 Beer Tax Return and Similar Fermented Malt Tax Ny

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement