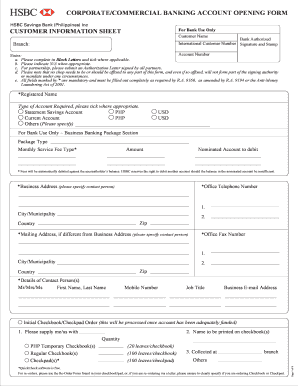

Corporatecommercial Banking Account Opening HSBC Philippines Form

What is the Corporatecommercial Banking Account Opening HSBC Philippines

The Corporatecommercial Banking Account Opening HSBC Philippines is a formal process that allows businesses to establish a banking relationship with HSBC in the Philippines. This type of account is designed for companies and organizations that require specialized banking services tailored to their operational needs. It provides access to various financial products, including loans, credit facilities, and investment options, enabling businesses to manage their finances effectively.

Required Documents

To successfully open a Corporatecommercial Banking Account with HSBC Philippines, certain documents are essential. These typically include:

- Business registration documents, such as a Certificate of Incorporation or Business Name Registration

- Tax Identification Number (TIN)

- Identification documents of the authorized signatories, such as government-issued IDs

- Board resolution or partnership agreement authorizing the account opening

- Proof of business address, like a utility bill or lease agreement

Having these documents ready can streamline the account opening process and ensure compliance with regulatory requirements.

Steps to complete the Corporatecommercial Banking Account Opening HSBC Philippines

Opening a Corporatecommercial Banking Account with HSBC Philippines involves several steps:

- Gather all required documents as outlined above.

- Visit the nearest HSBC branch or access their online banking platform.

- Complete the application form, providing accurate details about the business and authorized signatories.

- Submit the application along with the required documents for verification.

- Await confirmation from HSBC regarding the status of your application.

- Once approved, set up online banking access and familiarize yourself with the account features.

Legal use of the Corporatecommercial Banking Account Opening HSBC Philippines

The Corporatecommercial Banking Account Opening HSBC Philippines must comply with local laws and regulations governing banking and financial transactions. This includes adherence to anti-money laundering (AML) laws, Know Your Customer (KYC) requirements, and other relevant financial regulations. Ensuring that all documentation is accurate and up-to-date is crucial for maintaining compliance and avoiding legal issues.

Eligibility Criteria

To qualify for a Corporatecommercial Banking Account with HSBC Philippines, businesses typically need to meet certain eligibility criteria. These may include:

- Being a registered business entity in the Philippines

- Having a valid Tax Identification Number (TIN)

- Meeting minimum capital requirements as specified by HSBC

- Providing necessary documentation to verify business operations and ownership

Understanding these criteria can help businesses prepare adequately for the account opening process.

Application Process & Approval Time

The application process for the Corporatecommercial Banking Account involves submitting the required documents and completing the application form. The approval time can vary based on several factors, including the completeness of the application and the verification process. Typically, businesses can expect a response within a few business days, but this may take longer if additional information is needed.

Quick guide on how to complete corporatecommercial banking account opening hsbc philippines

Complete Corporatecommercial Banking Account Opening HSBC Philippines effortlessly on any gadget

Web-based document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly without delays. Manage Corporatecommercial Banking Account Opening HSBC Philippines on any device using airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to edit and eSign Corporatecommercial Banking Account Opening HSBC Philippines with ease

- Find Corporatecommercial Banking Account Opening HSBC Philippines and then click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Highlight essential sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal standing as a traditional wet ink signature.

- Review all the information and then click on the Done button to retain your modifications.

- Select how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form searches, or errors that necessitate the printing of new paper copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from your preferred device. Edit and eSign Corporatecommercial Banking Account Opening HSBC Philippines and ensure effective communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corporatecommercial banking account opening hsbc philippines

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for Corporatecommercial Banking Account Opening HSBC Philippines?

The process for Corporatecommercial Banking Account Opening HSBC Philippines is streamlined and efficient. First, gather the required documents, such as business registration and identification. Then, visit the nearest HSBC branch or use their online platform to submit your application. HSBC representatives will guide you through the approval process once your application is submitted.

-

What are the requirements for Corporatecommercial Banking Account Opening HSBC Philippines?

To open a Corporatecommercial Banking Account with HSBC Philippines, you will need to provide valid identification and business documents, including your Certificate of Incorporation and Tax Identification Number. Ensure all documents are complete to avoid delays. Additional requirements may apply based on the nature of your business.

-

Are there any fees associated with Corporatecommercial Banking Account Opening HSBC Philippines?

Yes, Corporatecommercial Banking Account Opening HSBC Philippines may incur several fees, such as account maintenance, transaction fees, and charges for certain banking services. It's essential to review HSBC's latest fee schedule for a comprehensive understanding of potential costs. Choosing the right account type could also help minimize these fees.

-

What benefits do I get with a Corporatecommercial Banking Account at HSBC Philippines?

Opening a Corporatecommercial Banking Account at HSBC Philippines comes with numerous benefits, including access to a range of financial products tailored for businesses. You can enjoy enhanced cash management solutions and competitive interest rates. Additionally, HSBC provides expert banking support to help you manage your business finances effectively.

-

Can I access online banking with Corporatecommercial Banking Account Opening HSBC Philippines?

Yes, when you complete your Corporatecommercial Banking Account Opening HSBC Philippines, you will gain access to robust online banking features. HSBC's online banking platform allows you to manage your accounts, track transactions, and perform fund transfers securely from anywhere. This functionality enhances the convenience of handling your business finances.

-

What types of Corporatecommercial Banking Accounts are available at HSBC Philippines?

HSBC Philippines offers various types of Corporatecommercial Banking Accounts tailored to meet diverse business needs. You can choose from options such as checking accounts, savings accounts, and specialized accounts designed for specific industries. Assessing your business requirements will help you select the most suitable account type.

-

How does Corporatecommercial Banking Account Opening HSBC Philippines benefit small businesses?

Corporatecommercial Banking Account Opening HSBC Philippines provides small businesses with essential banking tools that streamline operations and improve cash flow management. Businesses can benefit from tailored financial solutions and support from banking professionals. This can help small enterprises grow by enhancing their financial stability and operational efficiency.

Get more for Corporatecommercial Banking Account Opening HSBC Philippines

Find out other Corporatecommercial Banking Account Opening HSBC Philippines

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free