T1013 Form

What is the T1013?

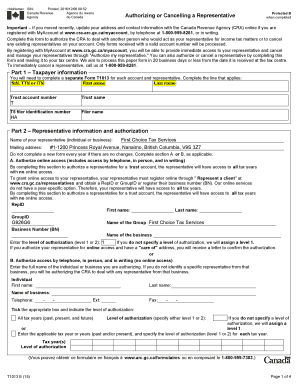

The T1013 form, officially known as the "Authorizing or Revoking a Representative," is a crucial document used by taxpayers in the United States to authorize someone to represent them before the Internal Revenue Service (IRS). This form allows individuals to designate a representative, such as a tax professional or attorney, to handle their tax matters, including discussions about tax returns, audits, and other IRS-related issues. By submitting the T1013 form, taxpayers can ensure that their chosen representative has the authority to act on their behalf, facilitating smoother communication with the IRS.

How to Obtain the T1013

Obtaining the T1013 form is straightforward. Taxpayers can download the T1013 form PDF directly from the IRS website or other official tax resources. It is essential to ensure that you are using the most current version of the form to avoid any compliance issues. Additionally, the form may be available at local IRS offices or through tax preparation services. Once you have the form, you can begin the process of filling it out to authorize your representative.

Steps to Complete the T1013

Completing the T1013 form involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Provide details about the representative you are authorizing, including their name, address, and phone number.

- Indicate the specific tax matters for which the representative is authorized to act. This can include income tax, employment tax, or other specific issues.

- Sign and date the form to validate your authorization.

Once completed, you can submit the form to the IRS, ensuring that your representative can effectively manage your tax affairs.

Legal Use of the T1013

The T1013 form is legally binding once it is properly filled out and submitted to the IRS. It complies with IRS regulations concerning taxpayer representation. To ensure its legal validity, it is crucial to provide accurate information and to sign the form. The IRS recognizes electronic signatures, provided they meet specific requirements, making it easier for taxpayers to submit the form digitally. This legal framework helps protect both the taxpayer's rights and the representative's authority to act on their behalf.

Form Submission Methods

Taxpayers can submit the T1013 form through various methods, including:

- Online Submission: If using an e-filing service, the T1013 can often be submitted electronically.

- Mail: Print the completed form and send it to the appropriate IRS address based on your location and the nature of your tax matters.

- In-Person: Deliver the form directly to your local IRS office, where you can also seek assistance if needed.

Choosing the right submission method can help ensure that your form is processed in a timely manner.

Key Elements of the T1013

Understanding the key elements of the T1013 form is essential for effective use. The form includes:

- Taxpayer Information: Essential details about the taxpayer, including identification numbers.

- Representative Information: Contact details for the individual authorized to represent the taxpayer.

- Tax Matters: Specific issues or tax years for which the representative is authorized to act.

- Signature: The taxpayer's signature is required to validate the authorization.

Each of these elements plays a critical role in ensuring that the form is accepted by the IRS and that the representative can act on behalf of the taxpayer.

Quick guide on how to complete t1013 396035279

Complete T1013 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and electronically sign your documents quickly and without delays. Manage T1013 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign T1013 with ease

- Locate T1013 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form: by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign T1013 and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1013 396035279

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t1013 form pdf, and why is it important?

The t1013 form pdf is a legal document used in Canada to authorize someone to manage your tax affairs with the Canada Revenue Agency (CRA). It is crucial for ensuring that a designated representative has the authority to handle your tax matters, making it an essential part of financial management.

-

How can I obtain a t1013 form pdf?

You can easily access the t1013 form pdf on the official Canada Revenue Agency website or through financial service providers. Once downloaded, fill it out with the required information and submit it according to CRA guidelines for proper processing.

-

Can airSlate SignNow help me with signing a t1013 form pdf?

Yes, airSlate SignNow makes it simple to sign and send your t1013 form pdf electronically. With our user-friendly interface, you can quickly upload your completed form, add your signature, and send it securely for efficient processing.

-

Is there a cost associated with using airSlate SignNow for the t1013 form pdf?

airSlate SignNow offers a range of pricing plans that cater to different business needs, including options for single users or teams. You can access essential features for managing your t1013 form pdf at an affordable rate, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing the t1013 form pdf?

airSlate SignNow provides a variety of features designed to streamline document management, such as electronic signatures, templates for the t1013 form pdf, real-time tracking, and secure cloud storage. These tools enhance productivity and ensure that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other tools I use for the t1013 form pdf?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage services and CRM systems. This makes it easier to manage your t1013 form pdf alongside other business processes without any disruption.

-

What are the benefits of using airSlate SignNow for my t1013 form pdf?

Using airSlate SignNow for your t1013 form pdf offers numerous benefits, including faster turnaround times, enhanced security features, and reduced paperwork. This not only saves you time but also minimizes the risk of errors, ensuring that your tax authorizations are processed smoothly.

Get more for T1013

- Out of state nurse aide application to become illinois department form

- Dd adult foster care residency agreement for private pay individuals handwritten version 2 oregon form

- Form for insfraction

- Enrollment form unitedhealthcareonline com

- Irving 24 card form

- Akc herding regulations form

- 86022ikmoodustamisemaaruselisa1oo markustegafinal form

- Republic of the union of myanmar individuals income tax return ird form

Find out other T1013

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free