it 1140 1999

What is the IT 1140

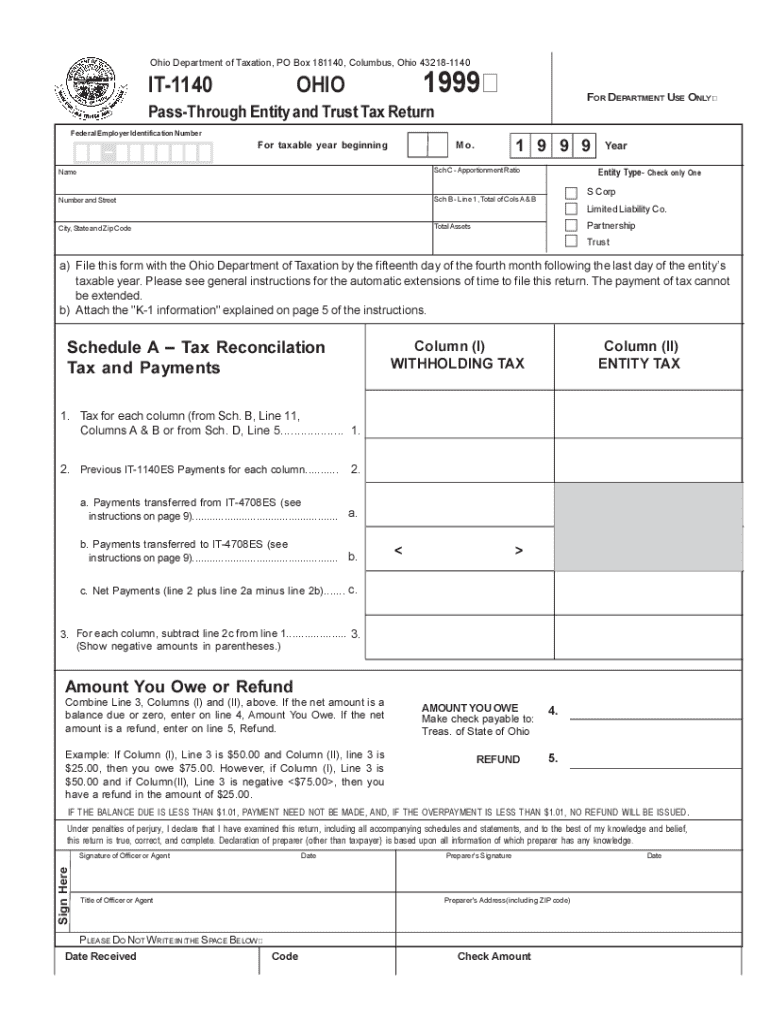

The IT 1140 is a form used by businesses in the United States to report and pay income tax for certain types of entities. This form is particularly relevant for corporations that are subject to the franchise tax in various states. It is essential for ensuring compliance with state tax regulations and accurately reporting taxable income.

How to Use the IT 1140

Using the IT 1140 involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and expense reports. Next, complete the form by entering the required information, such as gross receipts, deductions, and credits. Finally, review the completed form for accuracy before submission, as errors can lead to penalties or delays in processing.

Steps to Complete the IT 1140

Completing the IT 1140 requires careful attention to detail. Start by downloading the form from the appropriate state tax authority's website. Fill in your business information, including the name, address, and federal employer identification number (EIN). Next, calculate your taxable income by subtracting allowable deductions from gross receipts. Ensure that all calculations are accurate and complete any additional schedules or attachments as required. Once finished, sign and date the form before submitting it according to the instructions provided.

Filing Deadlines / Important Dates

Filing deadlines for the IT 1140 can vary by state, but generally, it is due on the fifteenth day of the fourth month following the close of the tax year. For businesses operating on a calendar year, this typically means the deadline is April 15. It is crucial to be aware of any state-specific deadlines to avoid penalties and interest on late payments.

Required Documents

When preparing the IT 1140, several documents are essential for accurate completion. These include financial statements, prior year tax returns, and any supporting documentation for deductions or credits claimed. Having these documents ready can streamline the process and ensure compliance with tax regulations.

Penalties for Non-Compliance

Failure to file the IT 1140 on time or inaccuracies in reporting can result in significant penalties. Common penalties include late filing fees, interest on unpaid taxes, and potential audits by state tax authorities. Understanding these consequences can help businesses prioritize timely and accurate submissions.

Create this form in 5 minutes or less

Find and fill out the correct it 1140

Create this form in 5 minutes!

How to create an eSignature for the it 1140

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is It 1140 and how does it relate to airSlate SignNow?

It 1140 is a specific form used for tax purposes, and airSlate SignNow provides a seamless way to eSign and send this document. With our platform, you can easily manage your It 1140 forms, ensuring compliance and efficiency in your tax processes.

-

How much does airSlate SignNow cost for managing It 1140 documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing It 1140 documents, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for It 1140 document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking specifically for It 1140 forms. These tools streamline the process, making it easier for users to complete and manage their tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for It 1140 processing?

Yes, airSlate SignNow offers integrations with various software applications that can enhance your It 1140 processing. This allows you to connect with your existing tools and create a more efficient workflow for managing your documents.

-

What are the benefits of using airSlate SignNow for It 1140?

Using airSlate SignNow for your It 1140 documents provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform ensures that your documents are handled with care and compliance, making tax season less stressful.

-

Is airSlate SignNow user-friendly for eSigning It 1140 forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to eSign It 1140 forms. Our intuitive interface allows users to navigate the signing process effortlessly, saving time and reducing errors.

-

How secure is airSlate SignNow when handling It 1140 documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your It 1140 documents, ensuring that your sensitive information remains confidential and secure throughout the signing process.

Get more for It 1140

Find out other It 1140

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed