How to Read a Reverse Mortgage Statement Form

Understanding a Reverse Mortgage Statement

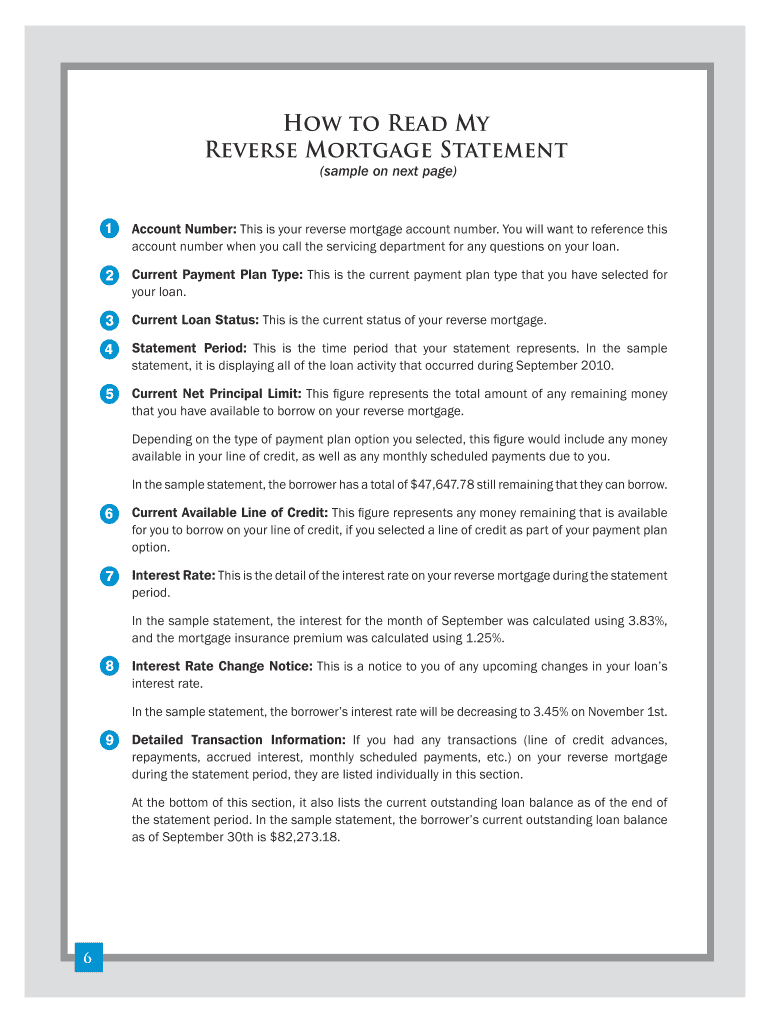

A reverse mortgage statement provides vital information about the status of your reverse mortgage loan. It typically includes details such as the loan balance, interest accrued, and any fees associated with the loan. Understanding this statement is crucial for managing your finances effectively, especially if you are considering repayment options or planning for future expenses. Key components of the statement include the principal limit, which indicates the maximum amount you can borrow, and the current balance, which shows how much you owe at that moment.

Key Elements of a Reverse Mortgage Statement

When reviewing a reverse mortgage statement, focus on several key elements:

- Loan Balance: This is the total amount owed on the reverse mortgage, including principal and interest.

- Interest Rate: The statement will specify the interest rate applied to the outstanding balance.

- Monthly Accrual: This indicates how much interest is added to the loan balance each month.

- Fees: Look for any fees charged, such as servicing fees or mortgage insurance premiums.

- Principal Limit: This shows the maximum amount you can borrow against your home.

Steps to Read a Reverse Mortgage Statement

To effectively read a reverse mortgage statement, follow these steps:

- Locate the loan balance section to understand your current debt.

- Check the interest rate to see how it affects your loan over time.

- Review the monthly accrual to gauge how quickly your debt is increasing.

- Identify any fees that may impact your overall financial situation.

- Understand your principal limit to know your borrowing capacity.

Legal Use of a Reverse Mortgage Statement

A reverse mortgage statement serves as an official document that outlines the terms and conditions of your loan. It is important for legal purposes, as it provides proof of the loan's status and details any obligations you have. When dealing with financial institutions or legal entities, having a clear understanding of your reverse mortgage statement can help ensure compliance with any legal requirements related to your mortgage.

Obtaining a Reverse Mortgage Statement

To obtain your reverse mortgage statement, contact your loan servicer directly. Most servicers provide statements on a monthly basis, either through mail or electronically. If you prefer digital access, inquire about online account management options, which may allow you to view and download your statements at any time. Ensure that your contact information is up to date to receive timely notifications regarding your mortgage.

Examples of Reverse Mortgage Statements

Reviewing examples of reverse mortgage statements can help you become familiar with the format and information presented. Look for sample statements that illustrate various scenarios, such as changes in interest rates or adjustments in fees. Understanding these examples can enhance your ability to interpret your own statement accurately and make informed decisions regarding your mortgage.

Quick guide on how to complete how to read a reverse mortgage statement

Effortlessly Prepare How To Read A Reverse Mortgage Statement on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage How To Read A Reverse Mortgage Statement on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign How To Read A Reverse Mortgage Statement

- Find How To Read A Reverse Mortgage Statement and click Get Form to begin.

- Utilize the available tools to complete your document.

- Mark relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, either via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign How To Read A Reverse Mortgage Statement to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to read a reverse mortgage statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a reverse mortgage statement?

A reverse mortgage statement is a document that provides key information about your reverse mortgage loan, including the balance, interest accrued, and available credit. Understanding how to read a reverse mortgage statement is essential for managing your finances effectively and ensuring accuracy.

-

Why is it important to know how to read a reverse mortgage statement?

Knowing how to read a reverse mortgage statement helps you track your loan balance and any fees associated with it. This knowledge enables you to make informed decisions about your financial future and avoid potential pitfalls associated with reverse mortgages.

-

What key elements should I look for when learning how to read a reverse mortgage statement?

When learning how to read a reverse mortgage statement, focus on elements such as the loan balance, interest rate, and any fees. Additionally, pay attention to the disbursement amounts and payment due dates, as these factors directly impact your financial planning.

-

Are there any tools to help me understand how to read a reverse mortgage statement?

Yes, airSlate SignNow offers resources that simplify the process of understanding how to read a reverse mortgage statement. Combining user-friendly guides and tools can help ensure you grasp the important details of your reverse mortgage, making it easier to manage your documentation.

-

How can airSlate SignNow assist me with reverse mortgage documents?

airSlate SignNow empowers you to manage your reverse mortgage documents effectively by providing an easy-to-use platform for eSigning and sending important paperwork securely. You'll be equipped to handle your financial documentation, helping you understand how to read a reverse mortgage statement and maintain clarity.

-

Is there a cost associated with using airSlate SignNow for reverse mortgage statements?

Yes, there is a cost associated with using airSlate SignNow, but it is an affordable solution compared to traditional methods. The plan you choose will depend on your specific needs, allowing you to manage and understand how to read a reverse mortgage statement without breaking the bank.

-

Can I integrate airSlate SignNow with other financial tools?

Absolutely! airSlate SignNow can integrate with various financial tools, making it easier to manage all your documents in one place. This integration can assist in your efforts to understand how to read a reverse mortgage statement by streamlining your documentation process.

Get more for How To Read A Reverse Mortgage Statement

- Sutter care at home timberlake respiratory care ampamp home medical equipment order form sutter care at home timberlake

- Elder or dependent adult restraining order form

- Cancellation notice contract template form

- Index of wp contentuploads04 solano county superior court form

- Sh 032 declaration regarding notice and service of ex parte application for order shortening time for hearing on motion to form

- Electrical permit application 765984917 form

- About continuum of care prince william county government form

- Continuum of care coc builds nofo final pro rata need form

Find out other How To Read A Reverse Mortgage Statement

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors