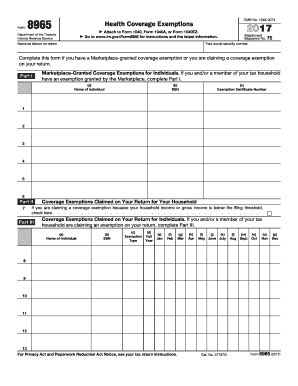

Irs Form

What is the IRS?

The Internal Revenue Service (IRS) is the federal agency responsible for administering and enforcing the internal revenue laws of the United States. It oversees the collection of taxes, processing of tax returns, and enforcement of tax regulations. The IRS plays a crucial role in ensuring compliance with tax obligations, providing guidance to taxpayers, and managing various tax-related programs. Understanding the IRS is essential for individuals and businesses to navigate their tax responsibilities effectively.

How to Use the IRS

Using the IRS effectively involves understanding its various functions and resources. Taxpayers can access a wealth of information on the IRS website, including tax forms, instructions, and guidelines for filing returns. The IRS also provides tools for checking the status of refunds, making payments, and understanding tax credits and deductions. Familiarity with IRS resources can help individuals and businesses make informed decisions regarding their tax situations.

Steps to Complete the IRS Form

Completing an IRS form requires careful attention to detail and adherence to guidelines. Here are the general steps to follow:

- Identify the correct form needed for your tax situation, such as the 1040 for individual income tax.

- Gather all necessary documentation, including W-2s, 1099s, and receipts for deductions.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the IRS e-file system or by mailing it to the appropriate address.

Legal Use of the IRS

Legal use of the IRS involves complying with federal tax laws and regulations. Taxpayers must ensure that they file their returns accurately and on time to avoid penalties. Understanding the legal implications of tax obligations is essential for maintaining compliance. The IRS provides resources and guidance on legal requirements, including information on audits, appeals, and taxpayer rights.

Filing Deadlines / Important Dates

Filing deadlines are critical for taxpayers to avoid penalties and interest. The primary deadline for individual income tax returns is typically April 15 each year. However, extensions may be available under specific circumstances. It is important to stay informed about important dates, such as the start of the tax season, deadlines for estimated tax payments, and the due dates for various forms. Marking these dates on a calendar can help ensure timely compliance.

Required Documents

When preparing to file taxes, certain documents are essential. Typical required documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Records of any tax credits claimed

- Previous year’s tax return for reference

Having these documents organized can streamline the filing process and reduce the risk of errors.

Quick guide on how to complete irs 100636358

Easily Prepare Irs on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Manage Irs on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Edit and eSign Irs Effortlessly

- Obtain Irs and select Get Form to begin.

- Leverage the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, cumbersome form navigation, or errors that necessitate reprinting copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs 100636358

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Irs?

airSlate SignNow is a reliable eSignature solution that simplifies the process of sending and signing documents. With its integration capabilities, businesses can easily comply with Irs requirements, ensuring that their documents are legally binding and secure.

-

How does airSlate SignNow help with Irs compliance?

Using airSlate SignNow ensures that your eSigned documents meet the Irs standards for electronic signatures. Our solution provides audit trails and secure storage, making it easier to maintain compliance with all relevant Irs regulations.

-

What are the pricing plans for airSlate SignNow and can they accommodate Irs needs?

AirSlate SignNow offers flexible pricing plans that cater to various business sizes, ensuring affordability while meeting Irs documentation needs. Each plan includes essential features for eSigning, document tracking, and compliance, making it an effective solution for businesses.

-

Can airSlate SignNow integrate with other software to assist with Irs documentation?

Yes, airSlate SignNow integrates seamlessly with popular applications like Google Drive, Salesforce, and Zapier, which can streamline the process of preparing documents for the Irs. These integrations enhance productivity and ensure a cohesive workflow.

-

What features make airSlate SignNow stand out for Irs-related documents?

AirSlate SignNow features user-friendly templates, customizable workflows, and comprehensive analytics capabilities, helping businesses create and manage Irs-related documents efficiently. These tools enable better organization and faster processing of necessary paperwork.

-

Is airSlate SignNow secure for sending Irs forms?

Absolutely! airSlate SignNow employs state-of-the-art encryption and security measures to ensure your Irs forms are protected. Our platform safeguards sensitive information, allowing businesses to send documents with confidence.

-

How quick is the turnaround time for Irs document signing with airSlate SignNow?

Using airSlate SignNow can signNowly reduce the turnaround time for getting your Irs documents signed. With real-time notifications and eSigning capabilities, you can have your documents completed in minutes rather than days.

Get more for Irs

- Standard for small unmanned aircraft systems suas used form

- Medication order form catawba county catawbacountync

- Grant utilities fill and sign printable template online form

- Rescue program information sheet oxbow animal health

- Automatic withdrawal aw authorization form

- Godparents permission form aganaarch

- Guam board of accountancy addressname change form guamboa

- Oyster bay planning ampamp development oyster bay opening form

Find out other Irs

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer