Sample 1099 Letter to Vendors Form

Understanding the Sample 1099 Letter to Vendors

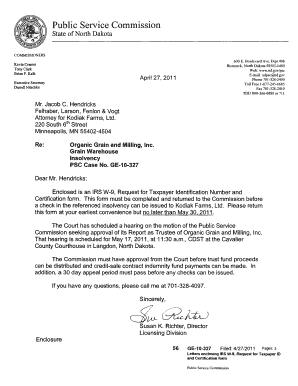

The Sample 1099 letter to vendors serves as a formal request for a W-9 form, which is essential for reporting income paid to independent contractors and vendors. This letter outlines the need for the vendor to provide their taxpayer identification number (TIN) to ensure compliance with IRS regulations. It typically includes details such as the requesting business's name, address, and contact information, along with a clear explanation of why the W-9 is necessary. By using this sample letter, businesses can streamline the process of collecting necessary tax information from their vendors.

Steps to Complete the Sample 1099 Letter to Vendors

Completing the Sample 1099 letter involves several straightforward steps. First, personalize the letter by including your business name and address at the top. Next, address the letter to the vendor, using their correct name and address. In the body, clearly state the purpose of the letter, emphasizing the need for the W-9 form to comply with IRS reporting requirements. Finally, provide a deadline for submission and include your contact information for any questions. Ensure that the letter is signed and dated before sending it to the vendor.

Key Elements of the Sample 1099 Letter to Vendors

A well-structured Sample 1099 letter to vendors should contain several key elements. These include:

- Sender Information: Your business name, address, and contact details.

- Recipient Information: The vendor's name and address.

- Subject Line: A clear subject indicating the purpose of the letter.

- Body: A concise explanation of why the W-9 form is needed.

- Deadline: A specific date by which the vendor should respond.

- Signature: Your name and title, along with the date of the letter.

Legal Use of the Sample 1099 Letter to Vendors

The Sample 1099 letter to vendors is legally significant as it establishes a formal request for necessary tax documentation. By obtaining a completed W-9 form, businesses ensure they can accurately report payments made to vendors, thereby complying with IRS regulations. This letter also serves as a record of the request, which can be important in the event of an audit. It is advisable to retain copies of all correspondence related to the W-9 request for future reference.

IRS Guidelines for the Sample 1099 Letter to Vendors

According to IRS guidelines, businesses are required to issue a Form 1099 to report payments made to independent contractors and certain vendors. The Sample 1099 letter to vendors is a crucial first step in this process, as it prompts vendors to provide their W-9 information. The IRS mandates that businesses collect this information to avoid penalties for non-compliance. It is important to follow the guidelines closely to ensure that all necessary information is gathered and reported accurately.

Examples of Using the Sample 1099 Letter to Vendors

There are various scenarios in which a Sample 1099 letter to vendors may be used. For instance, a graphic design firm hiring freelance designers would send this letter to request W-9 forms from each contractor. Similarly, a small business engaging a consultant for services would need to issue this letter to comply with tax reporting requirements. Each example highlights the importance of obtaining accurate tax information from vendors to ensure proper reporting and compliance.

Quick guide on how to complete sample 1099 letter to vendors

Prepare Sample 1099 Letter To Vendors effortlessly on any device

Digital document organization has gained immense traction among businesses and individuals alike. It serves as a perfect eco-friendly substitute for conventional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the features you need to generate, modify, and electronically sign your documents swiftly without any holdups. Manage Sample 1099 Letter To Vendors on any device using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

How to modify and electronically sign Sample 1099 Letter To Vendors with ease

- Obtain Sample 1099 Letter To Vendors and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Sample 1099 Letter To Vendors to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample 1099 letter to vendors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample 1099 letter to vendors?

A sample 1099 letter to vendors is a template used to inform vendors about their payment details and tax obligations. This letter typically outlines the total payments made throughout the year and helps vendors prepare for their tax filings. Utilizing a sample 1099 letter can streamline your communication and ensure compliance.

-

How can I create a sample 1099 letter to vendors using airSlate SignNow?

Creating a sample 1099 letter to vendors using airSlate SignNow is straightforward. You can start by selecting a template from our library or customizing your own. Our platform allows you to easily add necessary details and send documents for eSignature without any hassle.

-

What are the benefits of using airSlate SignNow for 1099 letters?

Using airSlate SignNow for your sample 1099 letters to vendors offers numerous benefits, including increased efficiency and compliance. You can quickly send, sign, and store your documents securely, reducing the risk of errors. This ensures your vendors receive accurate information to meet their tax obligations.

-

Is airSlate SignNow cost-effective for sending 1099 letters?

Yes, airSlate SignNow is a cost-effective solution for sending sample 1099 letters to vendors. Our pricing plans are designed to fit various business sizes and needs, allowing you to manage document workflows without overspending. You enjoy the benefits of electronic signatures and secure document management at a competitive price.

-

Can I integrate airSlate SignNow with other platforms for 1099 letter management?

Absolutely! airSlate SignNow offers seamless integrations with various software, allowing you to manage your sample 1099 letters to vendors efficiently. Whether you use accounting software or customer relationship management (CRM) tools, our platform easily connects to enhance your workflow.

-

What features does airSlate SignNow offer for managing 1099 letters?

airSlate SignNow provides several features that are particularly useful for managing your sample 1099 letters to vendors. These include customizable templates, secure eSignature capabilities, and automated reminders. Additionally, our platform tracks document status, ensuring you never miss a deadline.

-

How do I ensure compliance when using a sample 1099 letter to vendors?

To ensure compliance when using a sample 1099 letter to vendors, it's essential to include all necessary information required by the IRS. airSlate SignNow can help you create compliant documents easily. Additionally, you can consult with a tax professional to ensure all details are in order before sending.

Get more for Sample 1099 Letter To Vendors

- Rp13 form

- Application form for a soccer player

- Privacy consent form for business owners

- Application for refund of tax paid on undyed diesel form

- How do i generate a ma form 1 nrpy for nonresident

- Form 1099 int rev january interest income

- What is irs form 8868tax extension

- Reporting agent authorization instructions this form must

Find out other Sample 1099 Letter To Vendors

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer