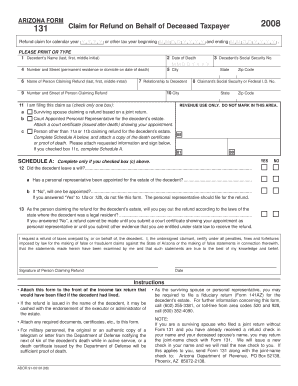

Arizona Form 131 Arizona Department of Revenue

What is the Arizona Form 131 Arizona Department Of Revenue

The Arizona Form 131 is a crucial document issued by the Arizona Department of Revenue. This form is primarily used for requesting a refund of overpaid taxes or to claim a credit for taxes that were previously paid. It is essential for taxpayers who believe they have overpaid their state taxes or are eligible for certain tax credits. Understanding the purpose of this form helps ensure that taxpayers can accurately assess their tax situations and take the necessary steps to rectify any discrepancies.

How to use the Arizona Form 131 Arizona Department Of Revenue

Using the Arizona Form 131 involves several steps to ensure proper completion and submission. Taxpayers should start by gathering all necessary documentation related to their previous tax payments. This includes copies of tax returns and any supporting documents that substantiate the claim for a refund or credit. Once the form is filled out, it should be double-checked for accuracy before submission. It is advisable to keep a copy of the completed form and any correspondence with the Arizona Department of Revenue for personal records.

Steps to complete the Arizona Form 131 Arizona Department Of Revenue

Completing the Arizona Form 131 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Arizona Form 131 from the Arizona Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are requesting a refund or credit.

- Provide details about the overpayment or credit claim, including amounts and relevant tax forms.

- Sign and date the form to certify that the information provided is accurate.

After completing these steps, the form can be submitted via the preferred method outlined by the Arizona Department of Revenue.

Legal use of the Arizona Form 131 Arizona Department Of Revenue

The Arizona Form 131 is legally binding when completed and submitted according to the guidelines set forth by the Arizona Department of Revenue. To ensure that the form is recognized legally, it must be signed by the taxpayer or an authorized representative. Additionally, compliance with eSignature laws is crucial if the form is submitted electronically. By following the legal requirements, taxpayers can secure their rights to any refunds or credits claimed through this form.

Key elements of the Arizona Form 131 Arizona Department Of Revenue

Several key elements must be included in the Arizona Form 131 for it to be processed correctly. These elements include:

- Taxpayer identification information, such as name and Social Security number.

- Details of the tax year in question.

- Specific amounts related to overpayments or credits being claimed.

- Signature of the taxpayer or authorized representative.

Ensuring that all these elements are accurately filled out is essential for the successful processing of the form.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Form 131 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the Arizona Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate address specified by the department.

- In-person submission at designated Arizona Department of Revenue offices.

Choosing the right submission method can help ensure that the form is processed in a timely manner.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Arizona Form 131 is crucial for taxpayers seeking refunds or credits. The deadlines typically align with the state tax return deadlines. Taxpayers should be aware of these important dates to ensure timely submission. Generally, the form must be filed within three years from the original due date of the tax return for which the refund or credit is being claimed. Keeping track of these deadlines can help prevent delays in receiving any owed refunds.

Quick guide on how to complete arizona form 131 arizona department of revenue

Set Up Arizona Form 131 Arizona Department Of Revenue Effortlessly on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Arizona Form 131 Arizona Department Of Revenue on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Arizona Form 131 Arizona Department Of Revenue with Ease

- Find Arizona Form 131 Arizona Department Of Revenue and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Arizona Form 131 Arizona Department Of Revenue and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 131 arizona department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 131 – Arizona Department of Revenue?

The Arizona Form 131 is an important document used by businesses and individuals to apply for a waiver of penalties and interest from the Arizona Department of Revenue. This form is crucial for taxpayers who need to address their tax compliance issues effectively.

-

How can airSlate SignNow help me with the Arizona Form 131?

airSlate SignNow streamlines the process of filling out and submitting the Arizona Form 131 to the Arizona Department of Revenue. By using our electronic signature features, you can quickly sign and send your documents, ensuring timely and efficient submission.

-

Is airSlate SignNow a cost-effective solution for managing the Arizona Form 131?

Yes, airSlate SignNow is designed to be a cost-effective solution for handling essential documents like the Arizona Form 131. Our pricing plans cater to a variety of business needs, ensuring you get the best value without compromising on features and functionality.

-

What features does airSlate SignNow offer for eSigning the Arizona Form 131?

airSlate SignNow offers a range of features that enhance your eSigning experience for the Arizona Form 131. You can easily add signatures, initials, and even text fields to your document, making it fully customizable and compliant with Arizona Department of Revenue requirements.

-

Can I integrate airSlate SignNow with other applications while managing the Arizona Form 131?

Absolutely! airSlate SignNow provides seamless integrations with various applications that you may already be using to manage your documents. This means you can efficiently handle the Arizona Form 131 alongside your other business processes without any disruptions.

-

What are the benefits of using airSlate SignNow for the Arizona Form 131?

Using airSlate SignNow for the Arizona Form 131 simplifies the document management process. You can expect faster processing times, reduced paperwork, and increased accuracy in your submissions to the Arizona Department of Revenue, helping you stay compliant and organized.

-

How secure is airSlate SignNow for submitting the Arizona Form 131?

Security is a top priority at airSlate SignNow. We ensure that all documents, including the Arizona Form 131, are encrypted and securely stored, protecting your sensitive information throughout the signing and submission process.

Get more for Arizona Form 131 Arizona Department Of Revenue

- Form 8082

- Form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year

- Asa applicant reference letter form american society of

- Agricultural marketing loan fund form

- Co petition for dissolution of courts oregon form

- Stat dec vic for handwriting docx form

- Representative contract template form

- Rescission contract template form

Find out other Arizona Form 131 Arizona Department Of Revenue

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF